To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

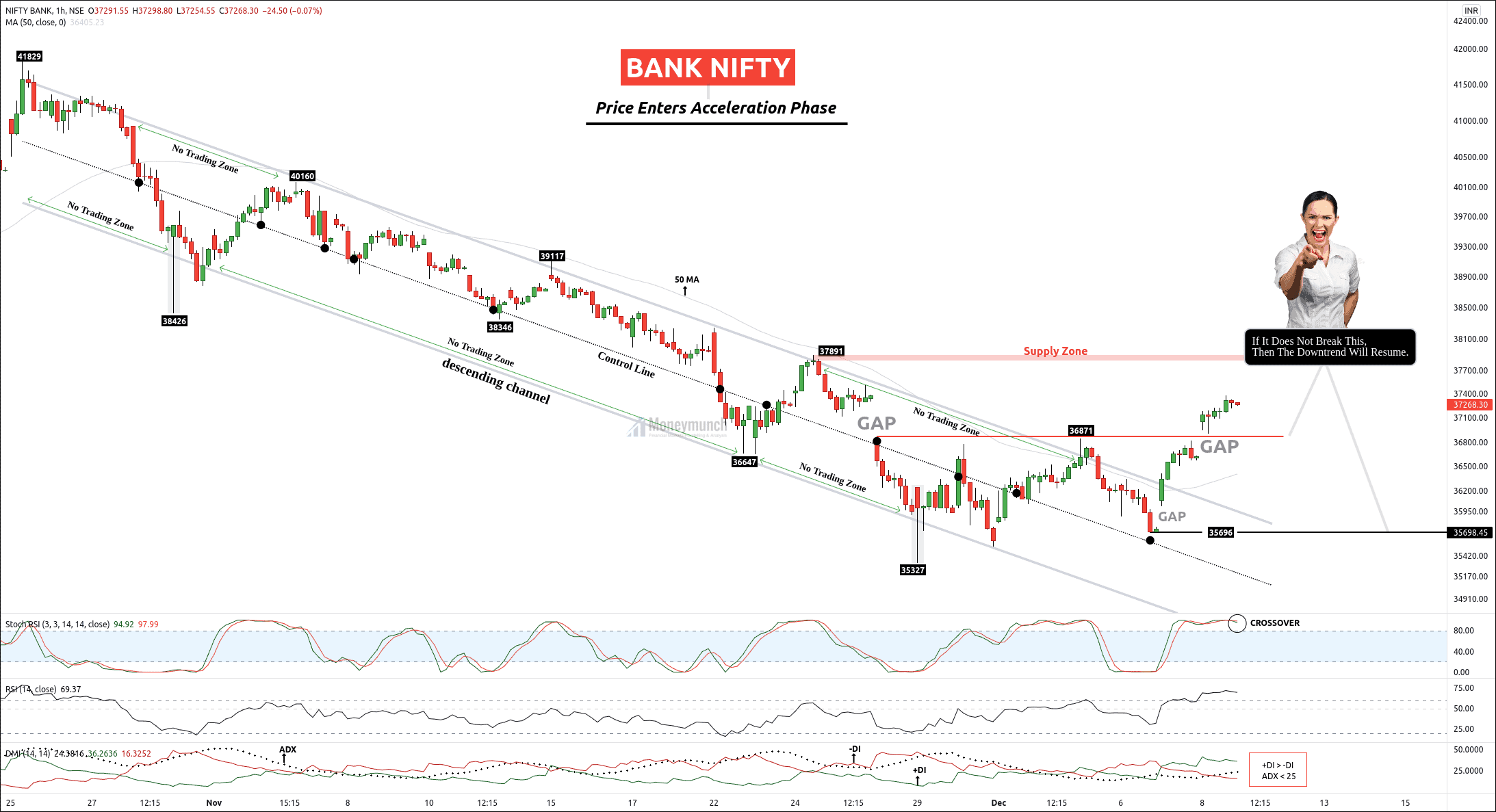

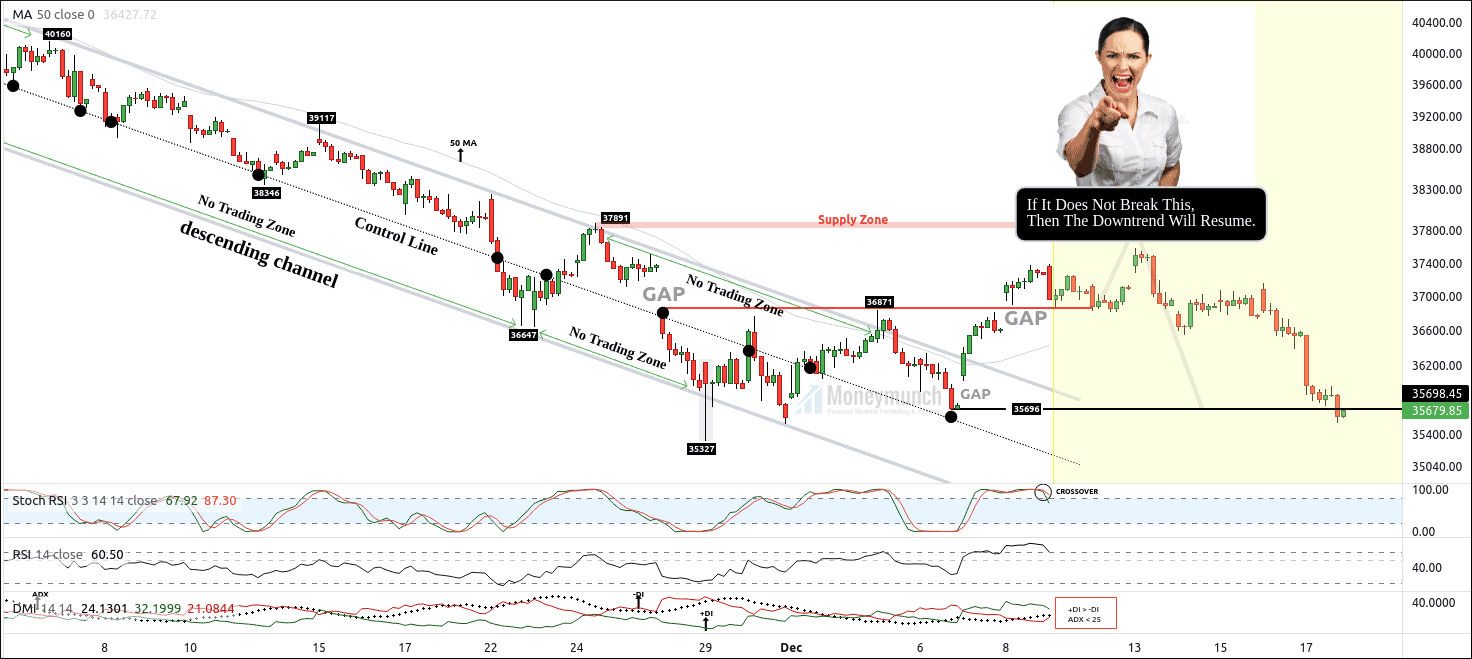

Bank Nifty Illustrates That Don’t Buy At Dip Blindly

Buyers neither faced the falling knife nor paused the bloodbath, and the sellers won the day.

Price had stuck in the descending channel, and we had a chance to see the maximum move of 37800 due to the supply zone.

I have mentioned (click here to read the previous bank nifty report), “you must note the second resistance of 36871. It is a barrier for buyers. If Bank Nifty remains under of it, then we may see an excess of this channel. And that will collapse the Bank Nifty prices from 36800 to 36300 – 35696 below.”

Price had started an upward move and made a high of 37581.

Bull traders pushed prices near the supply zone where sellers had taken control.

2:35 PM, Bank nifty reached the last target of 35696 and made a low of 35535.

Even if you have traded after the breakout of 36871, you could have 1164 points in just three days.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

