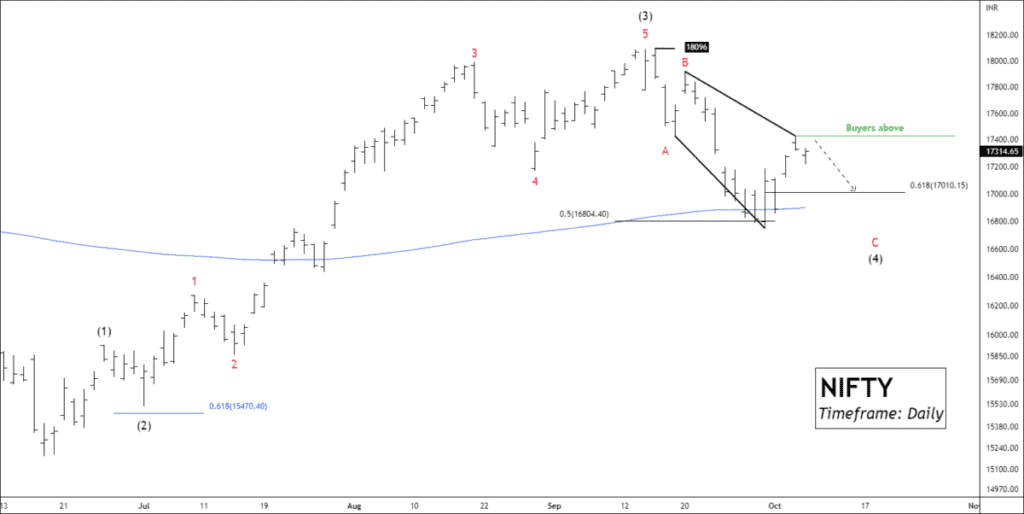

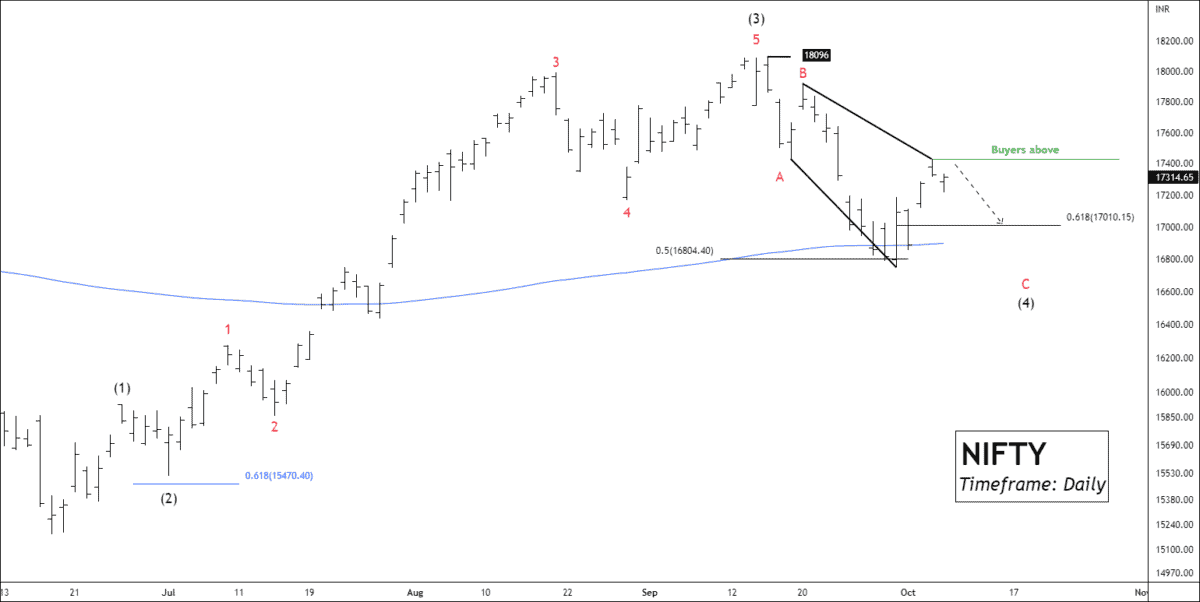

NSE Nifty: Elliott Wave Analysis

NIFTY has been forming corrective waves for more than two weeks. After making a low of 16647, nifty couldn’t hold above 17450. If Nifty wants to continue its bullish momentum, the price must sustain above 17450.

Even if nifty has bullish sentiments and is preparing for impulsive wave 5, it will take enough retracement to generate more buyers. If nifty sustains below 17300, traders can trade for the following targets: 17232 – 17135 – 17075.

In the case of bearish momentum, the breakdown of the lower low will lead the price to an extreme low. It is not advisable to buy blindly, but to wait for the bottom if you are a buyer/investor.

Subscribers will have excess information. (To become a subscriber, subscribe to our free newsletter services. Our service is free for all.)

NSE TITAN: Reversal or Trend Continuation

TITAN is at 12-week old resistance. Price couldn’t break the 2755 level with five attempts.

Price ended up falling to find enough demand. If the price fails to break 2755, traders can sell for the following targets: 2689 – 2634 – 2583.

There is a low possibility for a new high for TITAN. But we should look at every possible outlook. If the price sustains above 2755, traders can buy for the following targets: 2770 – 2825.

Will NSE Dalmia Bharat Break The Neckline?

Dalmia Bharat is trading below 200 EMA, which signals a bearish movement. The RSI of the price is below 42 points. Price has reached a crucial support level of 1520.

Traders must wait for the break out of the range 1520 – 1540. If the price sustains below 1520, traders can sell for the following targets: 1507 – 1490 – 1481.

As I mentioned, the price will be at a powerful support level of 1520. If sellers fail to stop bulls from sustainably above 1540, traders can trade for the following targets: 1554 – 1569 – 1587.

In addition, Dalbharat has formed a head and shoulders pattern, and the neckline is 1518.

We will update further information soon.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Perfect analysis for beginner as well as pro trader to initiate first trade of the day. Thank you.

Good insight

Love your work from Toronto, Canada.

I would like to give a try to your premium services. Have a great day!

Beautifully Explained 👍