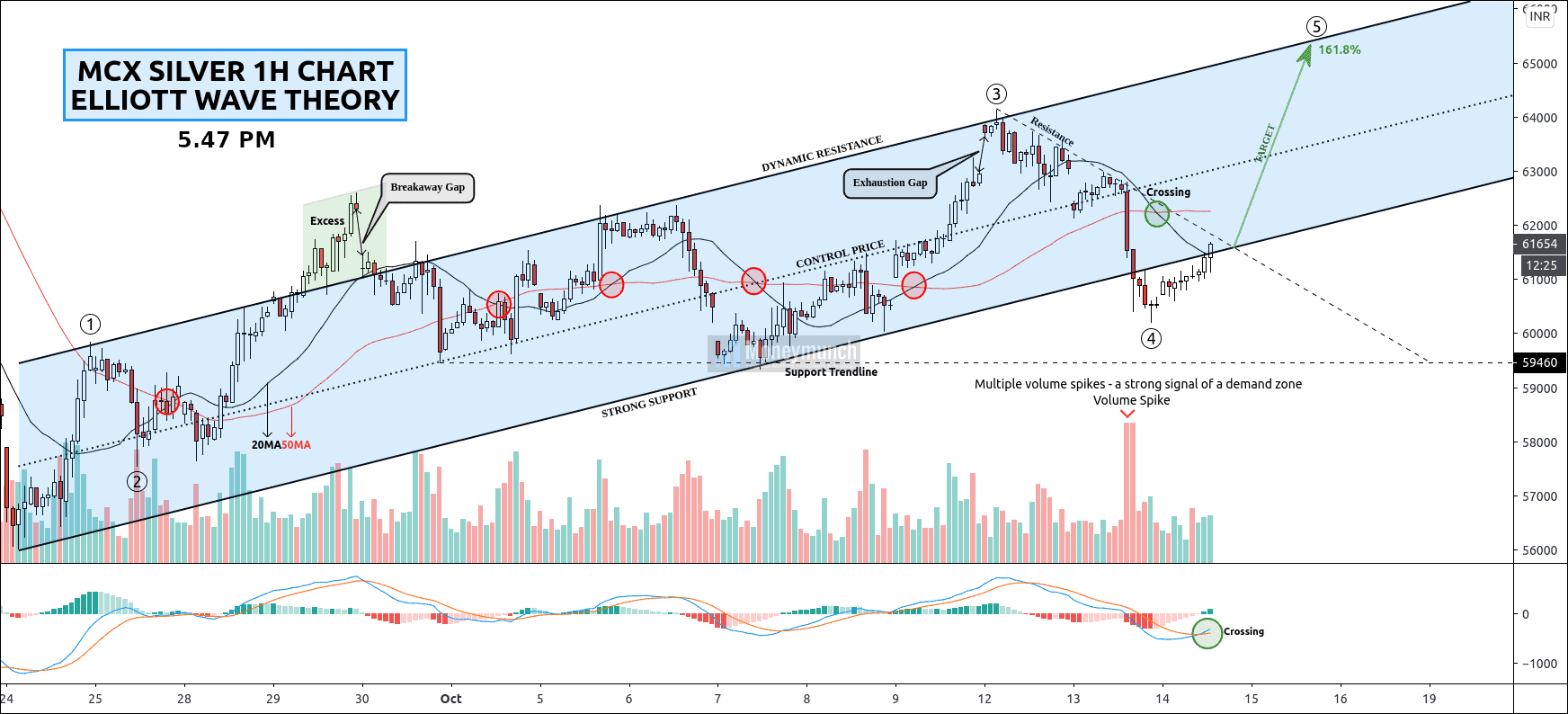

Here, I have applied Elliott wave, moving average, volume, and MACD. Wave 4 can be steady or sideways for a while. Overall, silver is in an uptrend. Safe investors can buy silver at wave 4 for the following levels:

Intraday Targets: 62100 – 63300

Positional Targets: 64260 – 65200

At present, moving average and MACD throwing upward signal by crossover. Technically, multiple volume spikes are a great sign of a bullish trend.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock