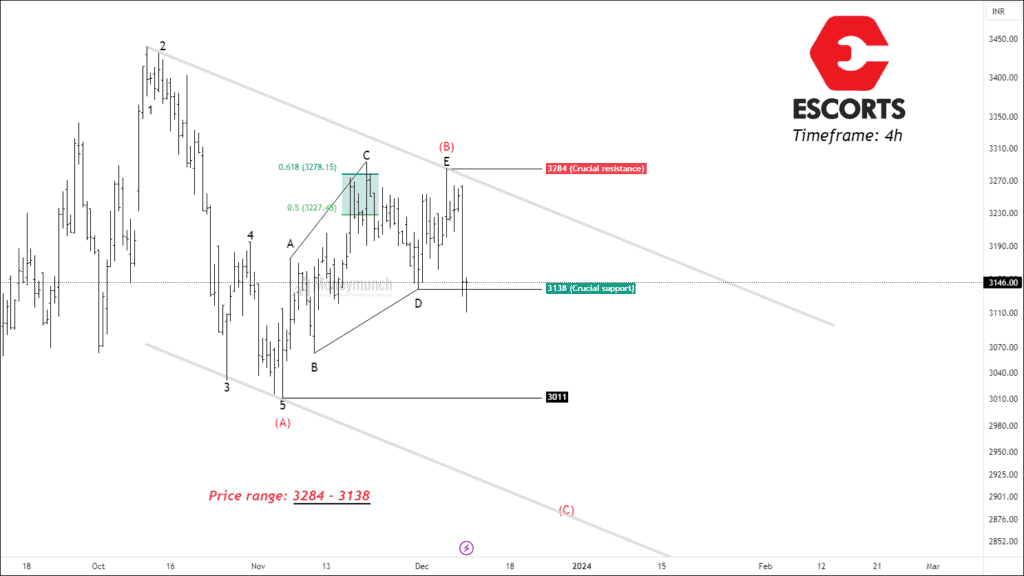

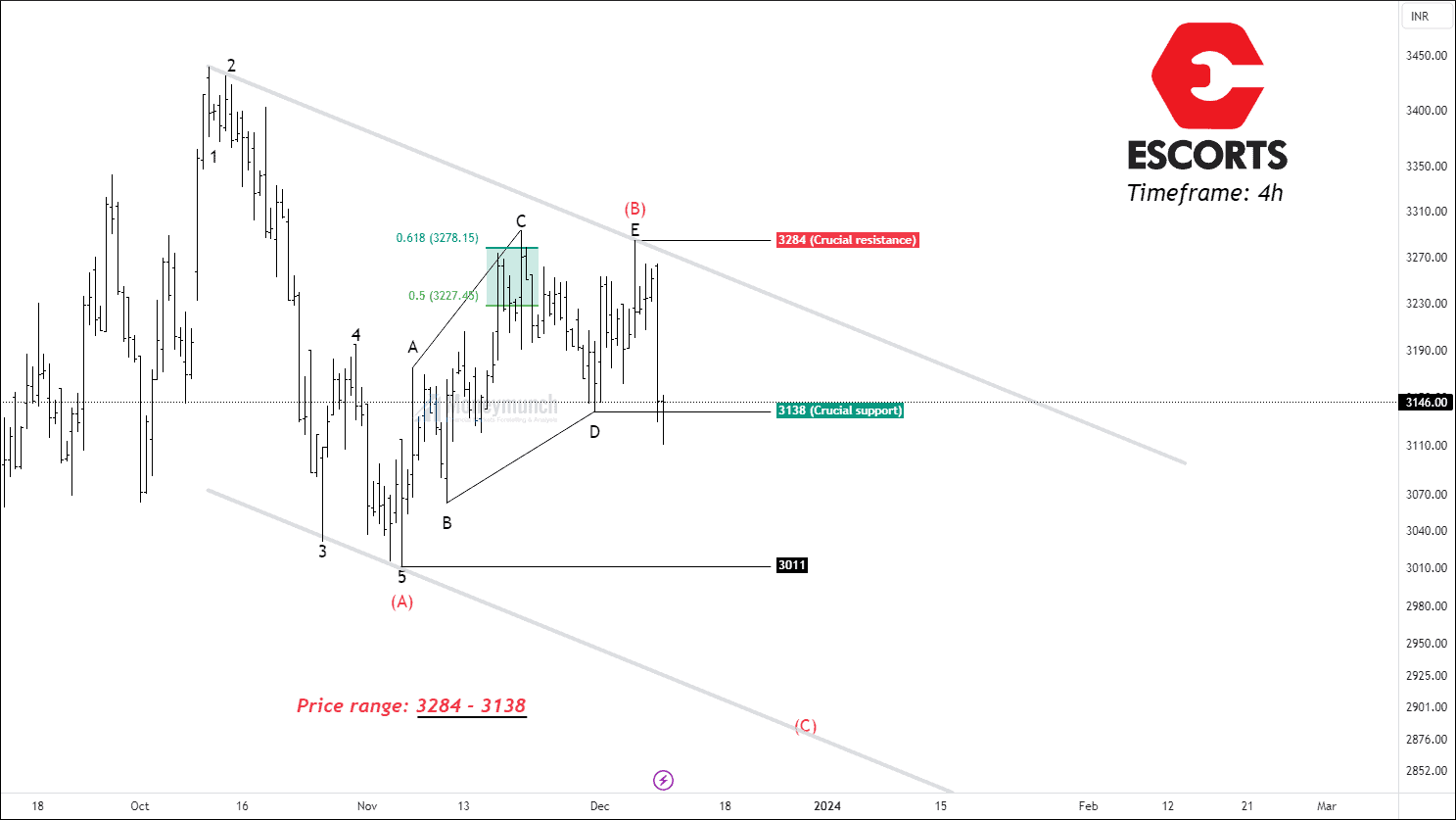

NSE ESCORTS – Elliott Wave Projection

Timeframe: 4h

NSE ESCORT has begun to decline for the corrective structure A-B-C after reaching a peak of 3410. With support from the 100 EMA, the price has broken below the 20/50 EMA. The range of prices from 3284(R) to 3138(S) is significant. The security hasn’t reached any higher highs or lower lows for a number of trading sessions.

At 3284, the price completed the triangle of wave (B) and began to decline for the last wave (C). The price has to close below triangle wave d at 3138 in order to start a short position. Bulls can only seize the initiative following wave (B)’s breakthrough at 3284. For this reason, the specified price range is important for both bulls and bears. Investors should anticipate some relief in the event that the structure breaks.

We will update further information soon.

NSE UJJIVANSFB – Breakout Setup

On the daily timeframe chart, UJJIVANSFB has created an ascending triangle & Wammie bottom. The pattern indicates the emergence of a bullish momentum.

The price’s RSI reached 65.75, while its ATR increased to 1.77. The price strength might be considered before making the entry. If the price breaks out and sustains above 58, traders can trade for the following targets: 61 – 63 – 64+. Free subscribers may consider the low from the previous session as invalidation level.

Premium subscribers will have further information soon.

NSE ZEEL: Positive Outlook

The lower high and significant resistance level of 276 has been breached by NSE ZEEL. The price’s ATR is 7.89 while its RSI has increased to 63.75. The 20/50/100/200 averages’ EMA band has been breached by the price. The price formation seems bullish.

Since a higher low at 242 has been identified, traders can anticipate a bullish move. If the price sustains above 276, traders can trade for the following targets: 284 – 290- 308+. Free subscribers can take invalidation as the previous trading session’s low.

Only premium subscribers will get trade setup with entry, exit, and invalidation levels.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Nice work

Thanks for sharing. Also, analyze cub, Iob and hdfcbank.

Good analysis