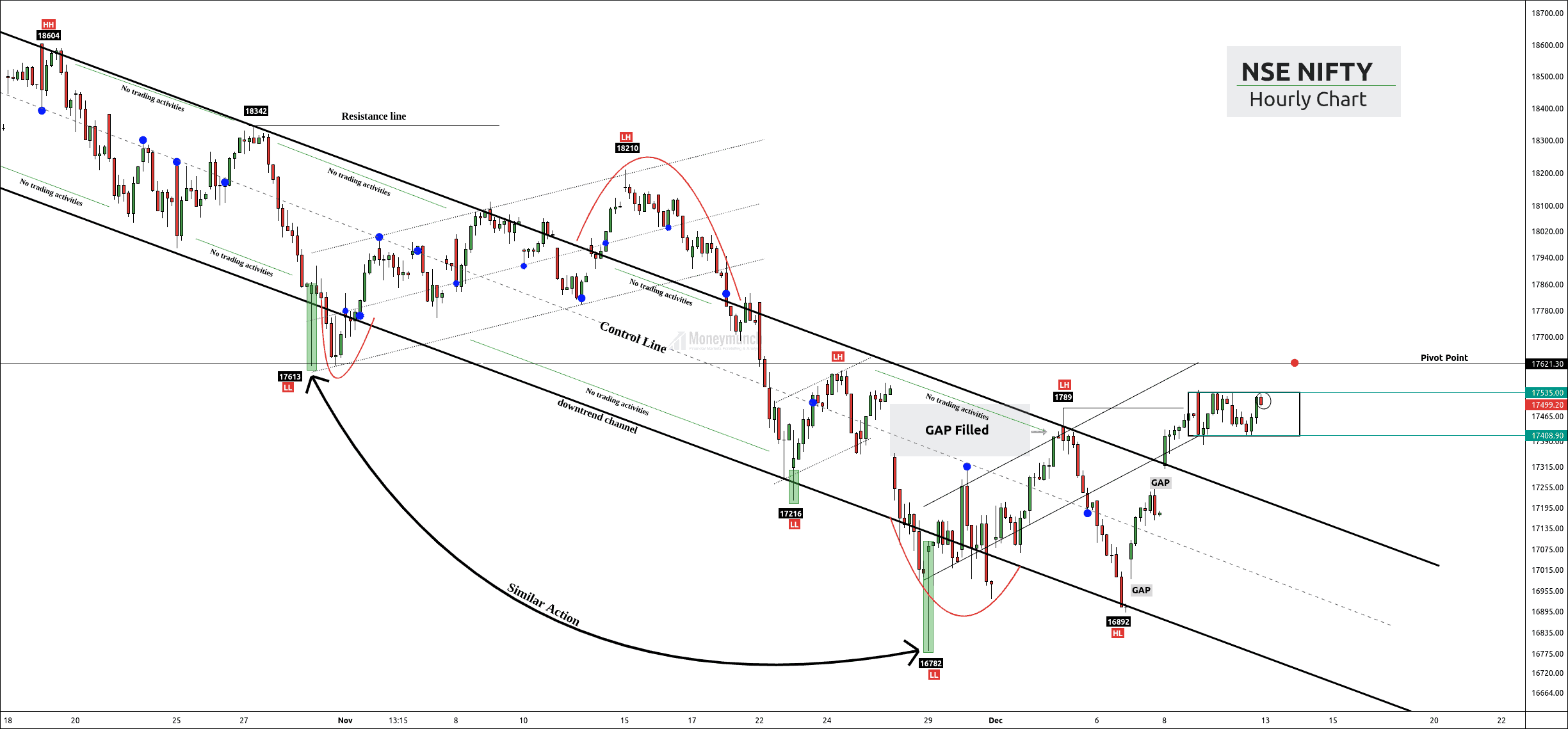

Nifty Can Step Back Here To Get The Following Targets

Nifty was out of the downtrend channel, but it hasn’t confirmed the bull run by breaking the nearest lower high. There was an important pivot point of 17646.

I have mentioned the following targets (Click here to read that nifty report):

“If nifty gives a continuous break to the upper band of the value area, traders can initiate a buy position for the target of 17554-17586-17618.”

“Strong closes above 17621 indicate a good time for bull traders.

Swing failure may drive the price lower. Bear traders can look for 17465-17408-17312.”

Nifty made a gap-up morning and hit all upside targets of 17554-17586-17618.

After reaching the last upside target of 17618, the price couldn’t give a strong close above it and fall for the downside target.

The pivot point has supplied to exceed the demand, and our downside targets have been reached by nifty.

It’s a sure thing that after losing one opportunity, you will find another but, if you lose this 12th-anniversary offer, it won’t come back again: Click Here to Join Now

NIFTY FUT Trade Setup For Subscribers (1:3 Risk Management System)

