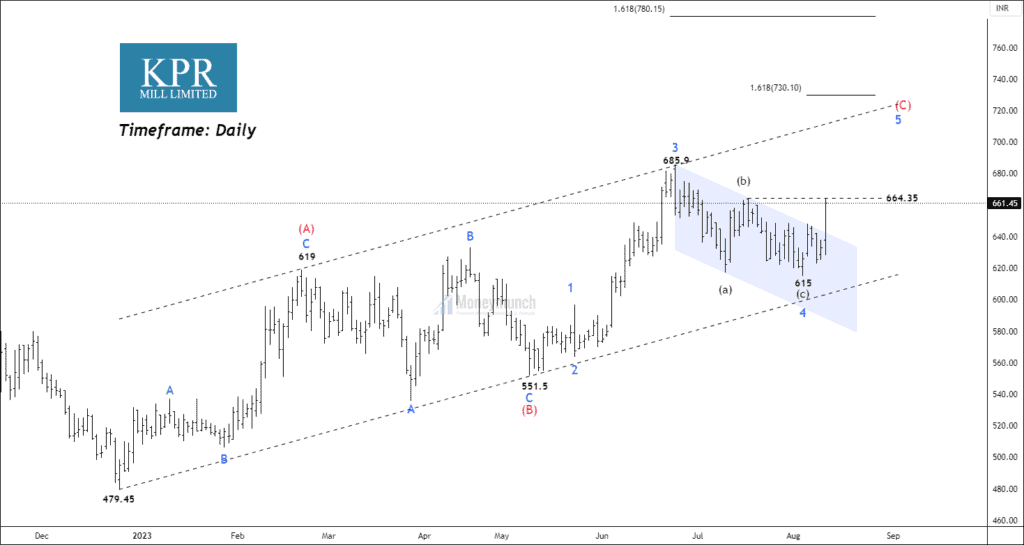

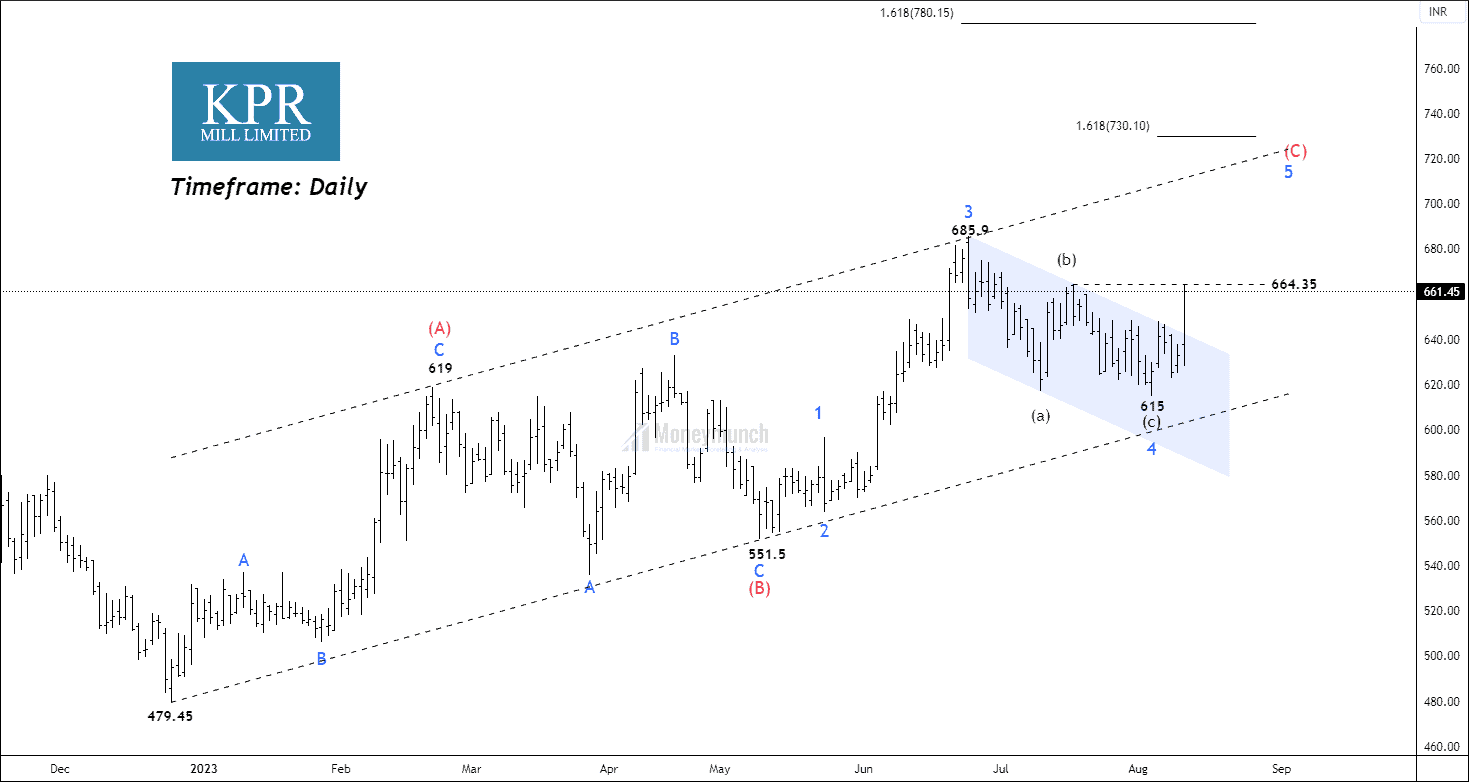

Timeframe: Daily

NSE KPRMILL has initiated a corrective phase from the level of 479.45. The current market prices are trading above the 20-day, 50-day, 100-day, and 200-day Exponential Moving Averages (EMAs), indicating positive momentum. The Relative Strength Index (RSI) for the stock has climbed to 58.83, suggesting a robust underlying trend.

In the context of Elliott wave analysis, NSE KPRMILL has successfully completed wave (B) at 551.5. According to the Elliott wave principle, a change in trend can only occur following a breakout of the corrective wave pattern B/X/2. If the price manage to sustain itself above the level of 664.32, traders may consider engaging in trades targeting the following levels: 686 – 709 – 728.6+. These target levels are derived from the reverse Fibonacci measurements of wave 4 within wave (c).

Upon achieving the specified target levels, there exists the possibility of an extension to the upside, reaching up to the 1.618 Fibonacci extension level, which stands at 777.7.

We will update further information for premium subscribers soon.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.