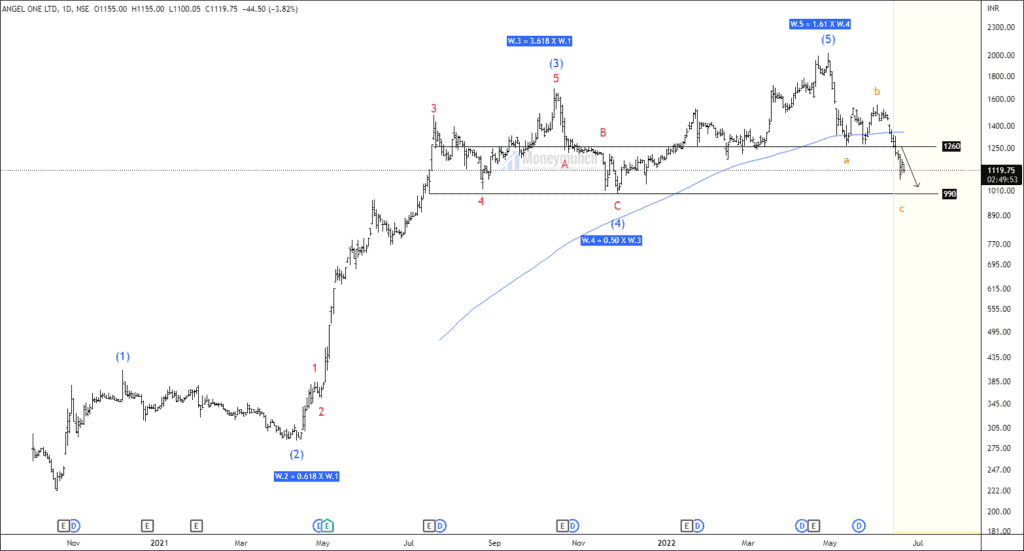

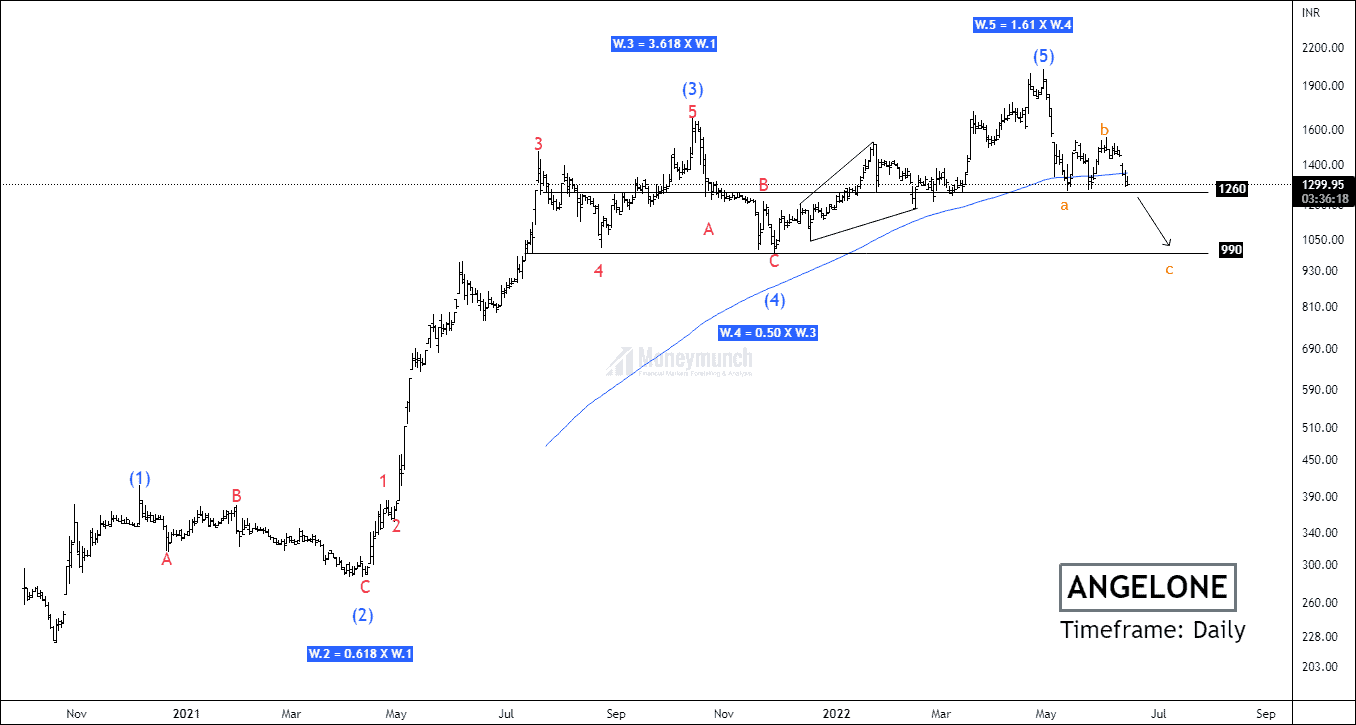

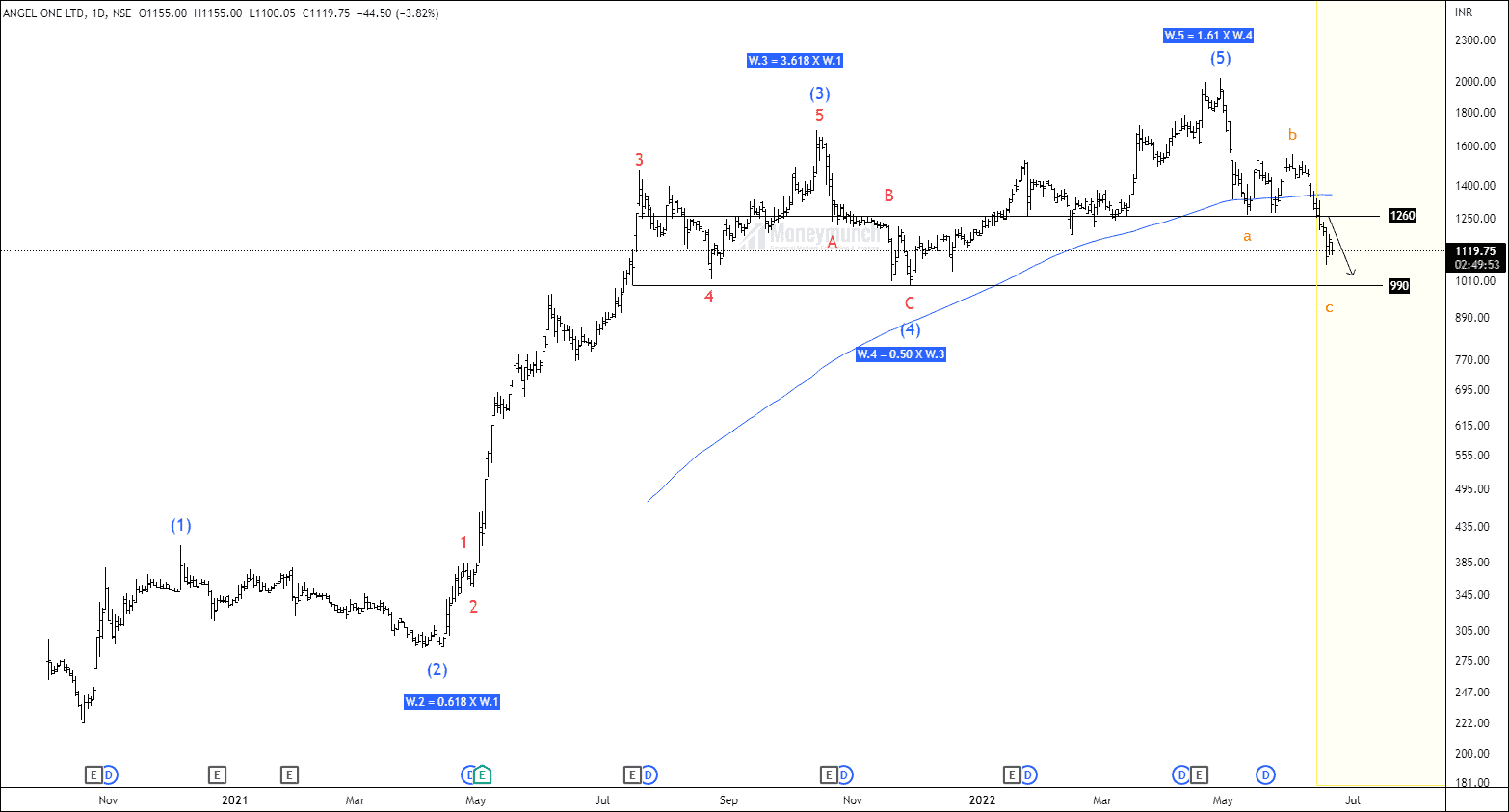

Do you remember NSE Angel one stock research report?

Click Here – ANGEL ONE: ELLIOTT WAVE-BASED SWING SETUP

Angel one had accomplished the final impulsive wave five and was falling to correct the structure. Price has also broken down to 200 EMA.

I had mentioned in clear words”, If the price breaks down the low of wave A, traders sell for the following targets: 1202 – 1123 – 1024.

[17 June 2022]

- 9:15 AM – Angle one reached the first target of 1202.

[20 June 2022]

- 11:23 AM – angle one hit the second target of 1123

- 2:45 PM – angel one has made a low of 1066 and was close to the final target of 1024.

AB CAPITAL – Support is broken due to an oversupply

Did you trade AB Capital’s trade setup?

Click Here: BAJAJ AUTO, AB CAPITAL & DBL TRADE ANALYSIS

