Are MCX Gold Stocks Preparing for A Rally?

Hurdle: 31660

Hurdle: 31660

Gold’s last trading session candle is indicating a solid uptrend start soon after a reversal. As per the technical analysis, we will see the gold’s price at 32000. It’s the best time for the intraday traders. And we will see the gold petal’s at 3150 level soon. And also gold guinea will jump up to 25300 – 25500.

Note: Reversal can drop the gold’s price below 31K level.

Silver Is Up But Bears Still Have The Advantage

For advanced traders, silver’s targets & turning points: 38200 – 38560.

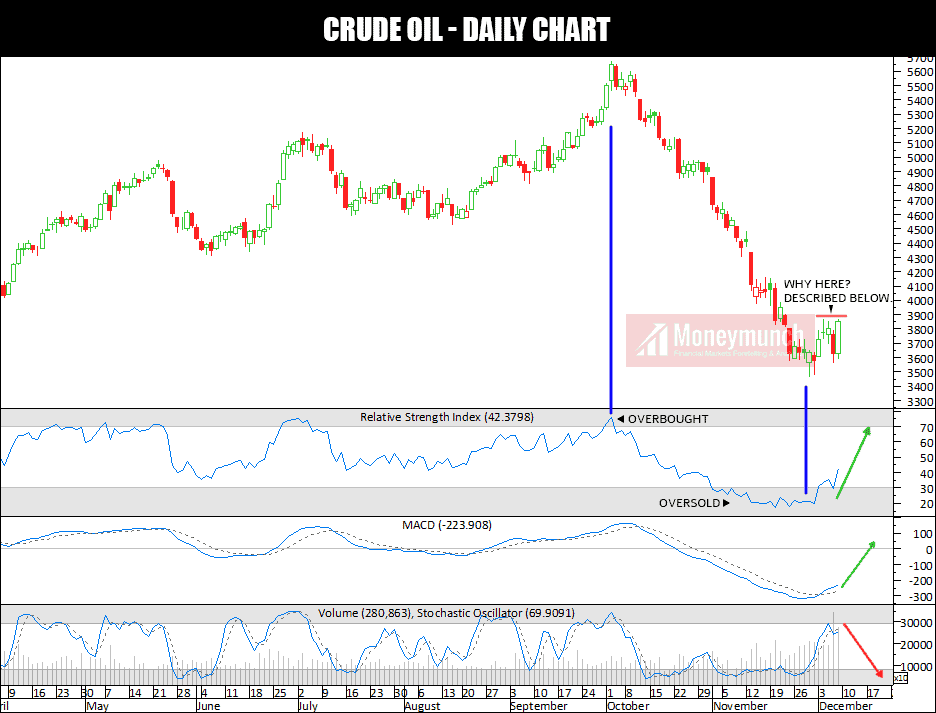

2 Signs Pointing To A Crude oil Rally

Crude oil price improved into last trading session. But it didn’t break the high of 3867 nor made a new high. That define, Bearishness has still existed.

MACD & RSA is indicating uptrend but So turned into a downtrend. It’s pointing that high volatility and unpredictable price’s fluctuation waiting ahead.

If you’re planning to buy the crude oil for the short-term, wait for 3900 level. Intraday traders can choose this level as a hurdle.

Long position above 3900 with targets at 4000 & 4100 in extension. And below 3900 looks for further downside with 3700 & 3600 as targets.

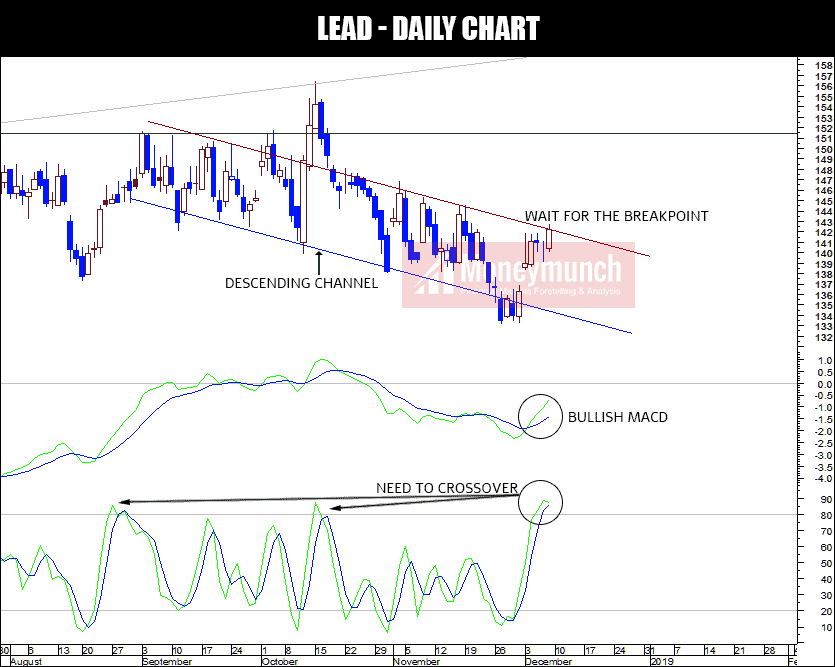

Is Lead Finally Ready To Rebound?

Since September, lead is under the descending channel. Two consecutive closing price above the descending channel (DC) will indicate uptrend. And that can be up to 145 – 147 – 150.

If you look at the lead’s price into DC, sell it for 138 – 135 levels.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.