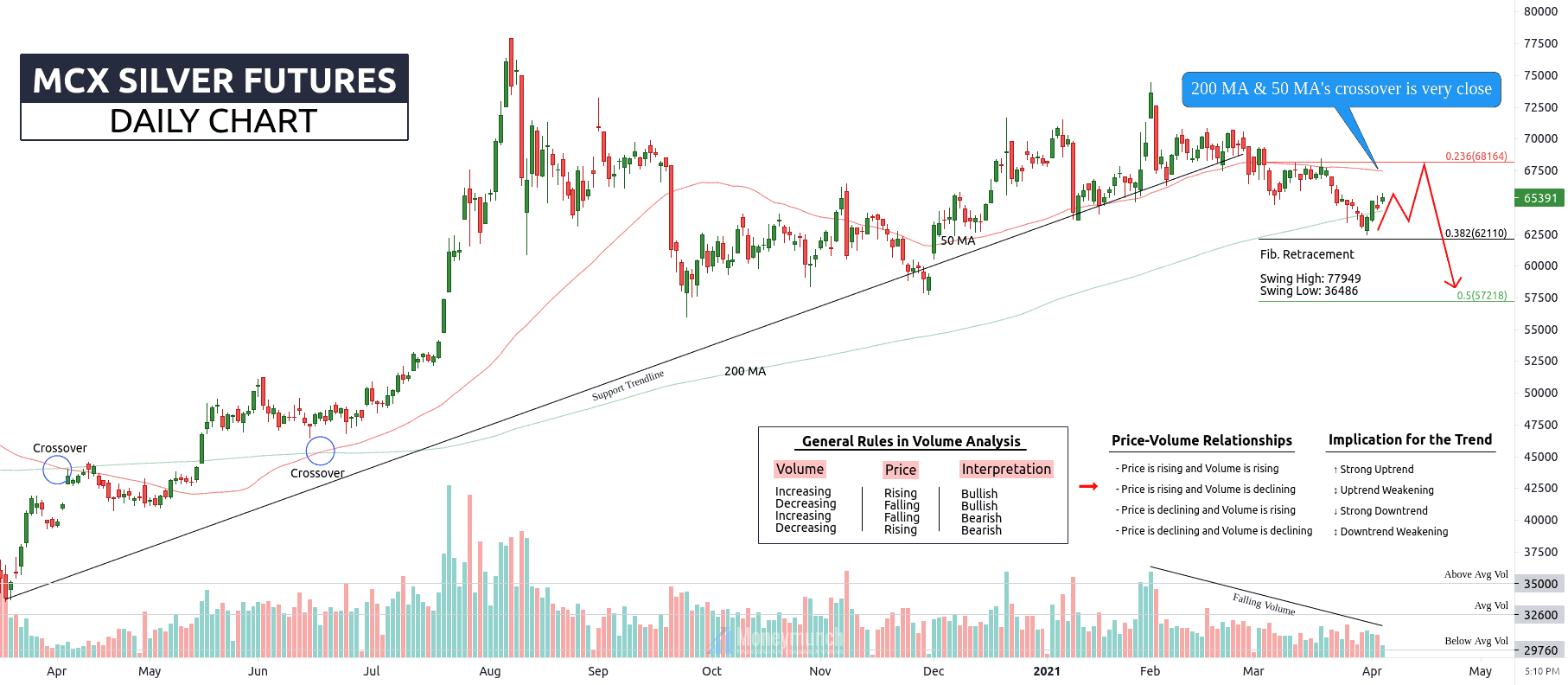

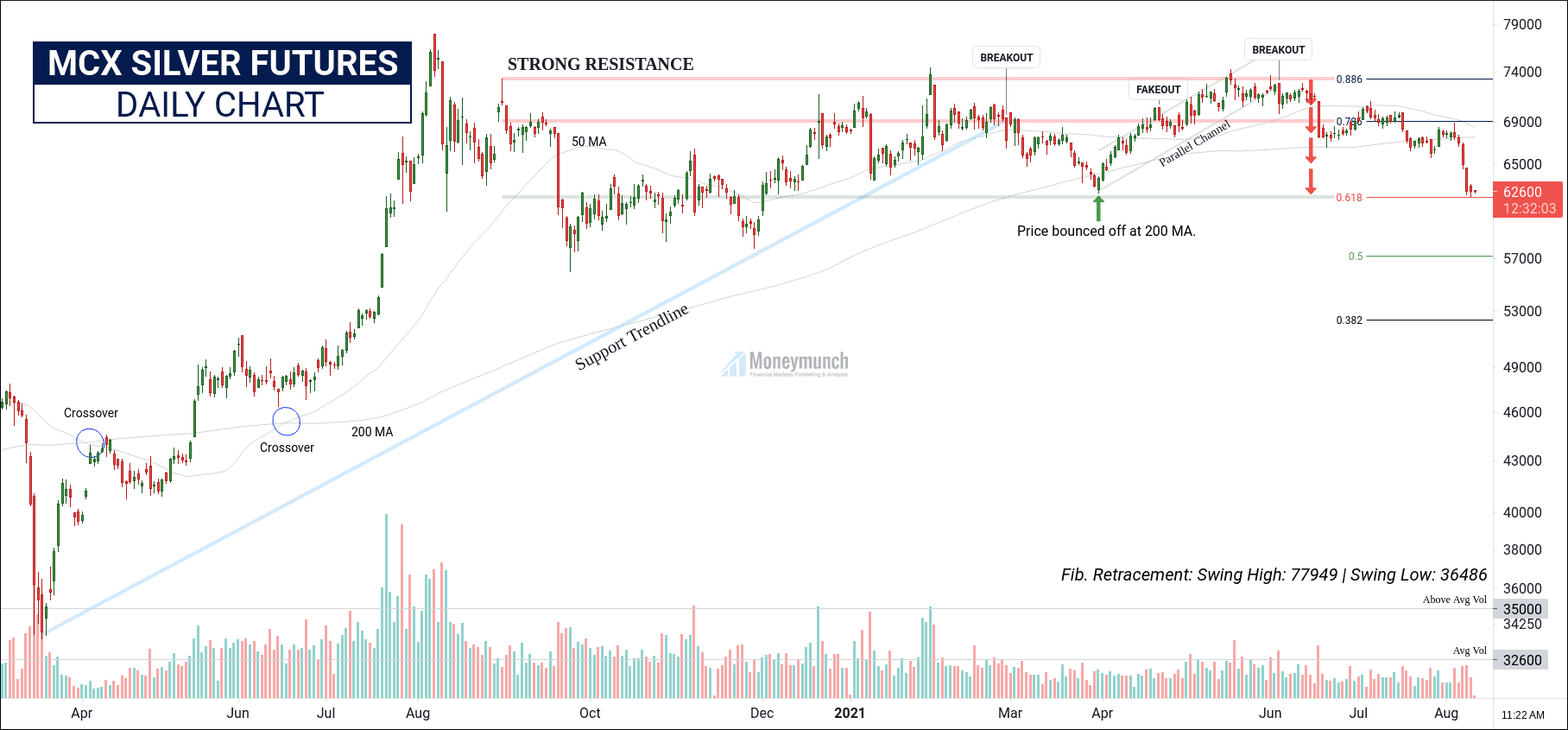

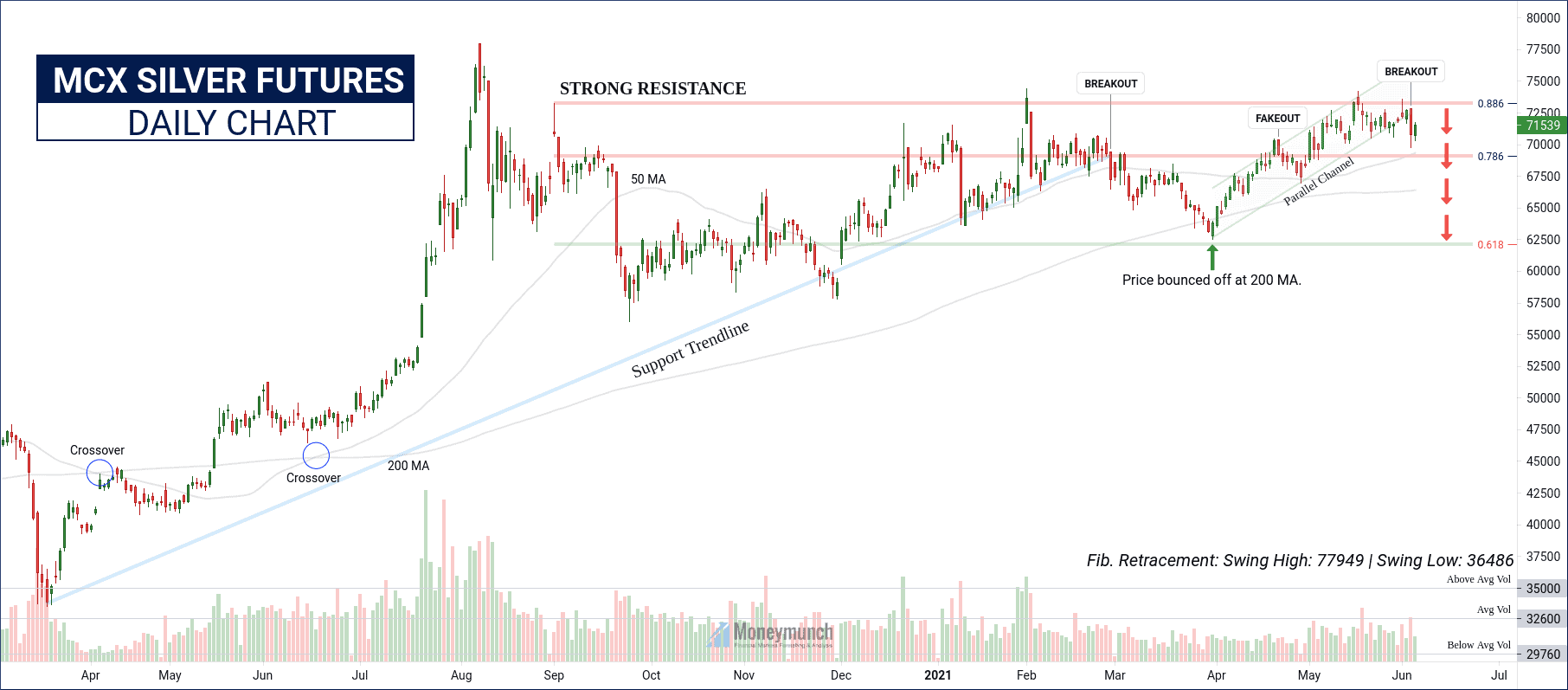

On 6 June 2021, I had drawn a chart of silver (URL: https://moneymunch.com/mcx-silver-touch-69200-this-week-tips/). Wherein, I’ve shown the silver can collapse up to 0.618. It has made a low of 62184 and touched 0.618 levels of retracement.

If MCX silver crossover and close below the level of 62110, it will try to hit 60000 – 58900 – 57260 levels.

Otherwise, it will take a bounce back from here and come back to the 65800 – 69200 levels.

Continue reading

Lock

Lock