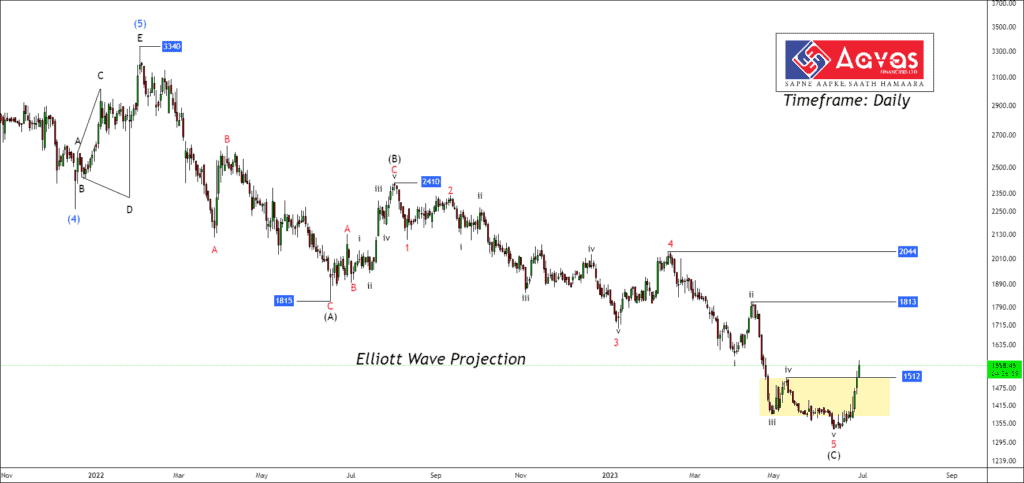

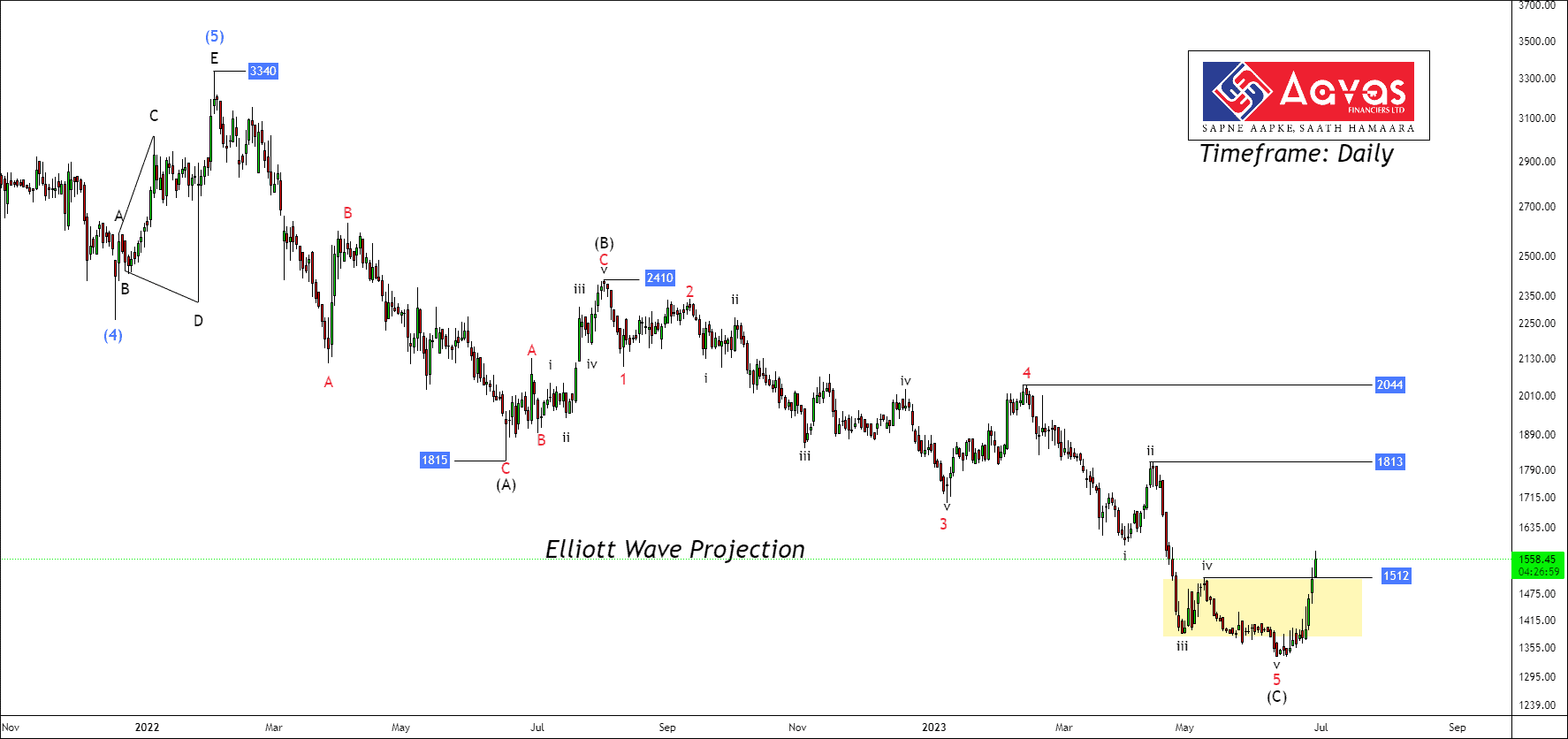

Timeframe: Daily

NSE AAVAS has been experiencing a decline within the corrective structure spanning over 73 weeks. The fall started from the highest high at 3340 and currently undergoing demand pressure. The bulls have begun to move prices up.

As per wave perspective, the price has accomplished the corrective wave structure. Price has occurred in sub-wave wave v of wave 5 of wave (c) and started rising upward. Those who wish to invest in the stock at the bottom will have an excellent opportunity to buy at a low price and realize a great profit. The best course of action is to wait for a pullback.

If the price sustains above 1512, traders can trade for the following targets: 1727 – 1840 – 1975+. Traders must trade one pullback with proper risk management.

We will update further information soon.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.