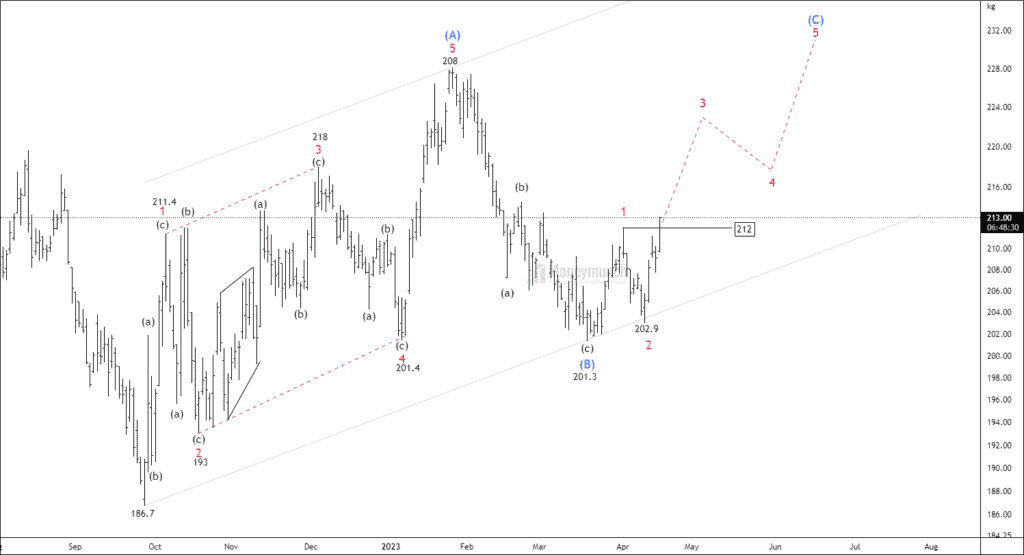

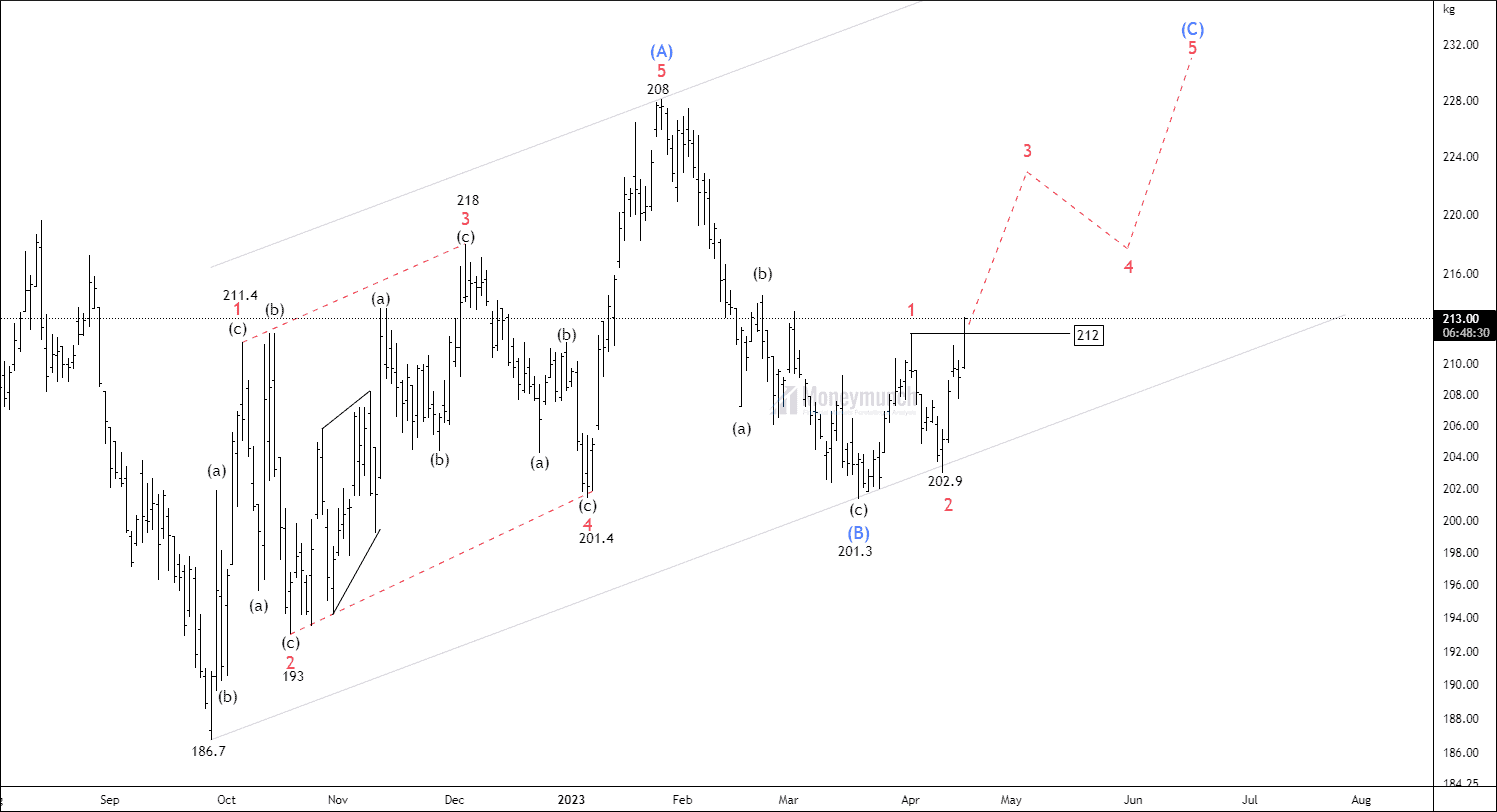

Timeframe: Daily

MCX aluminium has been undergoing a corrective a-b-c wave pattern for over 28 weeks. The price of MCX aluminium is currently trading above key exponential moving averages, specifically the 200/100/50/200 exponential moving averages, indicating bullish momentum in the market.

The average true range (ATR) of the price is 2.92 and is increasing, which further validates the upward trend. The price of MCX copper has completed the corrective wave (B) at 201.3 and has now started forming sub-waves of the impulsive wave (C). As a result, there is an opportunity for cautious traders to engage in trades after the breakout of sub-wave 1 of the impulsive wave C.

In case the price of MCX aluminium sustains above the level of 212, traders can execute trades with targets set at 217 – 223 – 231+. It is important to note that wave 2 cannot overlap the starting point of Wave 1.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Exciting :D let’s do it.

Thx for the suggestion!

Keep them coming

Amazing analysis

I find lots of value in your work. Please share more articles.