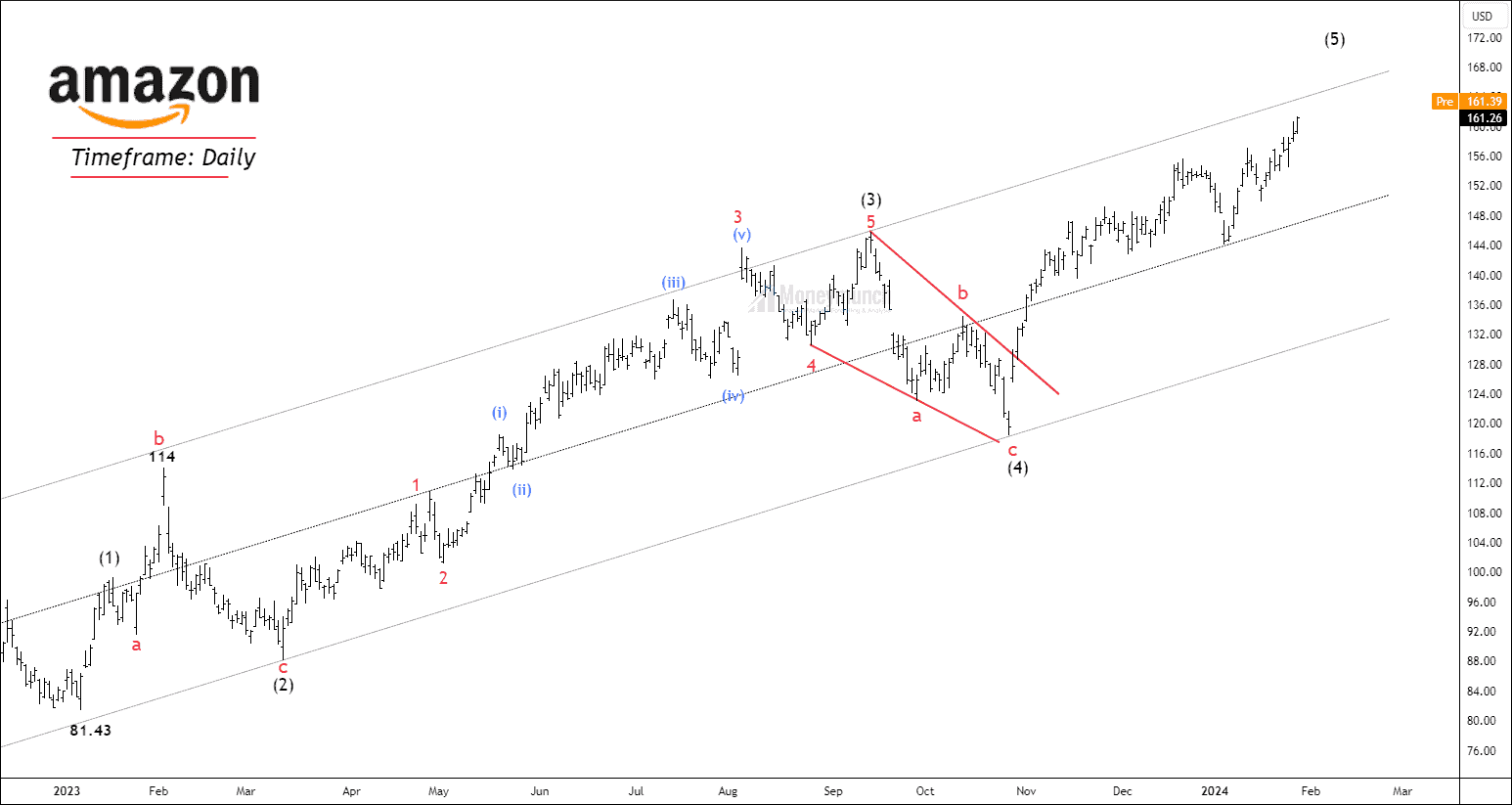

NASDAQ AMZN has started an impulsive cycle from 81.33, and the price is forming the final wave (5). The price has accomplished a corrective wave (4) and formed sub-waves of the impulsive wave (5).Wave Formation & Fibonacci relationships:

Wave (2):

- Wave 2 has formed an expanded flat with a 3-3-5 structure.

- Price retraced 78.6% of wave (1).

Wave (3):

- Wave 3 has constructed a motive structure.

- Wave 3 is an extensive wave with a 3.618 multiple of wave (1).

- The sub-structure and element structure is visible.

Wave (4)

- Wave 4 is a zigzag formation and can be mentioned as a triangle by changing the labels.

- Wave (4) retraced 50% of wave (3).

Wave (5)

- The structure of wave (5) does not look like an ending diagonal. So, the last option for us is to assume it is an impulse.

- The common Fibonacci relationships are:

– Wave 5 = Wave 1

– Wave 5 = 0.618 reverse Fibonacci of wave 4

– Wave 5 = 0.618 X Waves 1 through 3

– The upper band of the parallel channel and throw-out out in many cases.

ADX (average directional index):

The ADX (14-day setting) shows strength coming but doesn’t advocate the cause of the shart surge. Traders must note to take high probability traders after ADX crosses 30. It only measures whatever trend it is, should one trade or not, by measuring the strength of the trend.

ADX level of 22 shows that the market can be choppy in many instances.

Weekly Trend:

The weekly trend looks strong, as the price has broken out a crucial resistance zone at 143. If the weekly trend & Daily trend are bullish, day traders can take long traders to be within the trend.

To look in-depth, we have to analyze the shorter timeframe. This way, we can get a clear story of wave (5) before initiating any position.Continue reading

Lock

Lock