To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Words for nifty: choppy, range, side-way and break up-down…

In last update, We have book good amount of profit from the option trade:

Comment: BUY PUT OF NIFTY strike 11700 70-76 with stoploss 65 and targets 121-148 (CMP 79) wait for range

Comment: start booking on NIFTY PUT… CMP 102

Click here for last update:

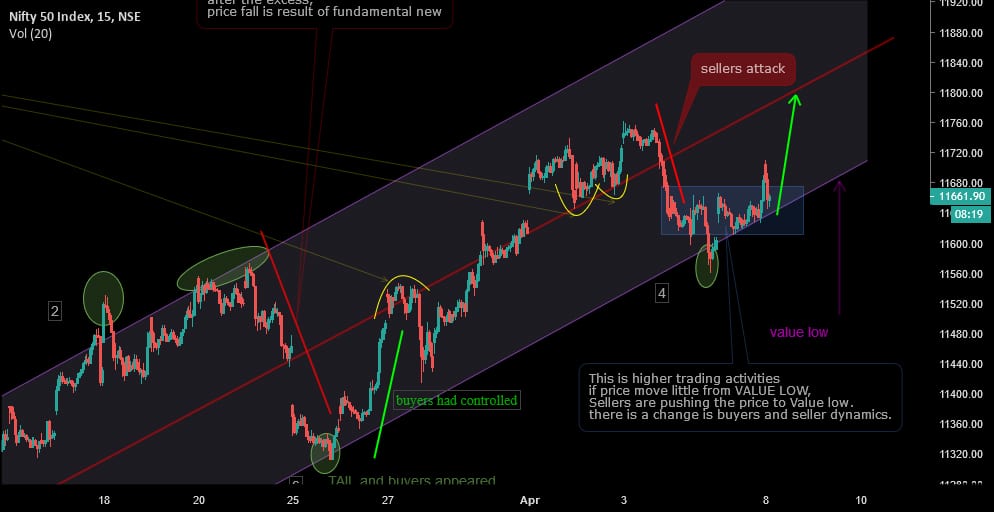

From the daily chart view, is signaling a sideways range movement in the market. Short term trend of Nifty is choppy and will expect to trade in the range of 11547-11636 intraday. After breaking, up-side will require a new update and downside breaking will lead to attracting target 11476-11489.

Intraday resistance at 11636 nearby where sellers can start taking their steps for target 11476-11489 if breaking down 11545.

- The general trend, however, is expected to remain bullish. General elections on April 11.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Nifty Has Two-Sided Assumption Found

Yesterday, I have clearly mentioned in chart to buy nifty with up buy arrow. Nifty exactly following our level.

Deeply researched on last Sunday for NIFTY which has a clear picture of what will be for it?

If I talk to you very frankly, there is two road-map for nifty and, from which it will follow that I don’t know.

Intraday support 11663 nearby where buyers can take positon.

Resistance plated on at chart 11705.

- Maximum Put writing was seen around 11,500.

- Positive global cues.

- Investments are likely to pick up after the Lok Sabha elections in 2019.

- Appeared today, fight between buyers and sellers in which seller has not much strenghth.

NIFTY FUTURE:

support for nifty future at 11702-11709 where buyers can think to buy with stop 20p stoploss and targets 11768-11815

R 11768 is resistance for nifty future.

below to 11700, be careful with long

Below both call given to subscribers…!

BUY YES BANK 270 strike PUT 8.5 t 9.35 with stoploss of 8.2 and targets 12.2 – 15

BUY PUT OF NIFTY strike 11700 70-76 with stoploss 65 and targets 121-148 (CMP 79) wait for range.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

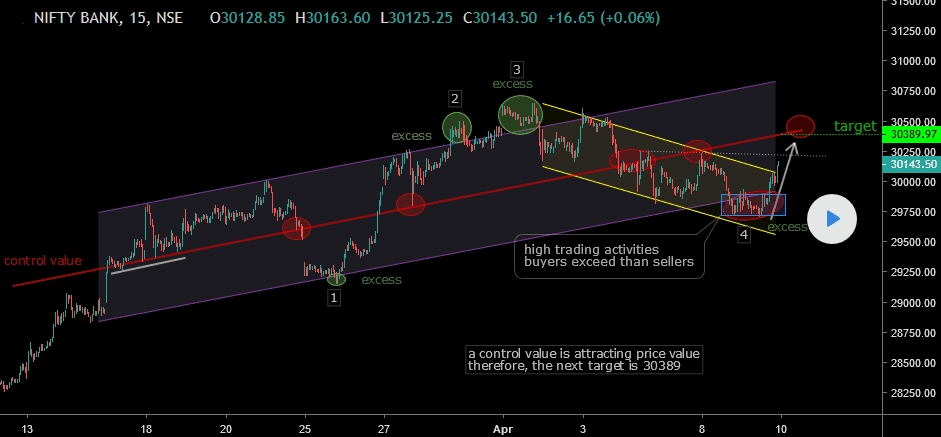

Who has controlled on BANKNIFTY, how?

We are again coming with BANKNIFTY analysis.