I had mentioned in clear words”, Traders can trade for the following targets: 89.21 – 88.2 – 85.50. If the price sustains below 91.90, traders can take short entries.”

[20 JUN 2022]

- 9:35 AM – AB capital has reached the first target of 89.21.

- 11:15 AM – AB capital reached the second target of 88.20.

- 14:45 PM – AB capital hit the final target of 85.50.

DBL – It was a bears’ victory

Did you trade DBL trade setup?

Click Here: BAJAJ AUTO, AB CAPITAL & DBL TRADE ANALYSIS

I had mentioned in clear words”, traders can initiate a short position if the price sustains below 205 for the following targets: 200 – 196 – 190 below.”.

[20 JUN 2022]

- 1:16 PM – Price reached the first target of 200.

- 1:42 PM – Price hit the second target of 196.

- 2:34 PM – DBL made a low of 191.30 was close to our final target of 190.

Bajaj Auto Couldn’t Sustain Below 3600

Click Here: BAJAJ AUTO, AB CAPITAL & DBL TRADE ANALYSIS

We had seen a flat movement in the Bajaj auto on 20 June. It couldn’t sustain below 3600. Price had made a day high of 3639.

Even if you traded this call, your maximum loss could be 39 points in the cash market only because there is a basis (difference between spot and futures price) of 141 points.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Thank you for these profitable trades. I’ve traded in the capital and enjoyed this call.

Your risk management is very strong. In dbl price had opened at 206 and started falling down. I set my order at 205 and made good profit.

Excellent analysis on AB capital. Please share nifty analysis!

Namaste sir.

Your Elliot wave analysis is very good. I have been following your Analysis for 2 years. I am not able to apply Elliot waves in real time. I request your to create a course so traders like me can plot these patterns in real-time