Gold has started rising from U.S. Presidential Election. I have said in the previous newsletters, bullion sector commodities are strongly bullish. How many of you bought Gold and Gold Guinea?

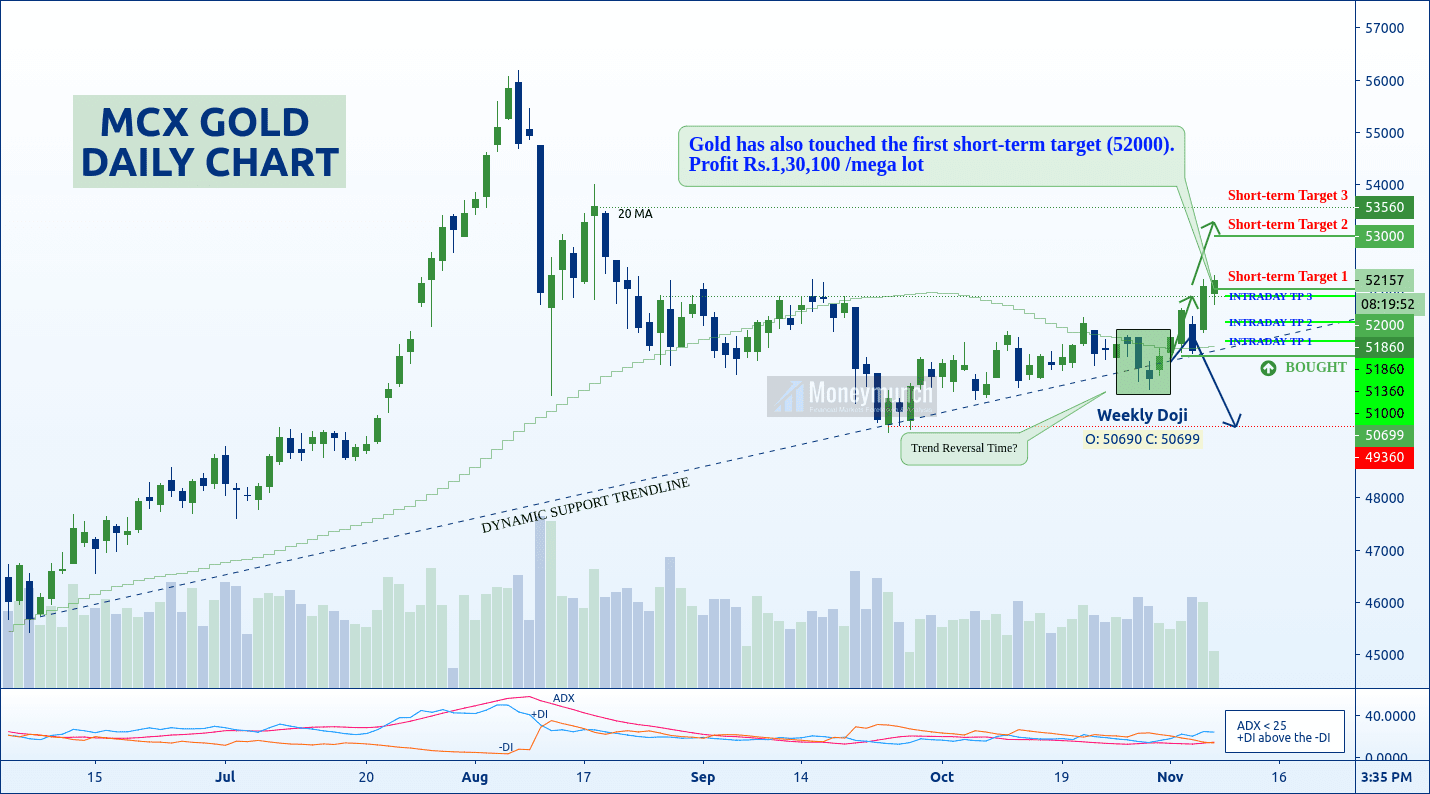

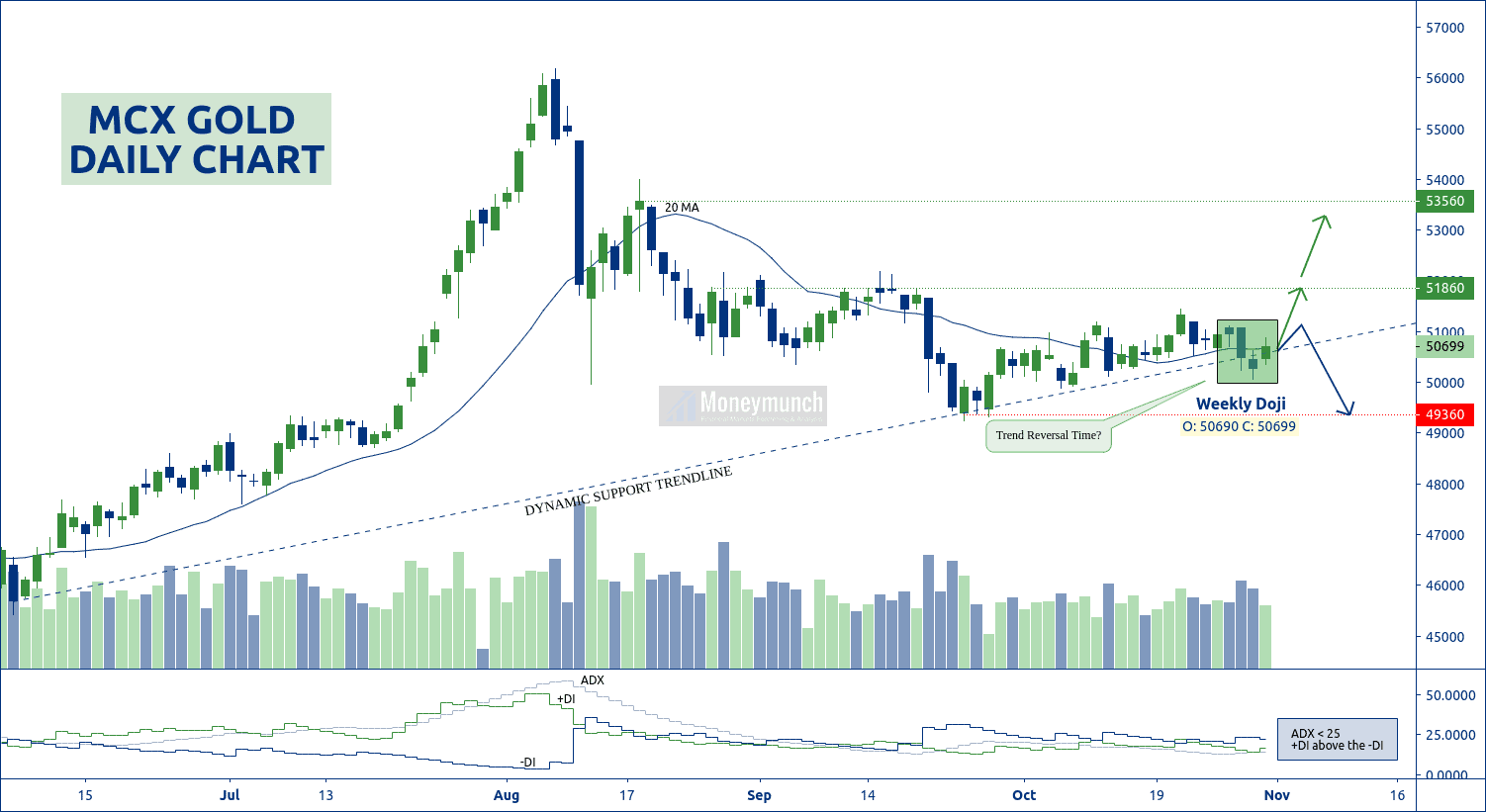

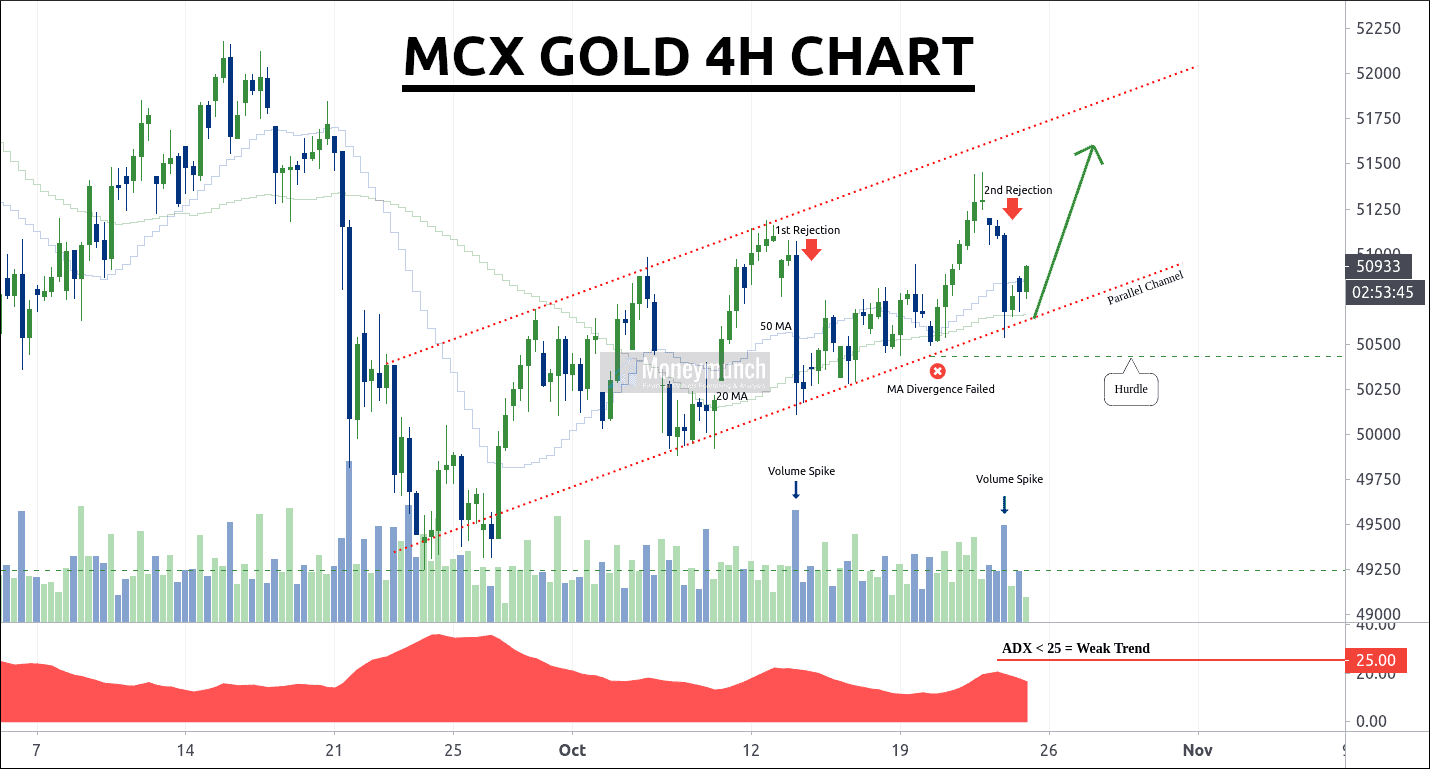

MCX Gold Measured Moves

I had written for the intraday traders that, “…the day traders can follow the following targets: 51000 – 51360 – 51860+

And short-term investors can hold for 52000 – 53000 – 53560+ levels”.

