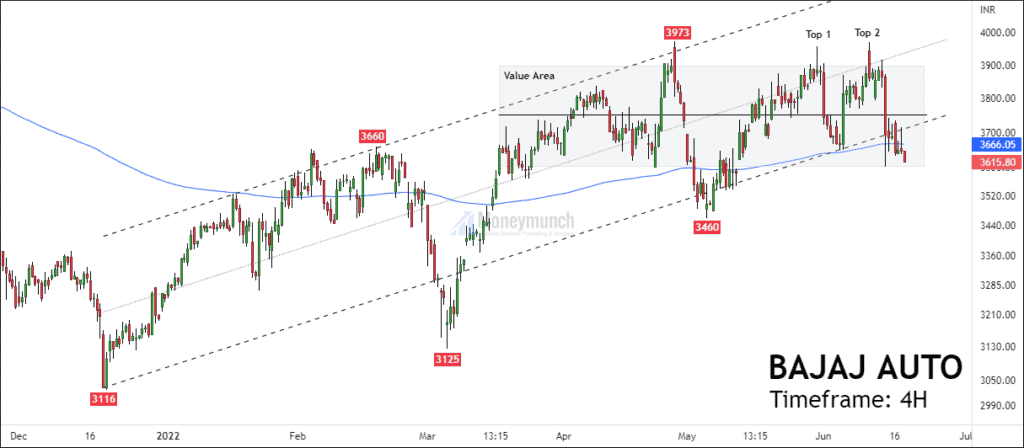

Bajaj Auto – BAJAJ AUTO: When Will The Bears Quit?

Over the past 25 weeks, Bajaj Auto has formed ascending channels. If we observe the channel’s angle, it appears to be a corrective formation. Recently, the parallel channel’s lower band has broken down.

As price continues to decline below the lower band, buyers aren’t generating enough demand to initiate a movement.

If the price breaks down from a recent low of 3600, traders can sell for the following targets: 3540 – 3476 – 3390.

In this way, fake-outs can be prevented.

Watch-out support breakout for AB CAPITAL

AB CAPITAL has taken support from the previous low at 90.05. A breakdown of 90.05will create a new low in AB capital. Traders can trade for the following targets: 89.21 – 88.2 – 85.50.

If the price is sustains below 91.90., traders can take short entry.

NSE DBL-A Bearish Trade Setup

DBL has broken down the previous low at 196, and the price started falling in search of new support.

Traders can initiate a short position if the price sustains below 205 for the following targets: 200 – 196 – 190 below. If the price breaks the previous session’s low, it will be extremely bullish.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.