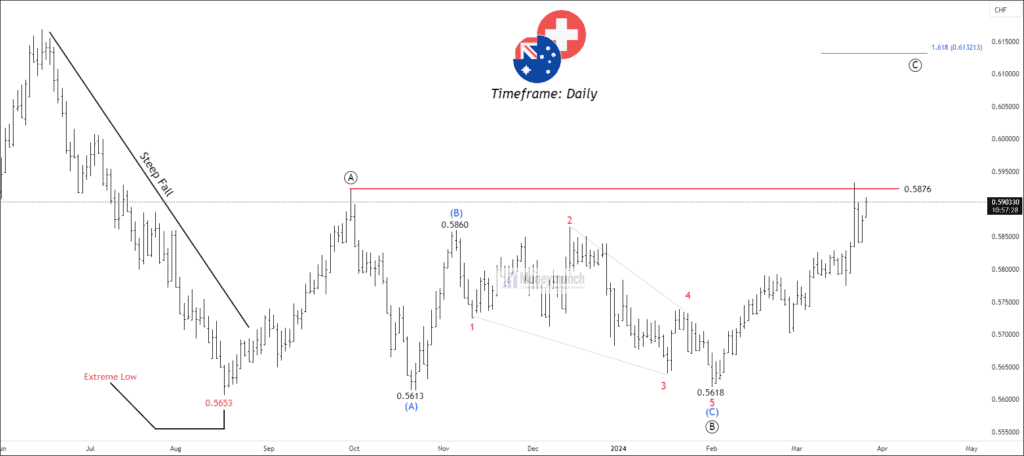

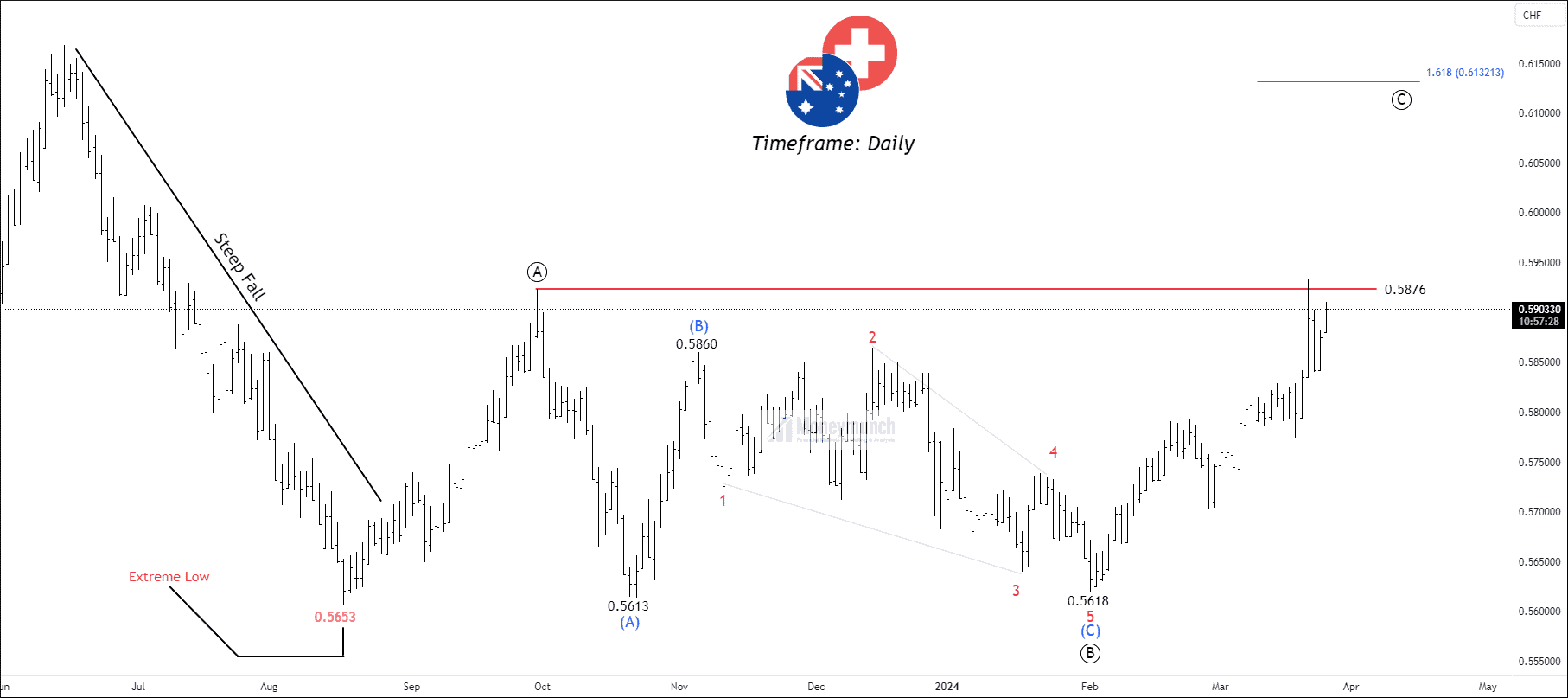

Timeframe: Daily

The price, originating from a significant low of 0.5607, has initiated a corrective structure known as A-B-C. During this process, the Average True Range (ATR) has been on the rise alongside the price. Additionally, the Average Directional Index (ADX) has shown an upward trend since the inception of wave C, reaching a notable level of 28.33.

Wave ((A)) exhibits a flat structure, while wave ((B)) has formed another flat structure with an underlying diagonal at wave (C). Currently, wave (C) is in the process of formation. The price has reached a 100% extension of wave ((a)) at 0.5876. If the price breaks out at 0.5876, traders can trade for an extended wave ((C)) with the following target: 0.5978 – 0.6037 – 0.6112+. We can change the wave count into impulse after the confirmation. Otherwise we should be ready for the fall after the completion of wave ((c)).

We will update further information for premium subscribers soon.

Get free forex & currency ideas, chart setups, and analysis for the upcoming session: Forex Signals →

Want to get premium trading alerts on GBPUSD, EURUSD, USDINR, XAUUSD, etc., and unlimited access to Moneymunch? Join today and start potentially multiplying your net worth: Premium Forex Signals

Premium features: daily updates, full access to the Moneymunch #1 Rank List, Research Reports, Premium screens, and much more. You΄ll quickly identify which commodities to buy, which to sell, and target today΄s hottest industries.

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.