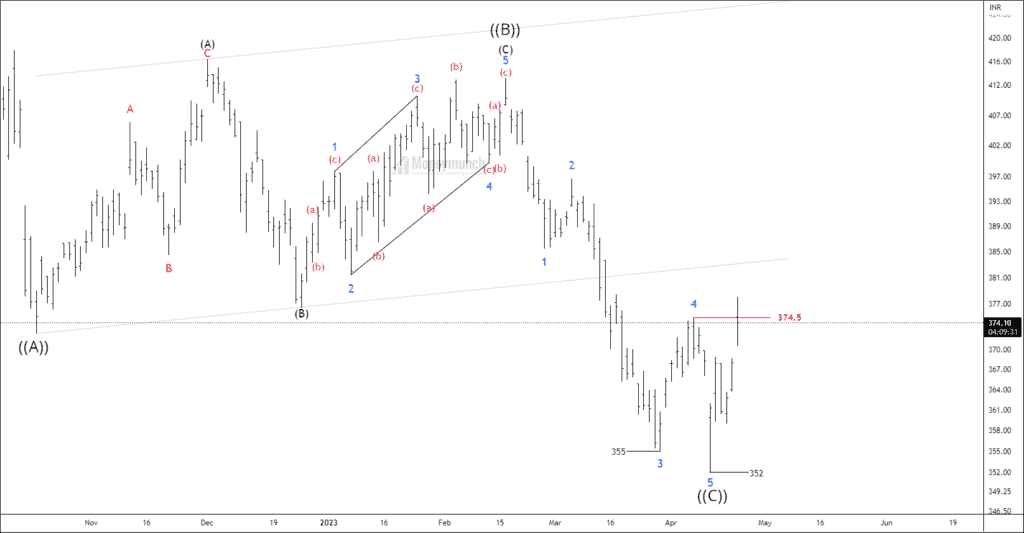

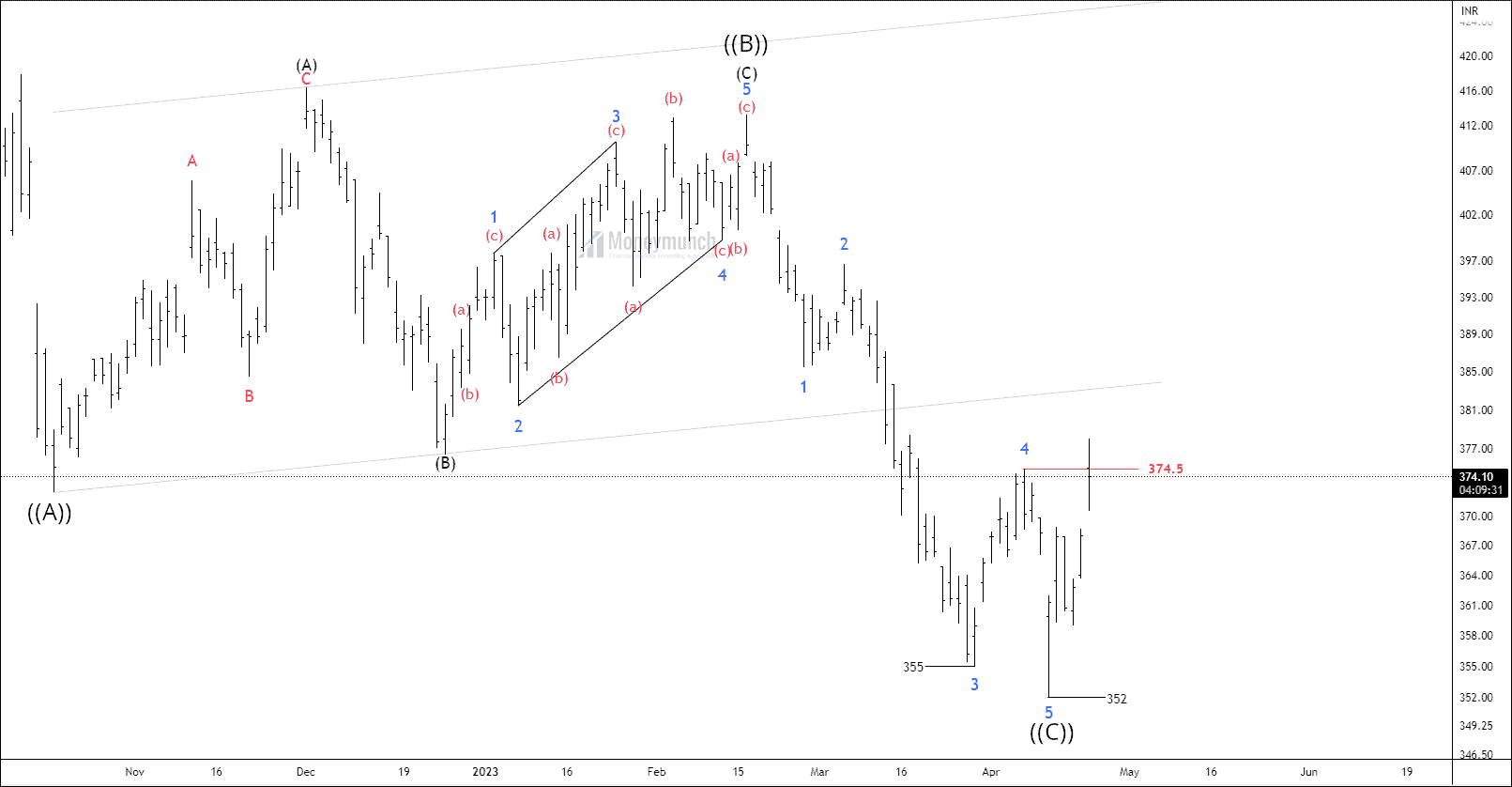

Timeframe: Daily

NSE WIPRO has been undergoing a corrective phase for over 18 months and is currently trading below its 200-day Exponential Moving Average (EMA). The security had reached a new high of 739 before experiencing a sharp decline to 352.

During a significant portion of this period, the security’s price has completed a corrective wave, indicated as (c) at the 352 level. Currently, it appears that a new impulsive cycle is forming, presenting a research opportunity with high risk but also the potential for a very high reward.

Based on the wave principle, an impulsive cycle can only commence after the breakout sub-wave of wave 4 from the previous cycle. If the price breakout wave 4 occurs at the level of 375, traders may consider buying with the following price targets in mind: 388 – 415 – 438+.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Thank you for creating such informative and accurate charts. Your attention to detail and dedication to accuracy is truly appreciated.

Wave analysis is incredibly insightful and provides a great understanding of market trends.