In the previous idea, we initiated a short position in NSE BRITANNIA to trade wave C of wave (4). Price reached all the given targets.

Click Here: NSE BRITANNIA – THE LAST MOVE OF CORRECTION

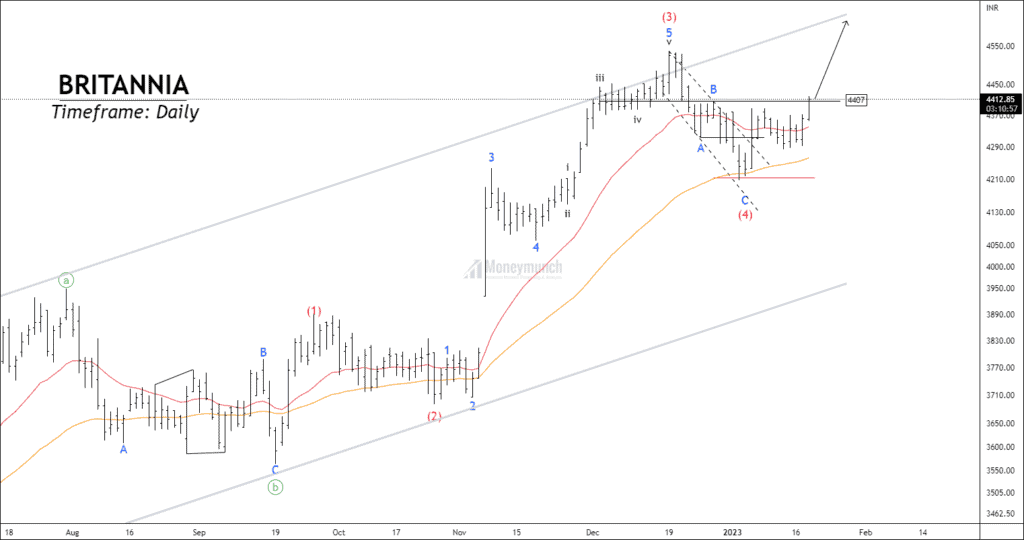

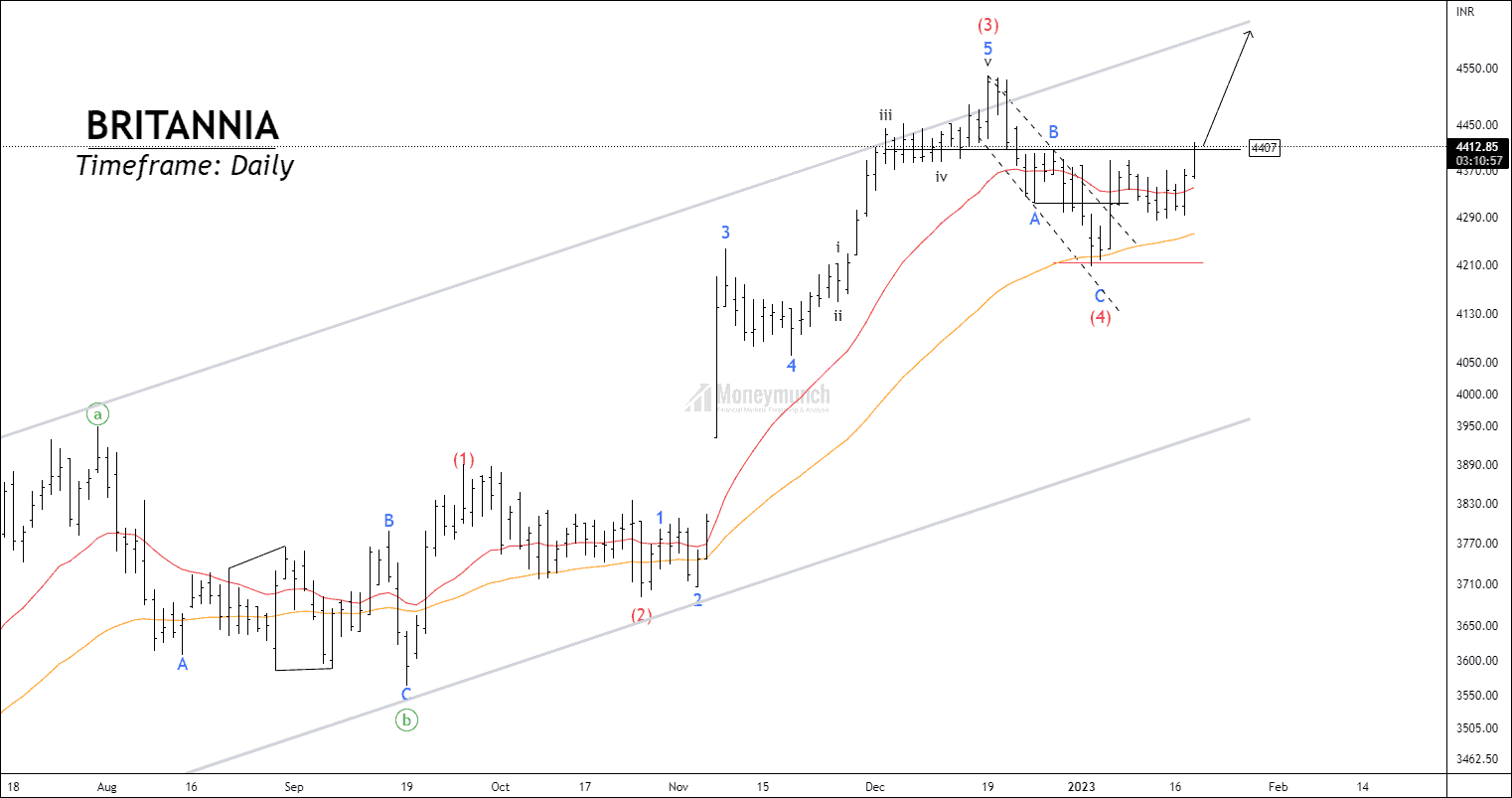

Timeframe: Daily

NSE BRITANNIA has accomplished wave C of wave (4) and started rising for an impulsive wave (5). This corrective wave (4) has a 38.2% retracement, one of the most common retracements.

According to the Elliott wave principle, the impulsive cycle can only confirm after the breakout of the previous corrective wave. Price has broken out the correction channel, but wave B must break for the 5th wave to form.

If the price breaks out wave B at 4407, traders can trade for the following targets: 4456 – 4500 – 4558+. However, failure will continue its corrective formation and lead to a new low. In case of failure, we will change our position with selling targets.

I will update further information soon.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Great analysis.Thank you for your hard work.

seems logical let’s get that target

Thanks for the informative information

Thank you – appreciated.

🙏🙏🙏

Good work and levels

Totally agree!