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

NSE – Nifty & Apollotyer Tips & Updates

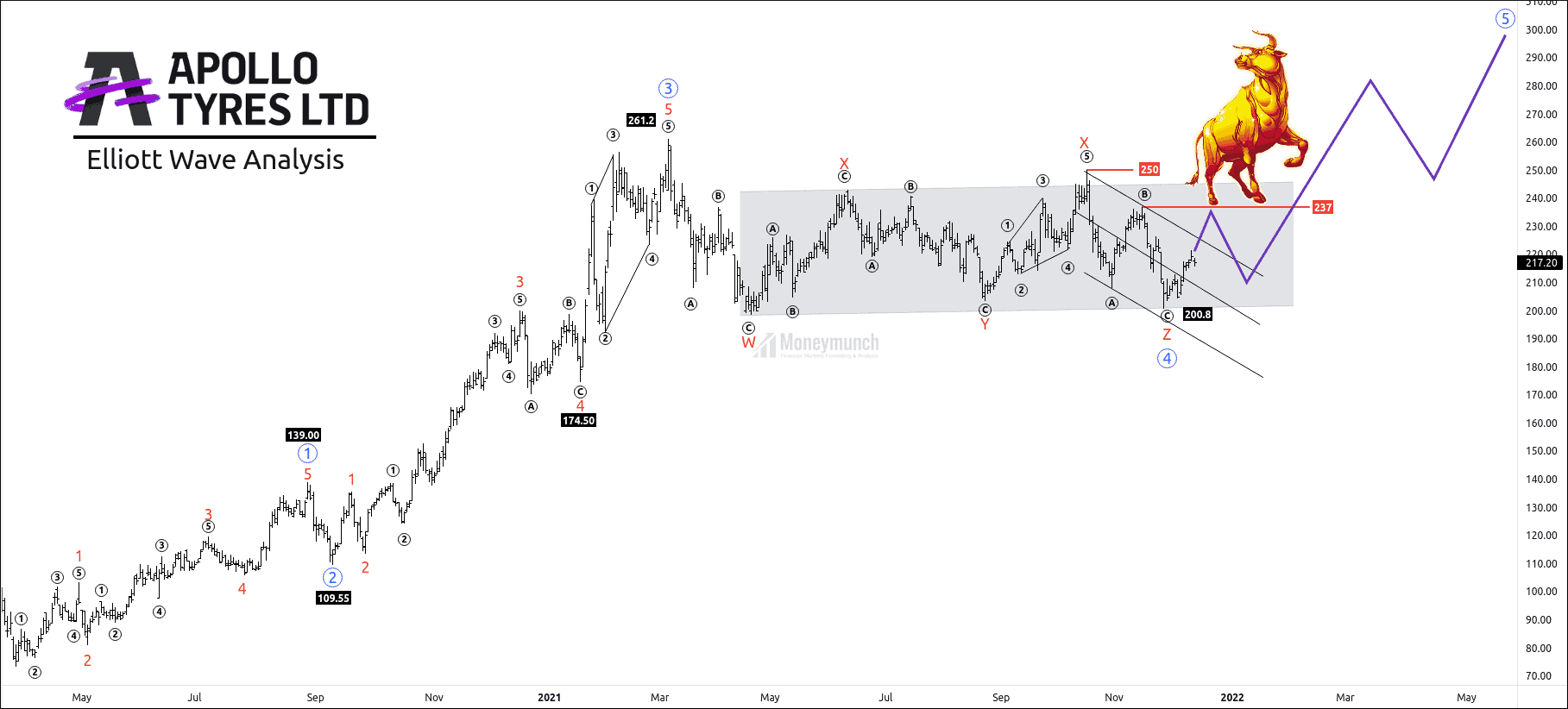

Will bull traders drive Apollotyer above Rs.300?

APOLLOTYER is preparing for a bull run. After completion of the 3rd wave at 261.2. Price had started a corrective wave ((4)) and took 38 weeks to finish this structure.

A trader can trade impulsive wave ((5)) to make a high confidence trade setup.

Wave Formations and Fibonacci relationships:

Wave ((1))is an impulse with a 5-3-5-3-5 wave structure.

Wave ((2)) is a zigzag move. Fibonacci retracement of wave 2 is 50% of 1st impulsive wave at 109.55. Sub-wave of wave 2 fulfilled the rule of equality (wave A= wave C)

Wave ((2)) is not exceeding the starting point of wave 1.

Wave ((3)) is an extensive impulse. 3rd wave has 261.8% retracement of 1st impulsive at 261.

Wave ((4)) is a triple three with a 3-3-3-3-3 wave structure.

It retraced 38.2% of the 3rd wave and did not overlap the starting point of wave 1.

What will happen next?

Completion of sub-wave z indicates that the corrective wave has ended. Price has started forming sub-waves of wave 5.

The sub-wave z of wave ((4)) has formed a descending channel.

If the price breaks descending channel and close above sub-wave ((b)) at 237, it will confirm the impulsive behavior.

(Note that the ending point of the corrective wave is the starting point of an impulsive wave.)