In the chart, it’s clearly visible that the strength of the buyers is much higher than the sellers. If a resistance not considered then, the next target is against our eye at 30389.

- Positive global cues.

- Investments are likely to pick up after the Lok Sabha elections in 2019.

- Appeared today, fight between buyers and sellers in which seller has not much strength.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

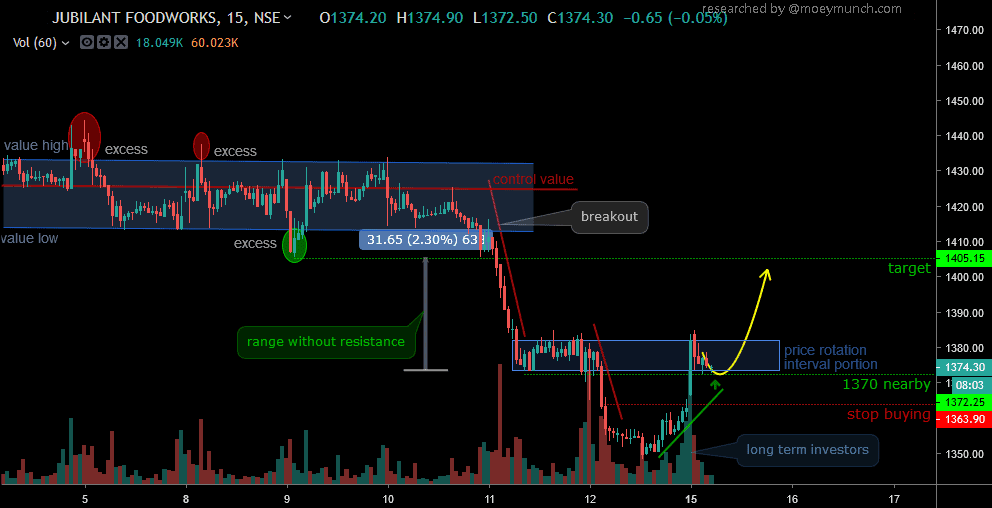

If we found long term buyers on DABUR, enter!

This is NSE equity daily chart of DABUR India.

we will see long term buyers will attract this stock.

Best buy level starts 390-396.

I expect the tail 390/396 and will update it live with targets.

I will update for subscribers after market open this stock with exact level for trade.To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Its Time To take Advantage Of Knowledge Over The NIFTY, Studied

Last friday, NIFTY future was followed accurately our intraday trading level.

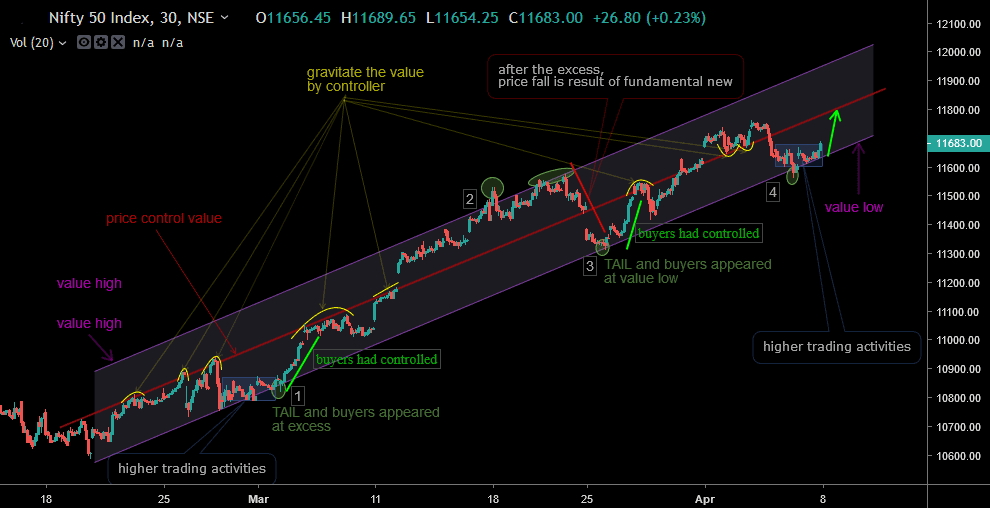

The right side of NIFTY chart, we have found that price rotation and higher trading activities plotted it by using a rectangle. Price value gravitating by control value. Suppose, it’s true then, nice can move upto 11780 again. Above 11626 we can think the bullish for the short term.

Price ration between buyers and seller are in the range of 11598-11678 appeared. (avoid the 3% penetration, any side price can see fire move)

In fact, there are the number of 5 excess, but I have shown 4 five excesses. Each excess has given single direction move, and we are at 4th excess.

We have seen very high trading activities when price moves away from VALUE LOW. It means, a war begins between buyers and seller at VALUE LOW. Sellers are ready to sell NIFTY if the price moves up, in another way buyers defeating with sellers.

just keep patience, wait to break the price… This is a critical situation. Just try to know which side seeing smart money, pension fund, hedge, insurance company, bank, broker, large individual traders or what every you called…

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock