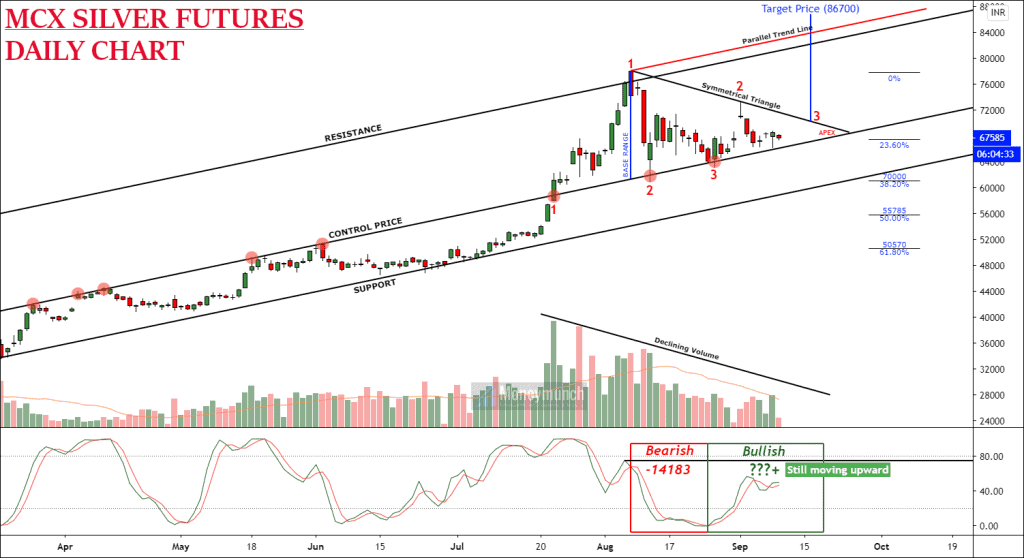

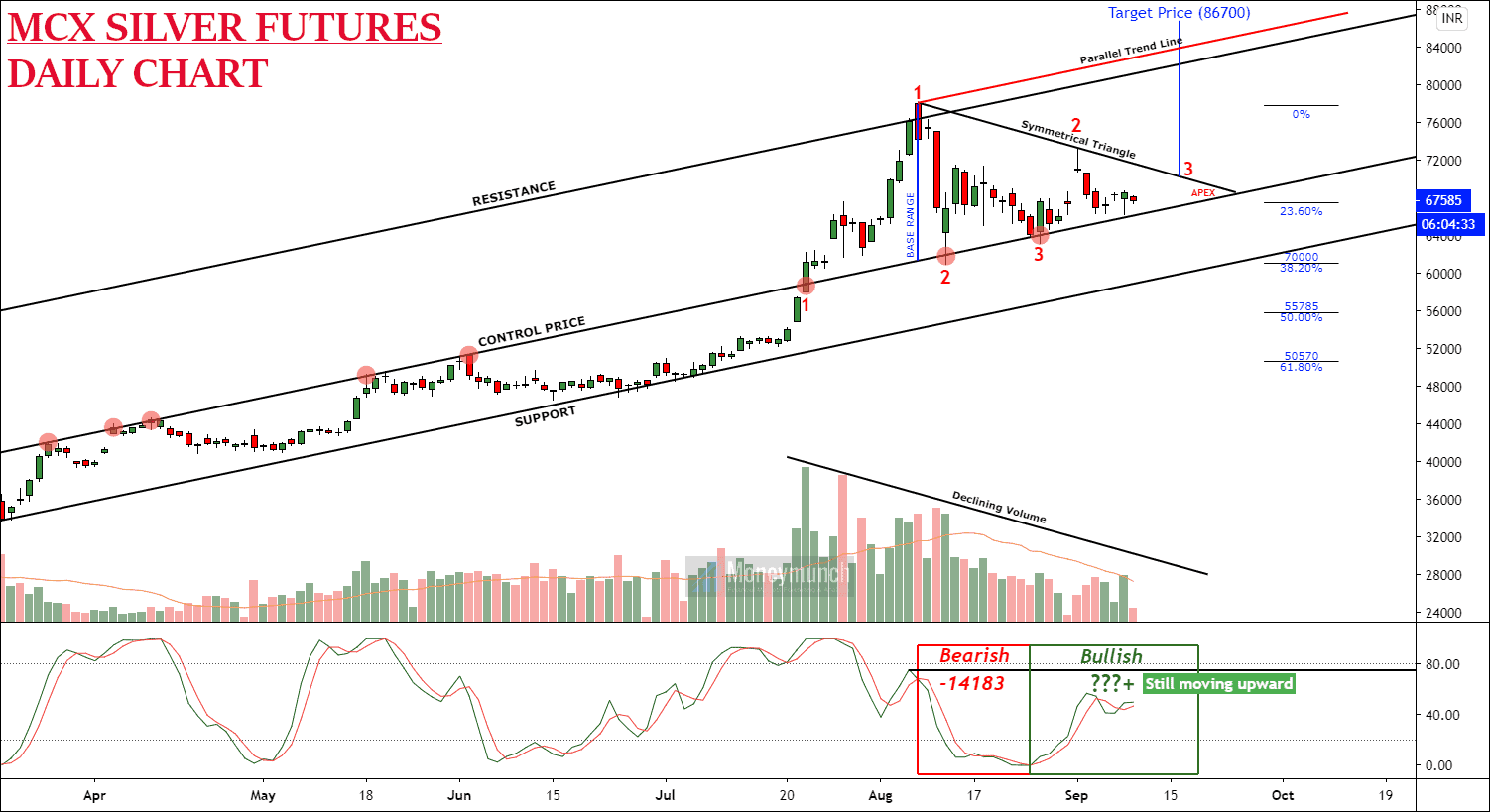

By following the symmetrical triangle (ST), we can say that if candles will consecutively crossover the upper line, the silver will hit the following targets: 72460 – 75360 – 77800 – 80000+

According to the ST, the final targets are 86700 to 88000 levels.

But if you look at the volume and S RSI indicators, it is planning for a downtrend. And at present, silver is very close to the control price line. Hence, a downtrend may start from this point. A breakdown of control price can initiate a new fall for 61000 – 55785 – 50570 levels.

Keep eyes open while it breaks ST upside or downside. It’s a key for the smart traders.

If You Own Commodity Gold, Look Out Below.

Have you read my last gold report? If not, then you must read now: click here

Have you read my last gold report? If not, then you must read now: click here

I had written, “The position can be initiated at 52360 (BUY). It will keep moving upward after consecutive closing above to the control price.”

But it failed to close above the control price. Hence, as described in the chart, short positions can be initiated at 51660 levels.

In that article, I had written in bold words, “If gold breakdown CP, it may fall to 51360 – 51000 – 50500 – 50000 levels”.

Do you think gold will touch the last target of the 50000 levels?

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

here you have shown at nearby 61k in d chart but you’ve written 70k. can you explain what are you trying to say?

It was a typing mistake, And I apologize for that. The retracement level is 61000.

Thank you!