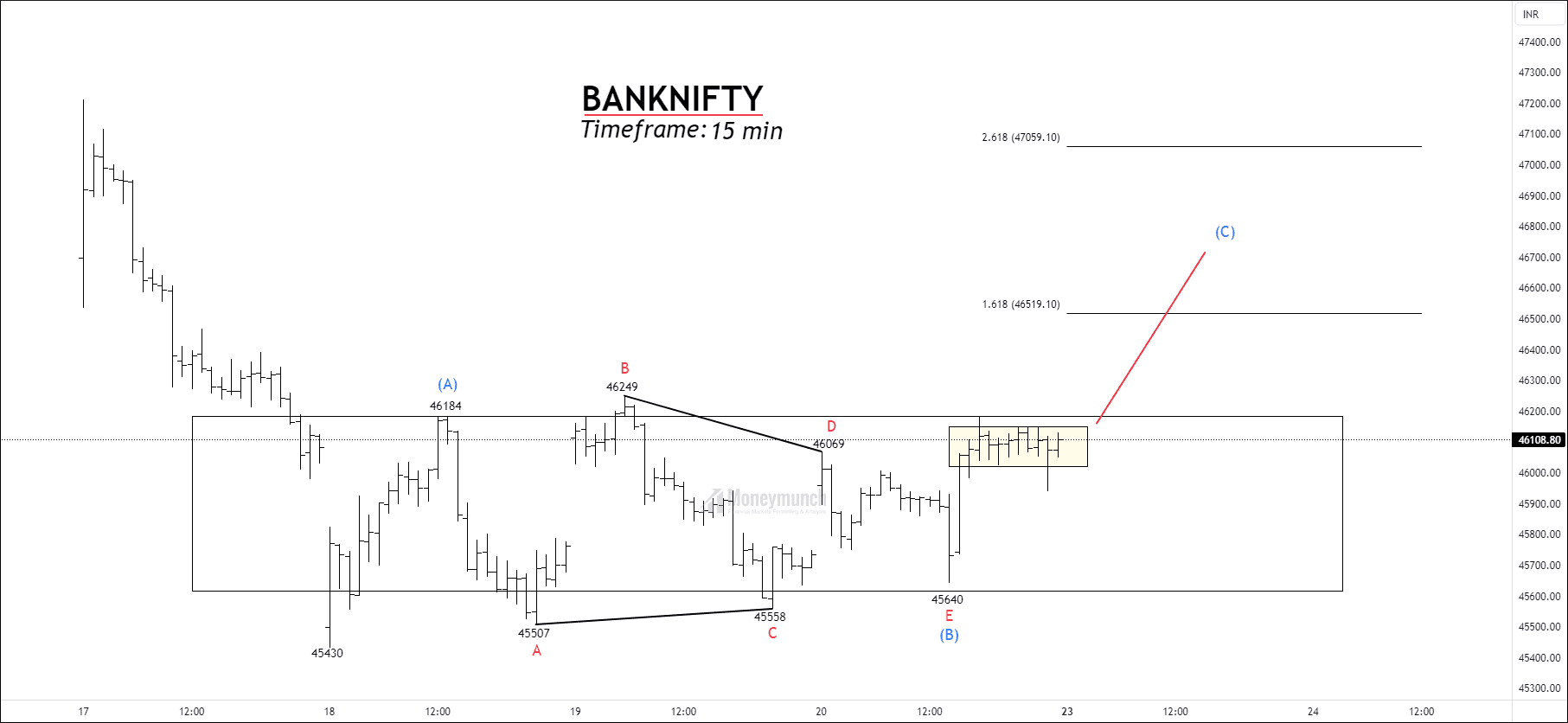

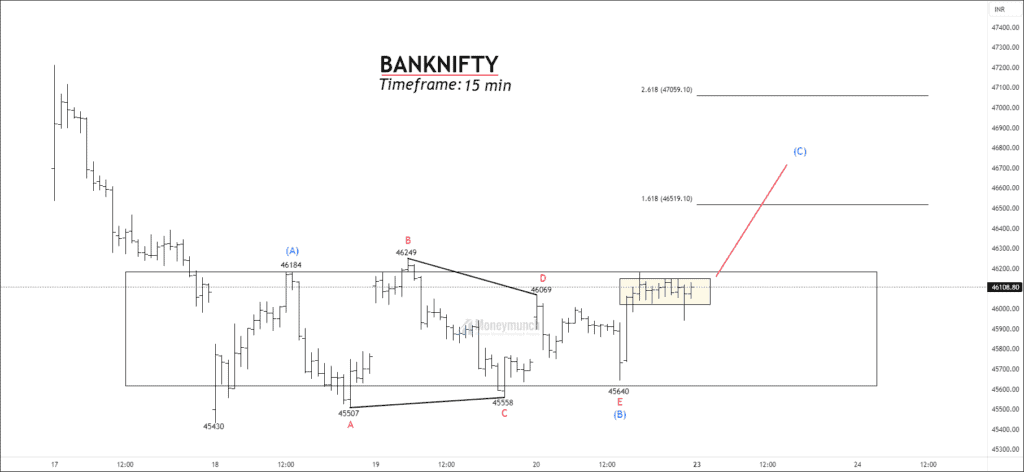

Intraday Analysis – BANKNIFTY Is Preparing For a Breakout

Timeframe: 15 min

In the current market scenario, NSE Banknifty has exhibited a corrective pattern subsequent to reaching a low of 45430. Notably, the price is currently trading above the 20/50 EMA crossover, while the 100/200 EMA acts as a steadfast resistance. The Average True Range (ATR) indicates a moderate momentum at 120.

The price has completed wave (A) at 46184, and the wave E of wave (B) triangle has concluded. Traders may observe a narrow value area ranging from 46155 to 46020. A break below this smaller value area would also signify a breakout from the major value area, surpassing three significant resistance levels. Such a breakout could potentially lead to the following targets: 46330 – 46515 – 46700 or higher. It’s crucial to note that the price may consolidate within the major value area.

We will update further information soon.

NSE ADANIPORTS – Bullish Formation

We Will update further information for premium subscribers soon

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Very good analysis sir