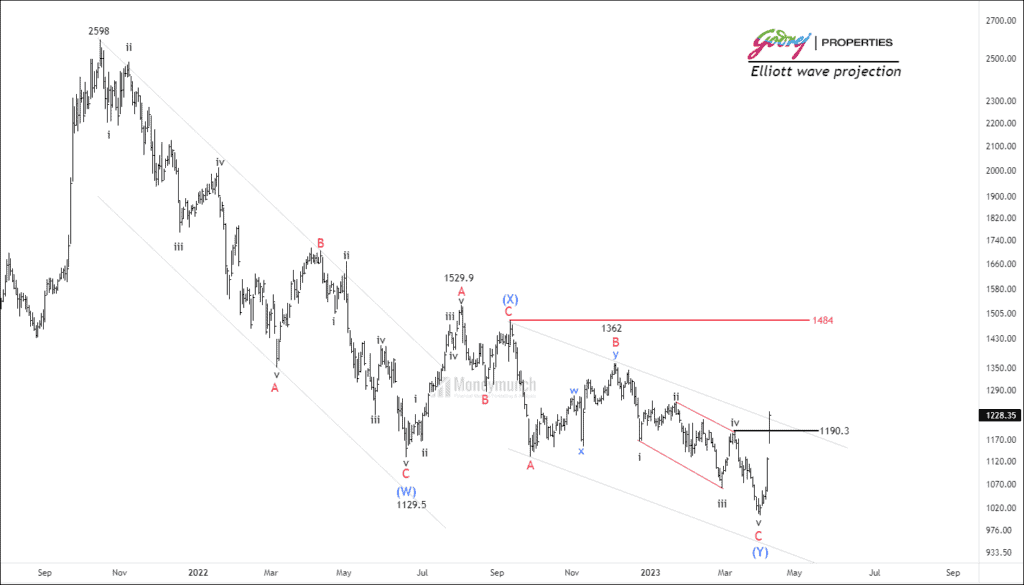

NSE GODRAGPROP’s Strong Momentum: Analysis and Forecast

Timeframe: Daily

The NSE GODREJPROP has been undergoing a correction phase for over 75 weeks, characterized as a double three correction in technical analysis. The current market price is hovering in close proximity to the 200-day exponential moving average.

The ongoing correction is identified as a double three pattern consisting of two sets of a-b-c corrections, which have merged to form the intermediate wave (X). The price has completed the final wave V of the ending diagonal pattern within wave C of wave (Y). The conclusion of wave C has generated significant momentum for the current movement, resulting in a 17% increase over two trading sessions.

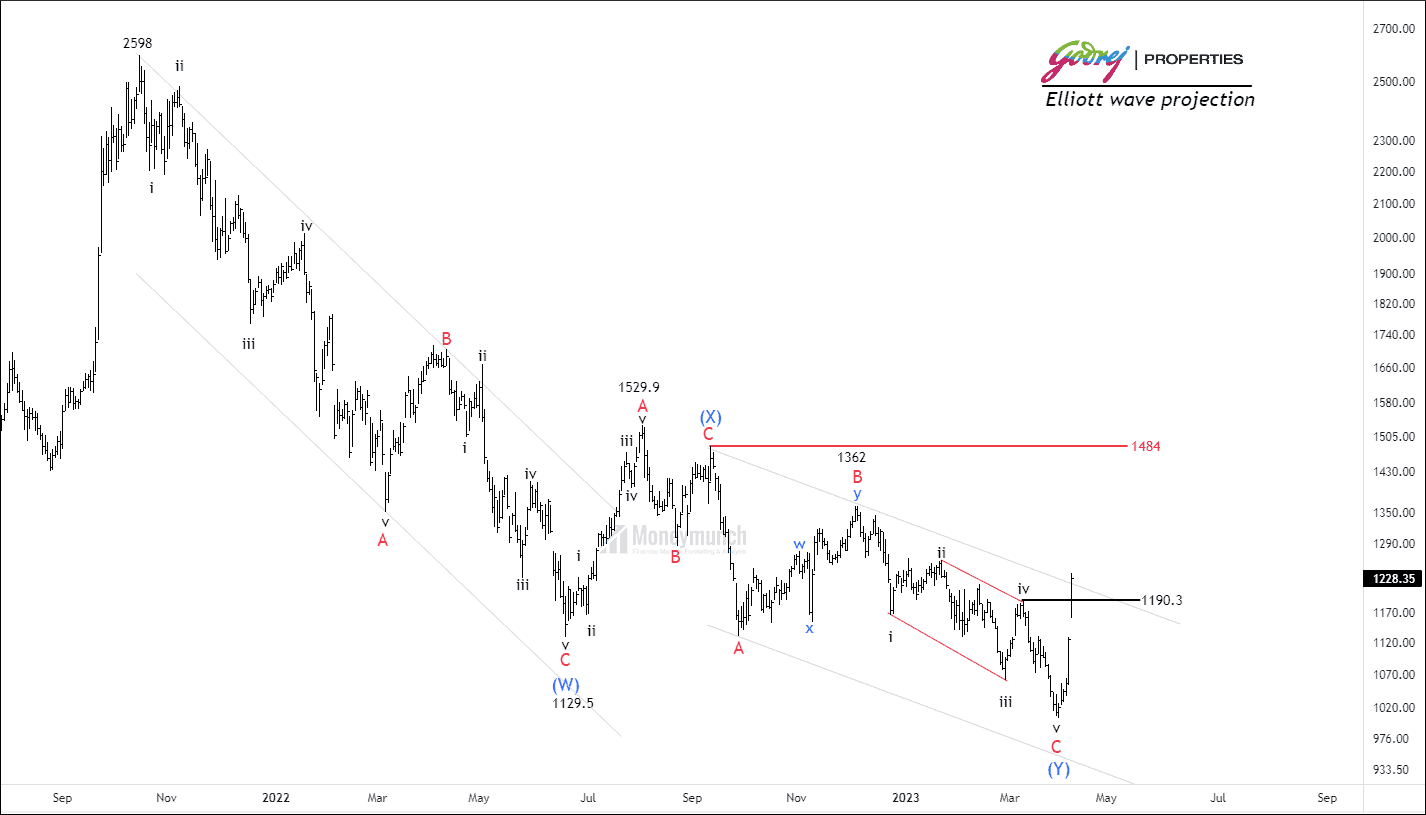

NSE GODFRYPHLP – Taking Advantage of Bearish Momentum

NSE’s GODFRYPHLP is currently undergoing a correction structure following a decline from its previous high of 2149. The price has already broken below the previous support level of 1755, indicating a potential opportunity for day traders until the price reaches the next support.

The Relative Strength Index (RSI) of the price is declining rapidly, adding further confirmation to a potential downtrend. If the price continues to sustain below 1747, traders can consider selling for the following targets: 1724 – 1700.5 – 1668+.

Is INDIANB on The Verge Of Bearish Reversal?

On the daily timeframe chart, NSE INDIANB appears weak. The price attempted to form a new high but ended up becoming a corrective structure. The price angle and structure, however, still appear Bearish market structure.

Traders can sell if the price sustains below 285, with targets at 282 – 279 – 274+.

NSE GILLETTE – Bottom Fishing

In the previous trading session, NSE’s GILLETTE recorded a strong close, and the daily Relative Strength Index (RSI) increased from 34 to 41.84. The price held steady at the previous support zone of 4150, indicating a potential rebound.

Traders can look for trading opportunities if the price continues to sustain above 4320. The suggested targets for traders are 4354 – 4424 – 4463+.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Great analysis. Keep it coming!

I agree with your analysis