Intraday Calls Profit: Rs.1,16,100+

Short-term Calls Profit: Rs.1,30,100+

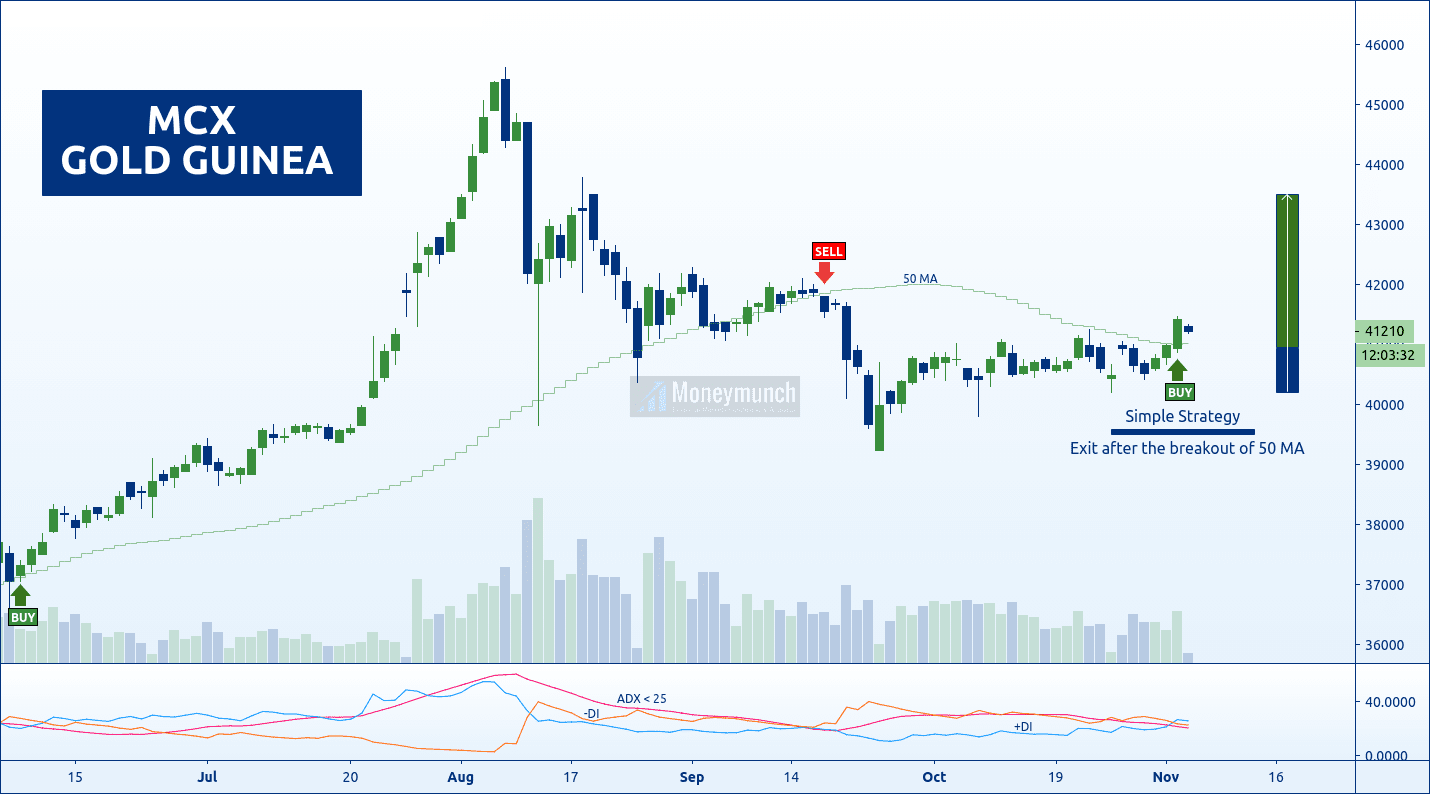

Gold Guinea price setting up for a big rally

I had written in bold word, “…intraday & short-term traders can buy using this strategy to make some money. Targets: 41800 – 42200 – 43000+“.

Profit: 600+ Points

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.