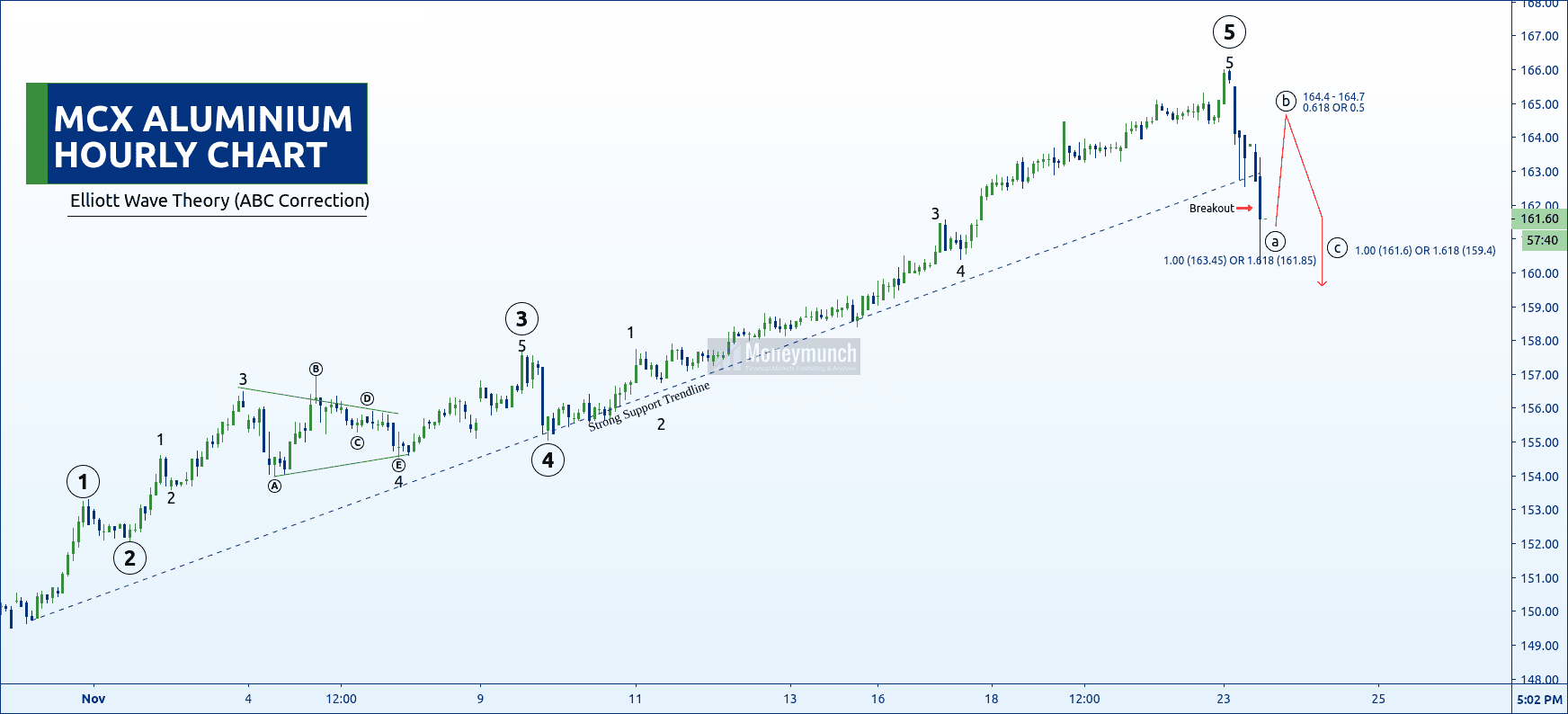

MCX Aluminium has started falling due to Elliott Wave’s ABC correction. Expected A is at 100% or 161% retracement of wave 5.

Therefore, it can start rising from here to the level of 164.4. The day traders can have the advantage of this impulsive ride of B.

According to ABC correction, we may see the Aluminium prices below 161.6 – 159.4 before the weekend.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.