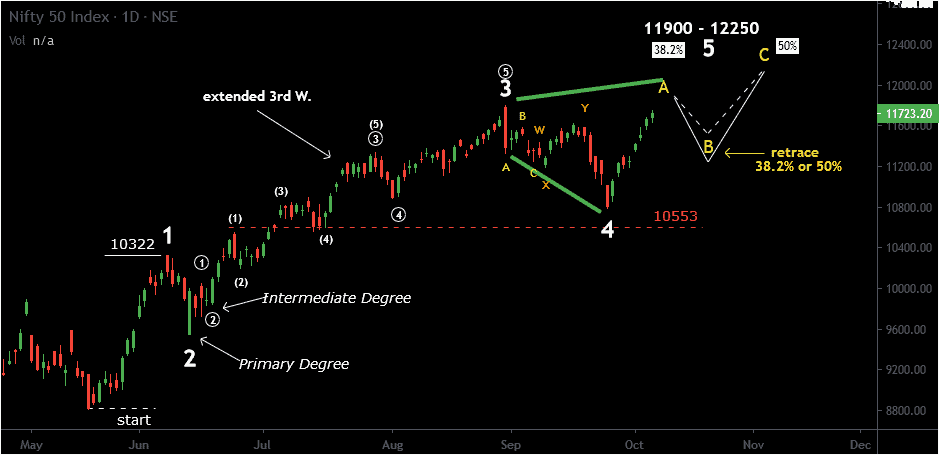

FIRST Wave: (Leading Diagonal Contracting)

In the first wave, we have detected the Leading Diagonal contracted within two yellow-colored covering lines but the leading diagonal occasionally appear in the first wave position of impulse. I have labeled by using roman numbers.

SECOND Wave: (The 50% Retraced)

Its a corrective wave formed A, B, and C. Its retraced 50% from the first wave and the price didn’t carry to a new low.

THIRD Wave: (Impulsive and Extended)

This wave is strong and broad with the Extension moved. The subdivisions of an extended wave are nearly the same amplitude and duration as required.

FOUR-Wave used Technique : (of Channeling to determine Five Wave)

I’ve used here channeling technique for confirmation of four-Wave completed perfectly. In this case, suppose to the fourth wave ends at a point touching the parallel channel.

FIVE Wave: (Price is currently toward this wave)

I have connected the ends of waves two and four to determine the five-wave causing wave one and three is normal.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock