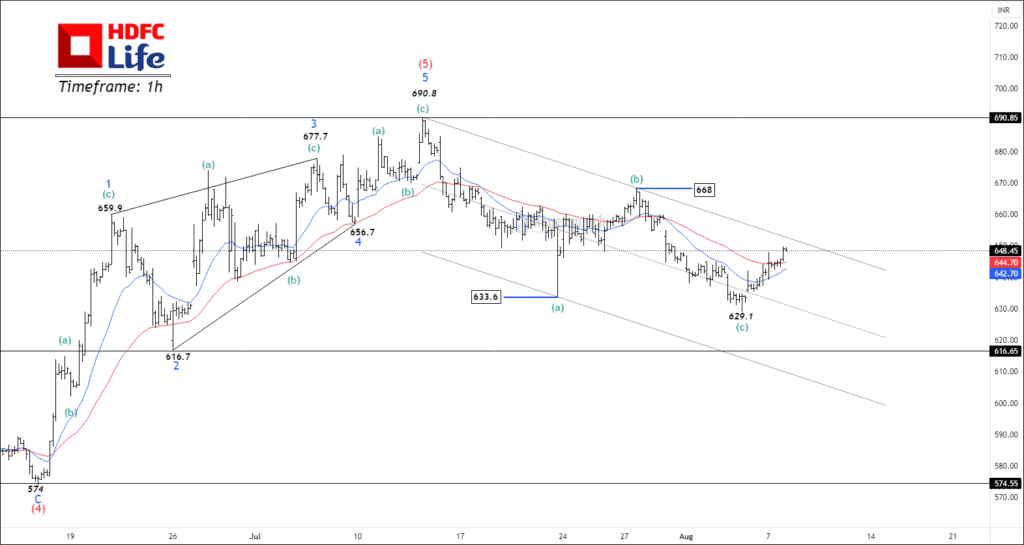

NSE HDFCLIFE – Elliott wave Projection

Timeframe: 1h

HDFC Life’s stock recently completed an impulsive price movement and has since entered a corrective phase following its peak at 690.8. This correction took the form of a pattern labeled as A, B, and C, with Wave C retracing 78.6% of the preceding Wave 5, indicating that price equality has not been achieved.

In line with Elliott Wave theory, the potency of corrective Wave B/2/X lies in its capacity to effect a substantial correction. Thus, breaching the boundaries of these levels becomes imperative for a potential change in direction. Should the price breach Wave B, traders can consider pursuing trades with the following target levels: 669 – 690 – 720. It’s worth noting that some traders may opt for entry through a breakout from the established price channel, which remains viable in this context. However, failure to sustain this breakout could lead to a continuation of the ongoing correction.

We will provide further updates for our premium subscribers in the near future.

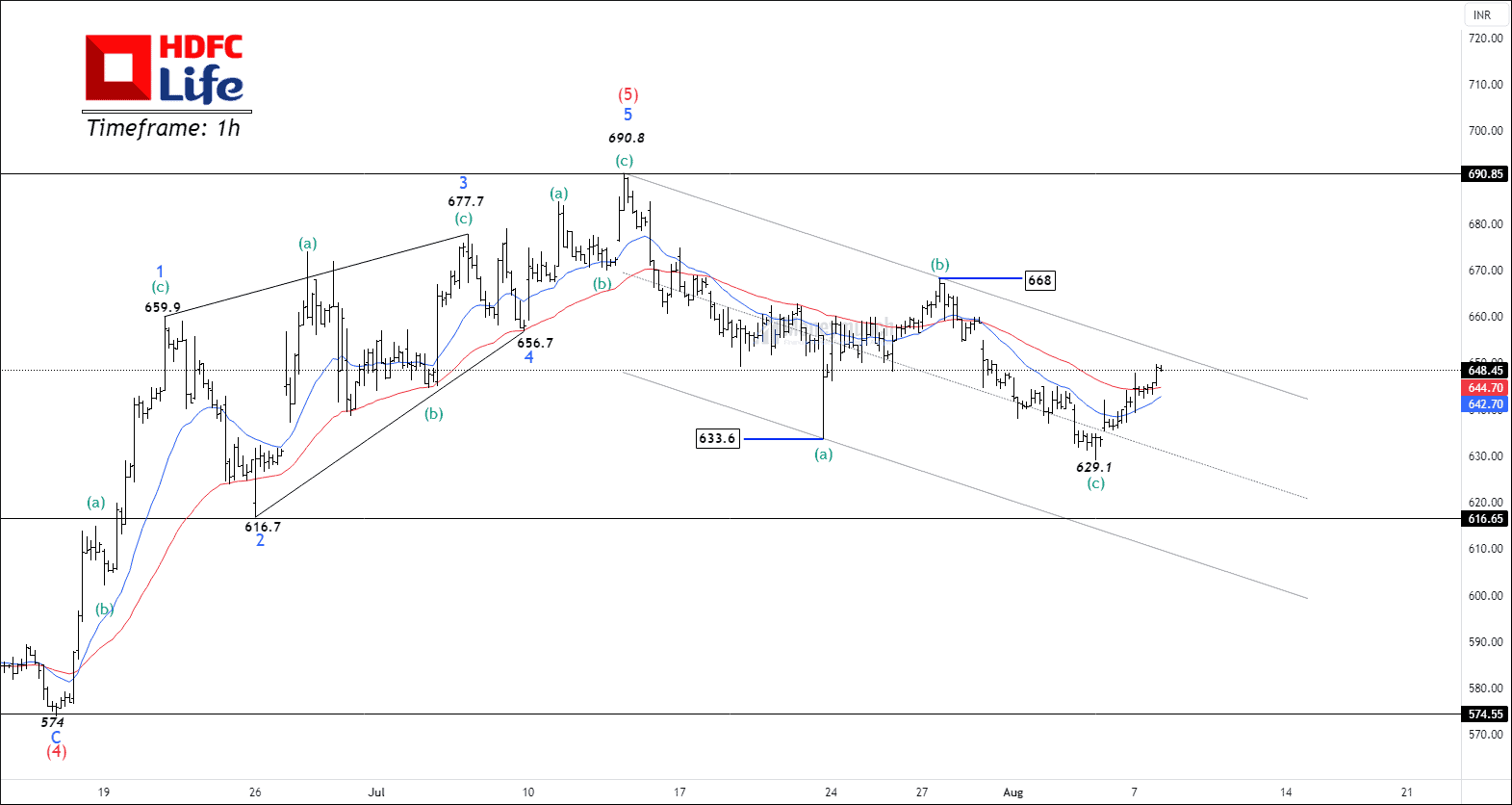

HINDUNILVR- Bottom Fishing

NSE HINDUNILVR is currently exhibiting a bullish trend based on the analysis of the daily timeframe chart. The Relative Strength Index (RSI) has initiated an upward movement, indicating potential positive momentum, and a hook pattern has formed on the chart. It’s important to note that prices are currently trading below the 200-day Exponential Moving Average (EMA).

In the event that the price manages to maintain its position above the 2555 level, traders may consider initiating buy positions, targeting the subsequent levels: 2570 – 2587 – 2600. It’s noteworthy that for those who are not subscribed to the premium service, utilizing the low of the preceding day as an invalidation threshold could be prudent to assess trade viability.

Only premium subscribers will get trade setup with entry, exit and invalidation.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.