A trader can expect the following targets: 237 – 250 – 279 – 297+

Target 1: 237

[Clusters: high of wave B, the breaking point of the channel, 61.8% of reverse Fibonacci retracement of wave 4]

Target 2: 250

[Clusters: 78.6% reverse Fibonacci retracement of wave 4, high of wave X]

Target 3: 279

[Clusters: 38.2% of reverse Fibonacci retracement of wave 4, 50% Fibonacci extension of wave 1 through 3]

Target 4: 297+

[Clusters:161.8% of reverse Fibonacci retracement of wave 4, 50% Fibonacci extension of wave 1 through 3]

The safe traders can wait for the breakout of wave X.

If the price fails to break the wave X, correction is about to make a new leg down.

They can enter on the pullback to enter where they can manage risk with tight stop loss.

Invalidation: pullback can’t break the low of wave ((4))

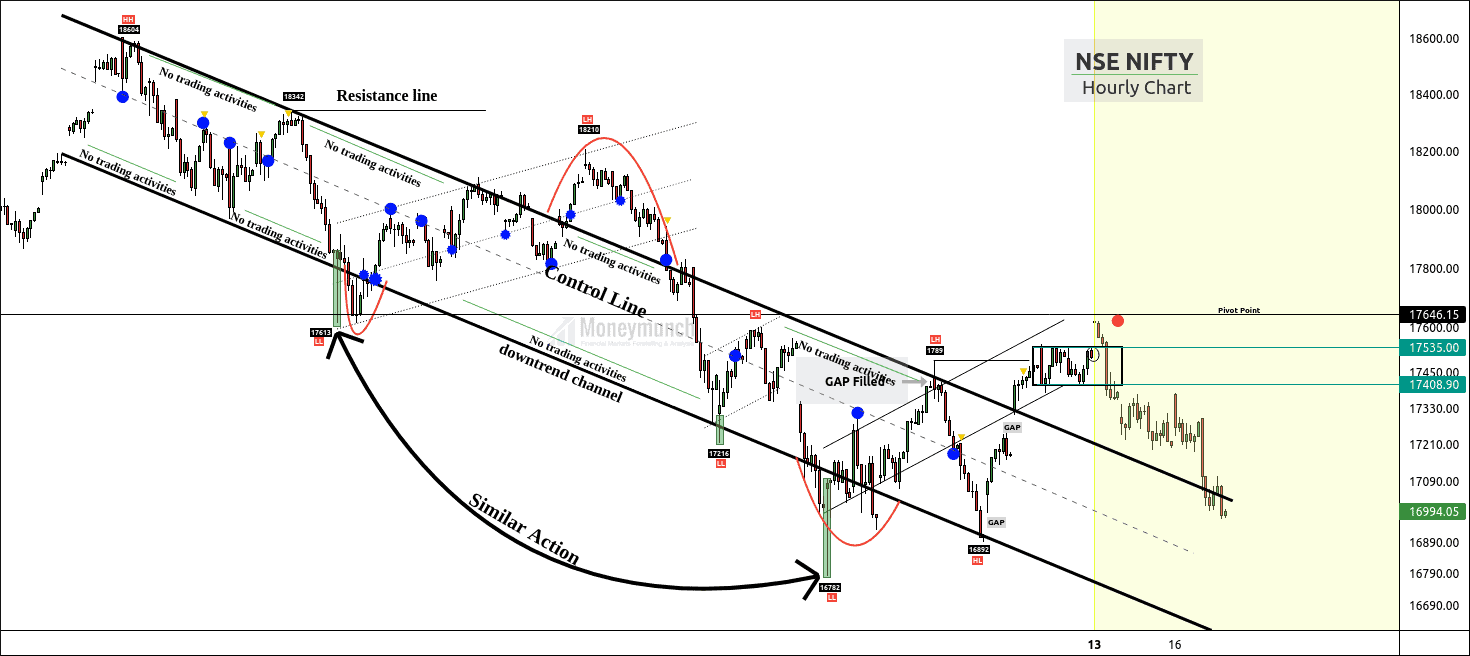

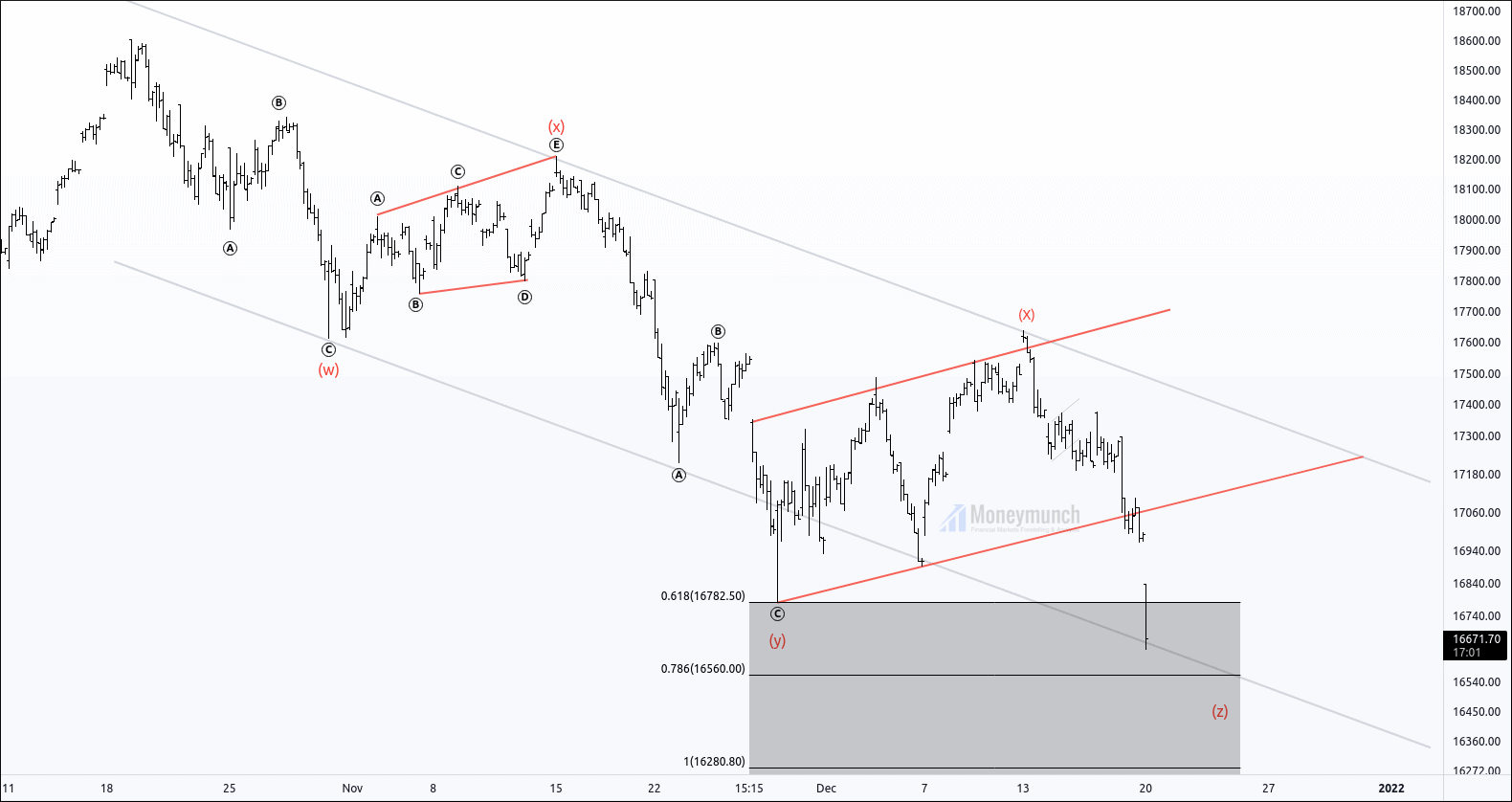

NIFTY UPDATE

Nifty has exactly performed as I described on the 13 Dec hourly chart. First, click the below link to read that Nifty Tips again:

Nifty is technically short-term bullish, but

First, nifty has touched the first three upside targets on the same day. And It has started collapsing to break downward targets of 17465-17408-17312.

Today nifty has made a low of 17225.8 and completed all targets. What’s next? I will update you soon.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Nifty technically short-term bullish, but…

Nifty hasn’t given a continuous breakout of the lower high. If nifty couldn’t give consecutive closes above lower high, there can be a failed swing low and signals resumption of the trend.

In 30-minute timeframe, the price has made a value area box where supply equals demand. If nifty gives a continuous break to the upper band of the value area, traders can initiate a buy position for the target of 17554-17586-17618.

Strong closes above 17621 indicate a good time for bull traders.

Swing failure may drive the price lower. Bear traders can look for 17465-17408-17312.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock