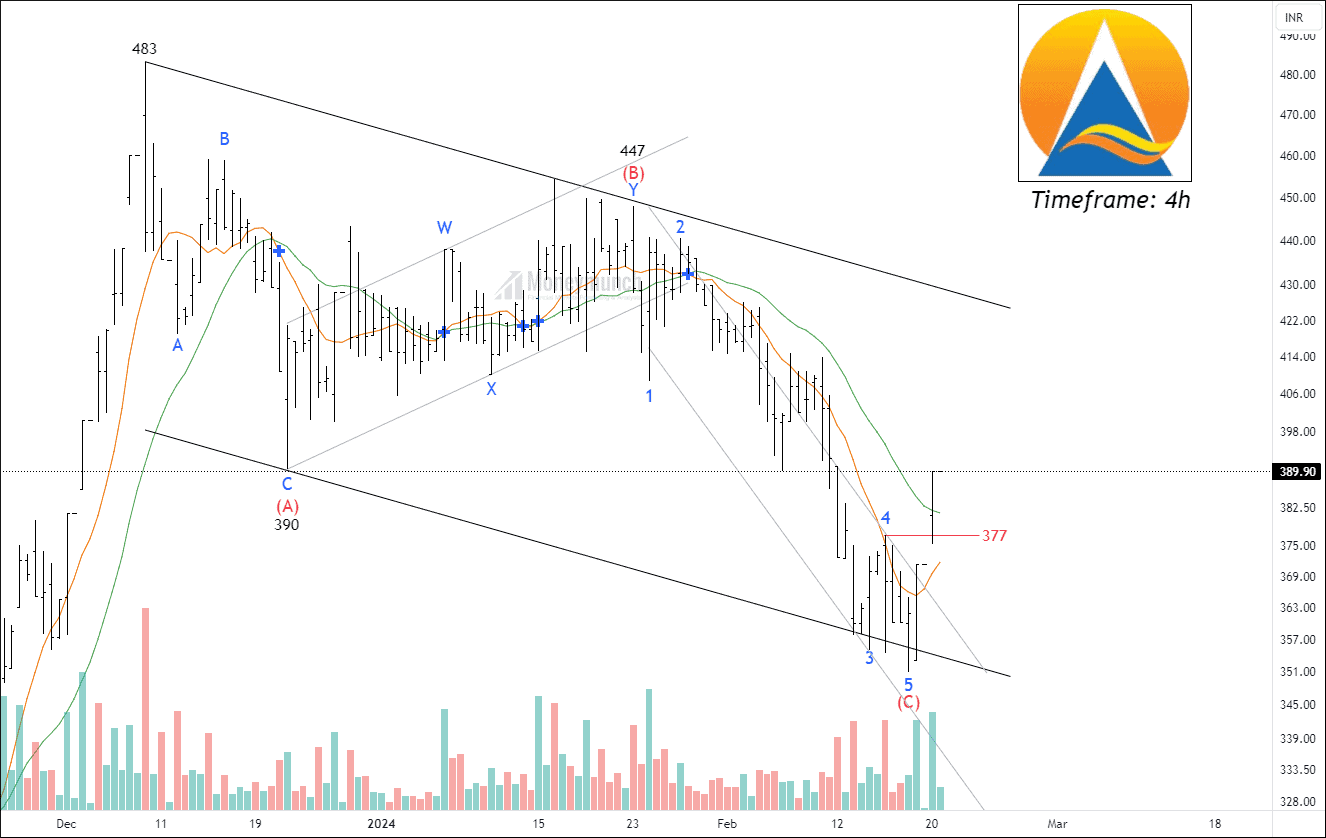

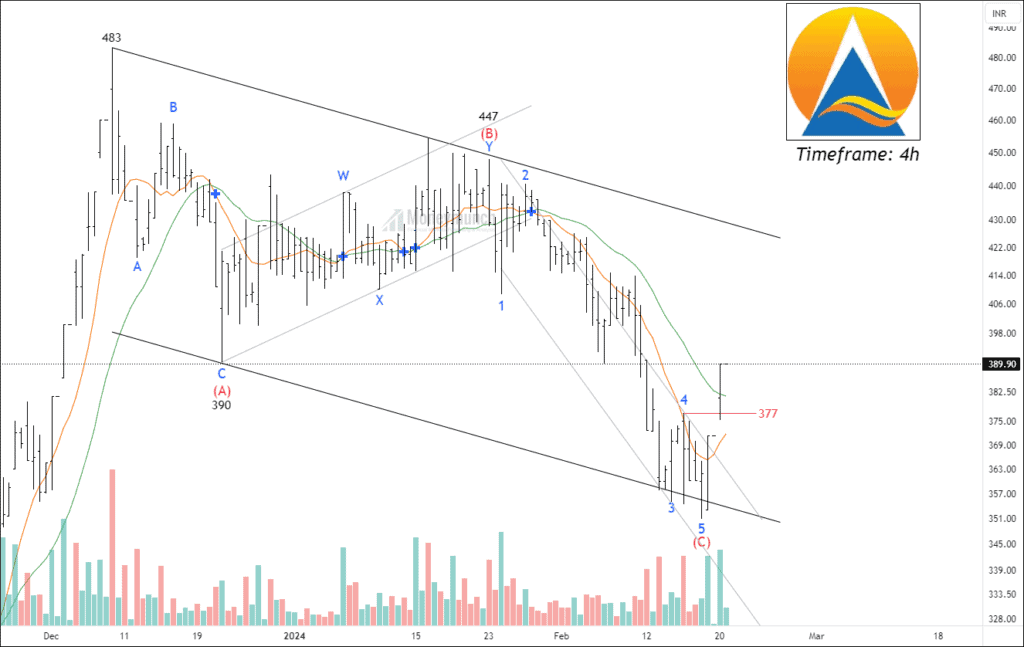

Timeframe: 4h

It appears that NSE ASHAPURMIN has undergone a corrective pattern in its structure. Recently, the current prices have broken out of wave 4 within wave (c) and have begun to rise. This breakout meets the criteria of the percentage filter, as the price surged by nearly 5% during the last trading session. Additionally, the price has broken out 9 and 35-period simple Moving averages.

Following a potential throwback, if the price manages to hold above wave 4 at 377, traders may consider initiating trades targeting the following levels: 402 – 425 – 447+. It’s important to note that wave (B) will serve as a significant resistance level, and traders could consider adjusting their targets upon a breakout beyond this level.

Stay tuned for further updates and information.

NSE NESTLEIND – Breakout Setup

NSE stock NESTLEIND recently broke out from a rounded bottom pattern, surpassing a critical resistance level at 2525. Following the breakout, the Average Directional Index (ADX) has begun to trend upwards. Additionally, the price is currently trading above the 50, 100, and 200 exponential moving averages.

This presents a promising opportunity for traders to consider buying the security on a pullback. If the price maintains itself above 2525, traders may target the following levels: 2540 – 2572 – 2601+. However, it’s important to note that the stock might experience consolidation due to proximity to the previous lower high. Free subscribers can take the previous day’s low as an invalidation level.

Further information is only available for premium subscribers.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Nice pick