NSE AUROPHARMA – Identifying & Capitalizing on Flag

Timeframe: daily

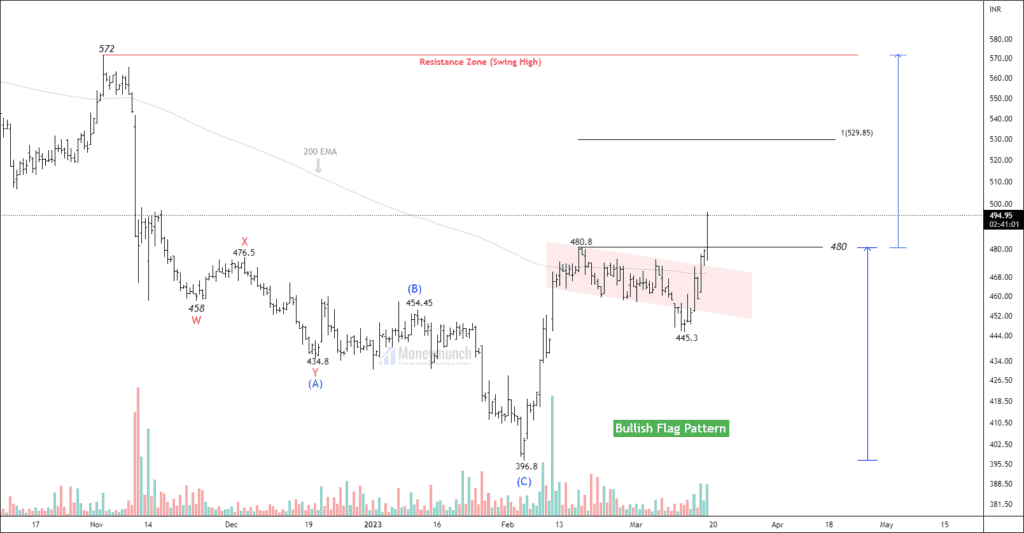

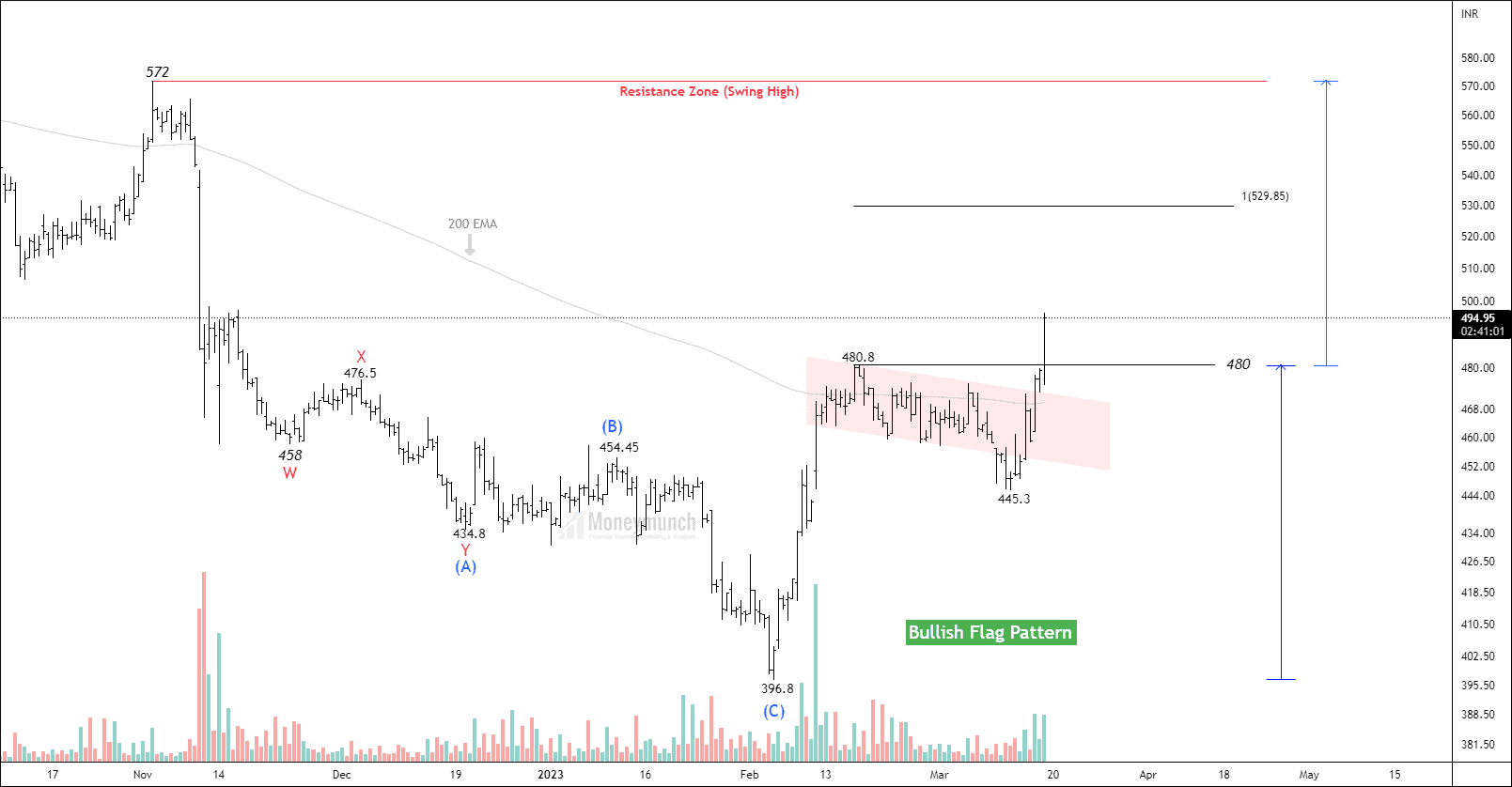

The price exhibited a bearish trend after reaching a high of 1067, falling by more than 62% to make a new low of 396.6. However, the price has recently formed a bullish flag and broken out of wave b at 454.45, which suggests that oversold prices are now being controlled by bulls.

Moreover, during the first move, the price generated a good volume, indicating an increase in demand from traders. Additionally, the recent breakout at the 200 EMA suggests that there is bullish momentum in the market.

Given the current market conditions, traders can consider buying Aurobindo Pharma if the price sustains above 480. If this level is maintained, the price can reach the following targets: 515 – 530 – 554+. Traders should closely monitor the market to ensure that the price remains above the critical level of 480.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

appreciate the time and effort you put into your stock research analysis. It’s clear that you are extremely knowledgeable about this field

Your stock research analysis is clear, concise, and informative. Thank you for sharing your expertise with the world!”

Impressive work. Thank you!

Your recommendation is top-notch.