Upload Date: 09/10 /2020

Update 2.0

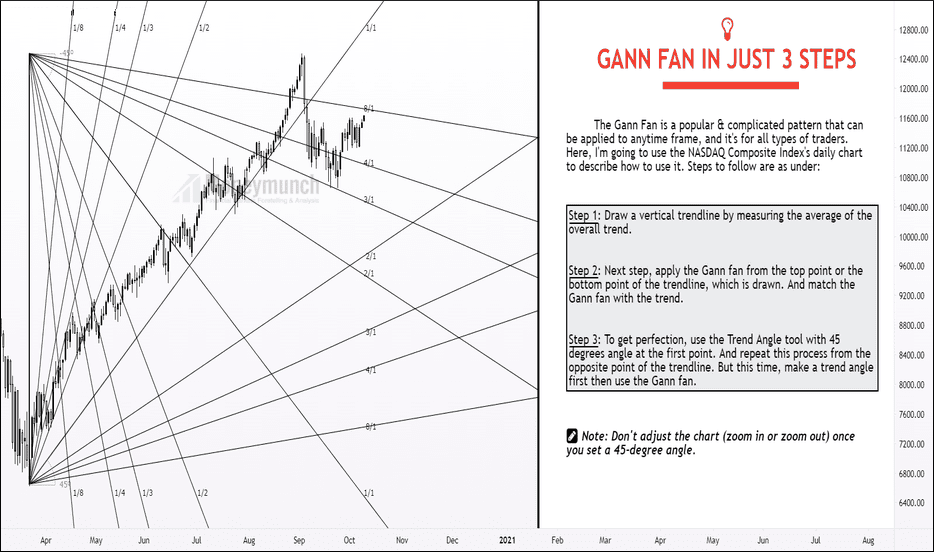

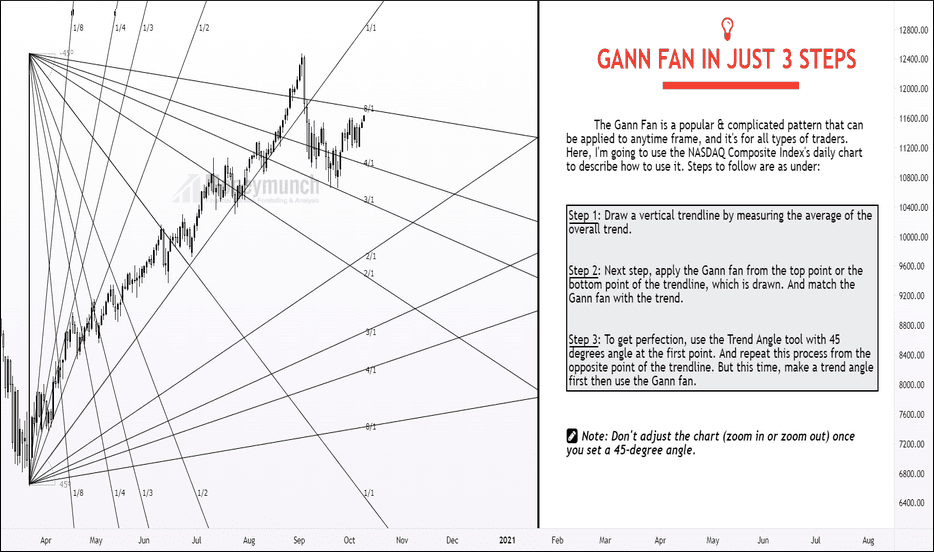

Gann theory has been widely used in various fields of finance. To learn to apply the Gann angle line, two problems need to be solved, namely, point selection and volatility . The question about volatility is in the Gann angle line. This article will mainly talk about the problem of selecting points.

The selection point of the Gann angle line is generally selected from the important top and bottom. When selecting, you can judge which point to choose based on your actual operating experience. But depending on the long-term trend, you can choose the Gann angle line starting from zero, which will play a very important role in future predictions.

We took NASDAQ as an example. In the chart, We have learned how to apply the Gann fan to a chart or the trend. It’s complicated, but I tried to make it easy to understand and easy to apply. I have used only 2 to 3 things to perfectly apply the Gann Fan.

Gann fan is useful to all the traders, It can be applied to all the time frame.

In the investment process, Many investors like to buy bottoms. This is everyone’s ultimate pursuit. That’s because every market has important tops and bottoms. Analysis of this position is to make your own funds safer, with minimal risks and greater profits. These will use the Gann angle line confluence position. The force formed at the intersection of the rising angle line and the falling angle line can often form a reversal trend.

In “Financial Analysis Trends“, the grades are divided as follows:

- 1×1 intersects with 1×1

- 1×2 intersects with 2×1

- 1×3 intersects with 3×1

- 1×4 and 4×1 intersect

- 1×1 intersects with 1×2 or 2×1

- 1×1 intersects with 1×3 or 3×1

- 1×1 intersects with 1×4 or 4×1

- 1×2 intersects with 1×4 or 4×1

We will update further information soon.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.