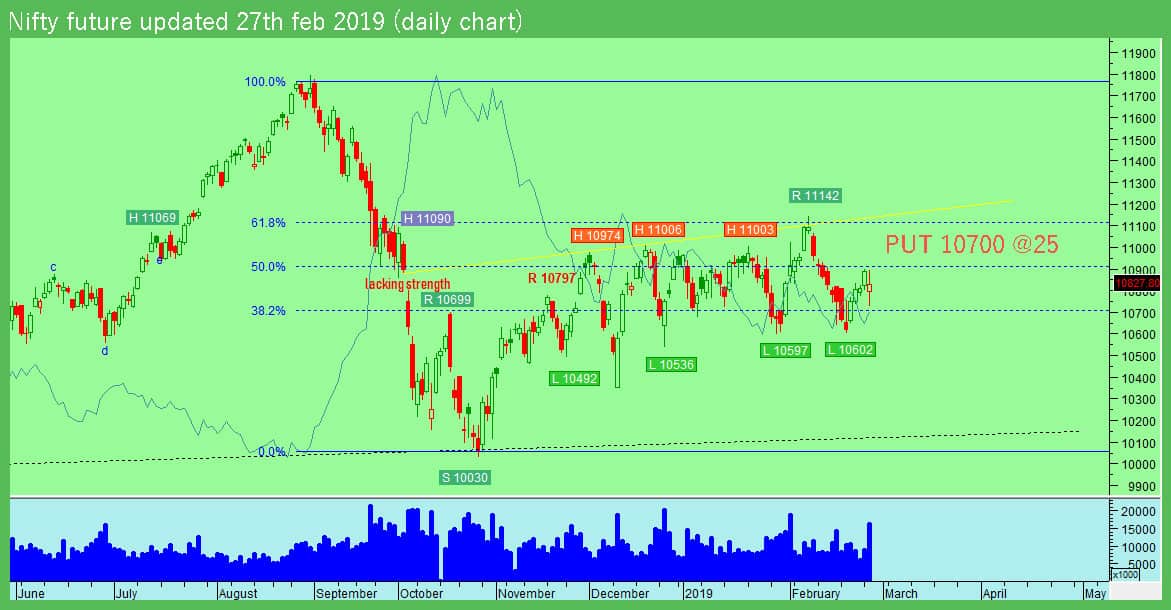

In the short term, the trend of nifty future appears to be change on the basis of technical.

According to change short term trend up to downside, we have picked few of stocks from Nifty 50.

- GRASIM

- COALINDIA

- BAJAJFINSV

- GAIL

As the trend is likely to change on the day of 6th mar 2019 or on the next day, the above 4 stocks are the best top-selling mentioned above.

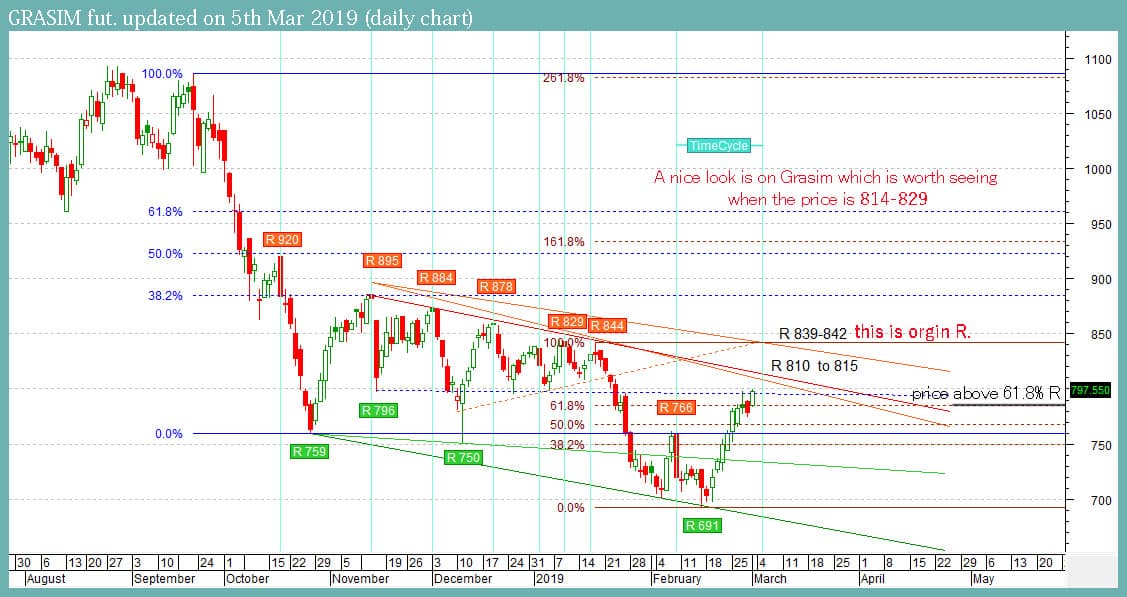

Presently we are going to update here GRASIM future chart.

GRASIM fut trading at 811 and high was 813. If we write technically, then now the GRASIM is drawing perfect level for selling…!

But, We should not act today because, We are expecting that Nifty index trend will change on or after 6th mar 2016 basis of Time Cycle expected. We should to try to sell at higher and higher price 814/829.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock