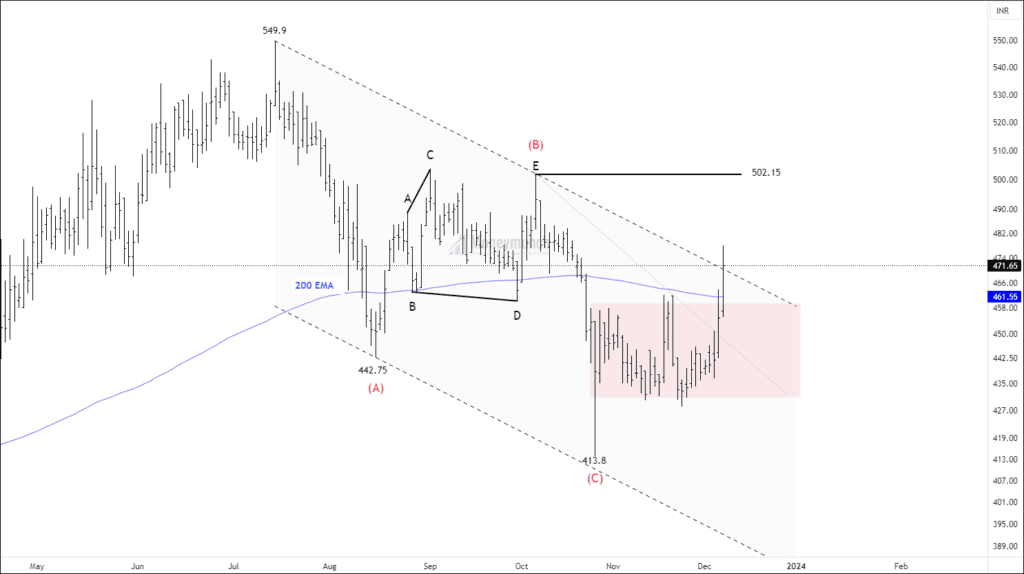

EIHAHOTELS – Elliott wave Projection

NSE EIHAHOTELS has constructed a corrective formation after making the high of 549.9. The RSI of the price has risen to 65.58, and ATR has reached 13.32. The previous candle has broken out of the 20/50/100/200 EMA band. It indicates the trend is in the bulls’ favor.

In corrective formation, wave (C) has extended 100% of wave (A). Hence, Wave (A) = Wave (C). There is a value area between 458 – 430. The area was being disturbed by bulls.

If the price breaks out and sustains above the corrective channel, traders can trade for the following targets: 502 – 524 – 542+. Intraday traders should close their position if the price reaches (B) at 502. Wave (B) at 502 is a crucial resistance and pivot point to confirm the bull run of the trend.

We will update further information for premium subscribers soon.

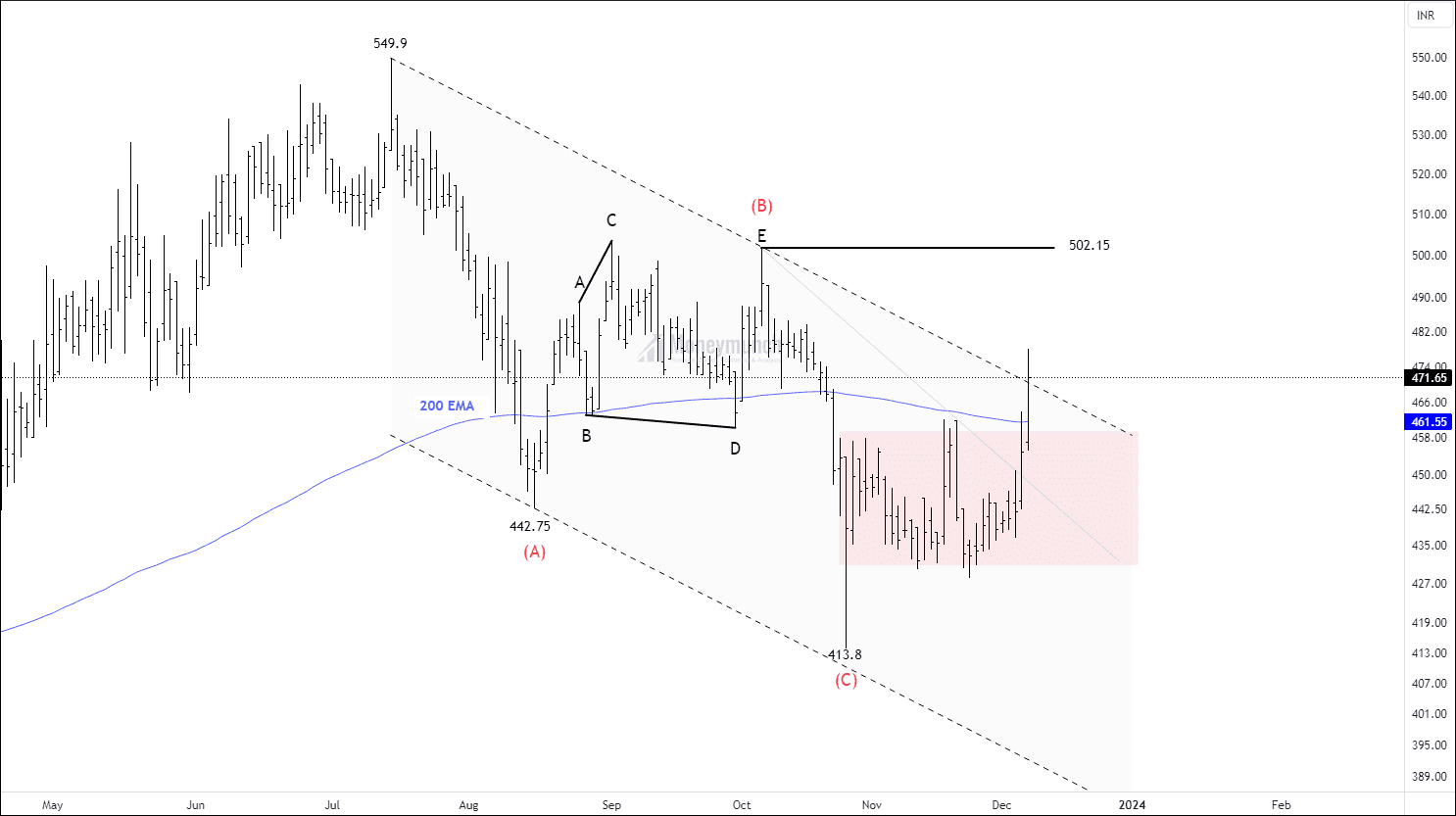

NSE SBICARD – Breakout setup

NSE SBICARD has corrected 100% of the previous move. The price has been trading in the corrective channel for 25 weeks. The price has broken out 50 EMA and rising towards 100 EMA.

Wammine formation is also visible in the daily time frame. The security is having strong resistance of 775. If the price breaks out of resistance at 775, traders can buy for the following targets: 790 – 815 – 824+. Free subscribers can take the previous day’s low as an invalidation level.

Only premium subscribers will have further information soon.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

tnx for sharing