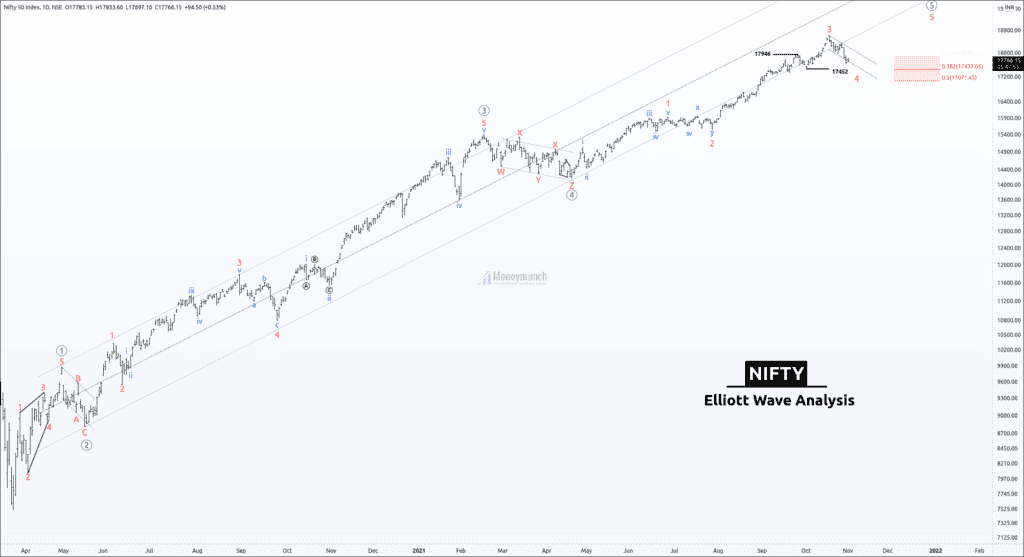

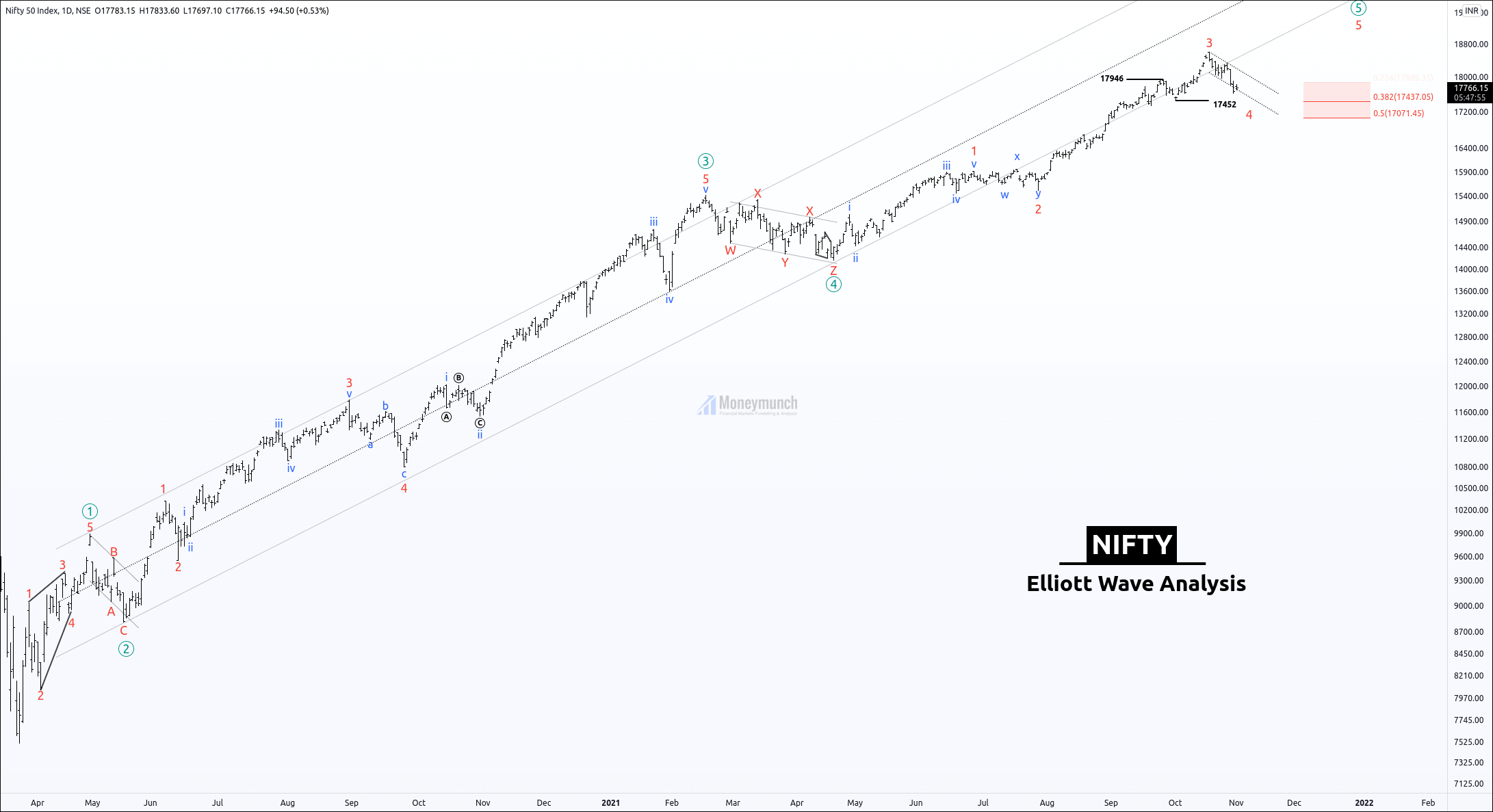

Nifty is forming corrective wave 4 of wave ((5))

Nifty has made a high at 18604 and started falling due to conclude of wave 3.

It has broken the base channel due to high selling pressure on Nifty.

The following terms confirm the nifty pullback.

- The common Fibonacci retracement of wave 4 is 38.2%. Nifty has entered the 38.2% retracement level. It seems like the reversal is ahead.

- Wave equality (A = C)

Wave C is 100% of wave A and vice-versa. If nifty breaks the previous low, then it can reverse between 100% to 161.8% range.

The corrective wave can complete if it sustains in the channel trendline.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Disclaimer: The information provided on this website, including but not limited to stock, commodity, and forex trading tips, technical analysis, and research reports, is solely for educational and informational purposes. It should not be considered as financial advice or a recommendation to engage in any trading activity. Trading in stocks, commodities, and forex involves substantial risks, and you should carefully consider your financial situation and consult with a professional advisor before making any trading decisions. Moneymunch.com and its authors do not guarantee the accuracy, completeness, or reliability of the information provided, and shall not be held responsible for any losses or damages incurred as a result of using or relying on such information. Trading in the financial markets is subject to market risks, and past performance is not indicative of future results. By accessing and using this website, you acknowledge and agree to the terms of this disclaimer.

Amazing Analysis!

helpful. thnx

fantastic…!!

You fulfilled my request. I am Much obliged. I will wait for your premium intraday chart.

Thank you for sharing Nifty outlook.

It helps me to make a good profit.

What next for nifty? 17050 levels?

that’s comprehensive… Bravo Bravo!!

Nifty is heaving corrective structure. After the breakout, we will wait for your premium call.

Interesting study. Thanks for sharing

Really Commendable Analysis on same

Great Dev sir . Ur charts are always marvelous. Wonderful analysis and forecast

I want to buy your service.

Help me!

I agree with you, sir.

We can wait for the confirmation to get more points.

Thank you for the Nifty and Bank Nifty analysis. I am very thankful for this initiative. I would love to see this type of quality analysis from you. I wonder If you can help me.

I would like to take your service for the stock market.