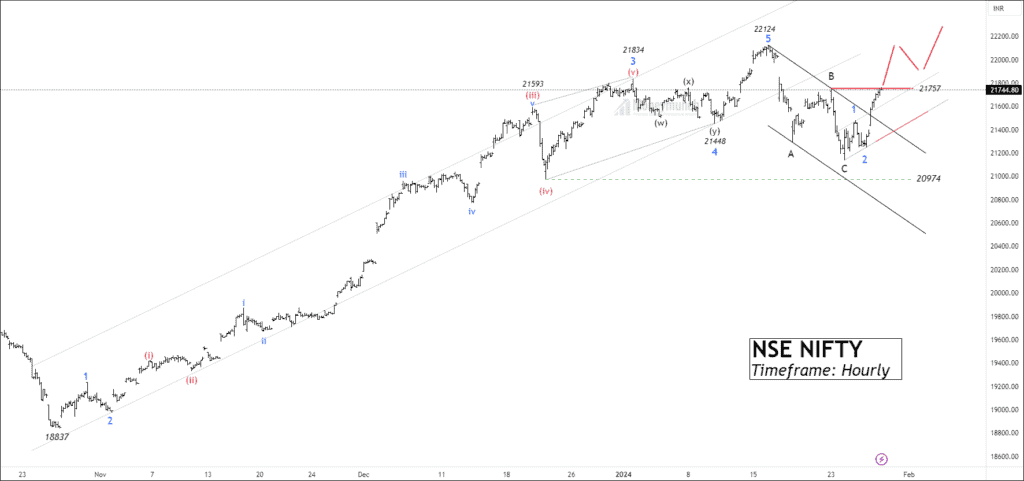

Timeframe: Hourly

In the previous session, we saw a sharp surge of 350+ points. The Nifty had accomplished wave C of the corrective phase, and the price broke out the sub-wave 1 of the impulse wave.

I am not interested in thinking about which wave it could be, whether wave B or wave 5. Whenever the price breaks out of the flat correction’s wave B, traders can have an opportunity to keep in mind that we are not biased toward the market and only try when a system or theory suggests the opportunity.

If the price breaks out of wave B, traders can trade for the 21856 – 21955 – 22100+. On the other side, the price is having strong resistance at 21757. In the case of the Breakdown of Wave 2, Sellers can lead the price to 20974 – 20780 – 20789+. ADX is not strong enough to advocate the upward move, so we have to wait for the confirmation of either direction.

One can keep an eye on ADX to see the strength of the trend. Also, one can use an oscillator to check the room while entering the trade.

We will update further information soon,

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.