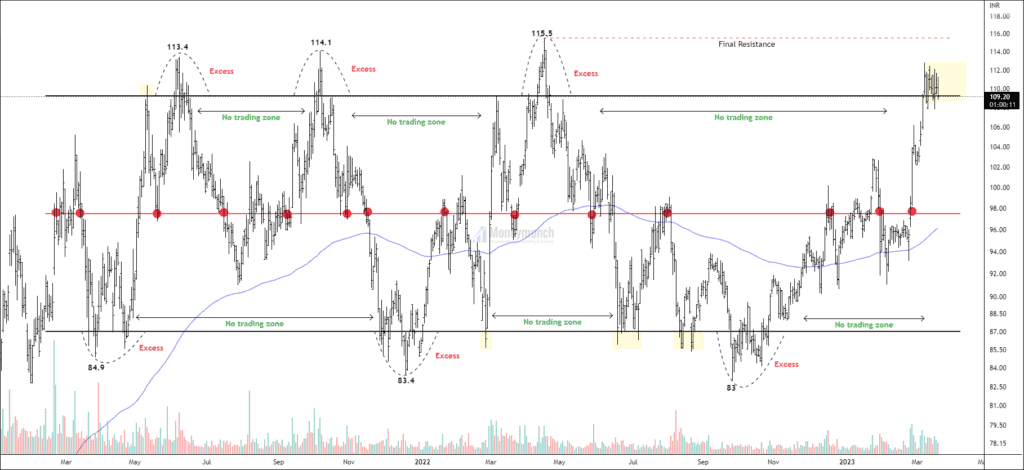

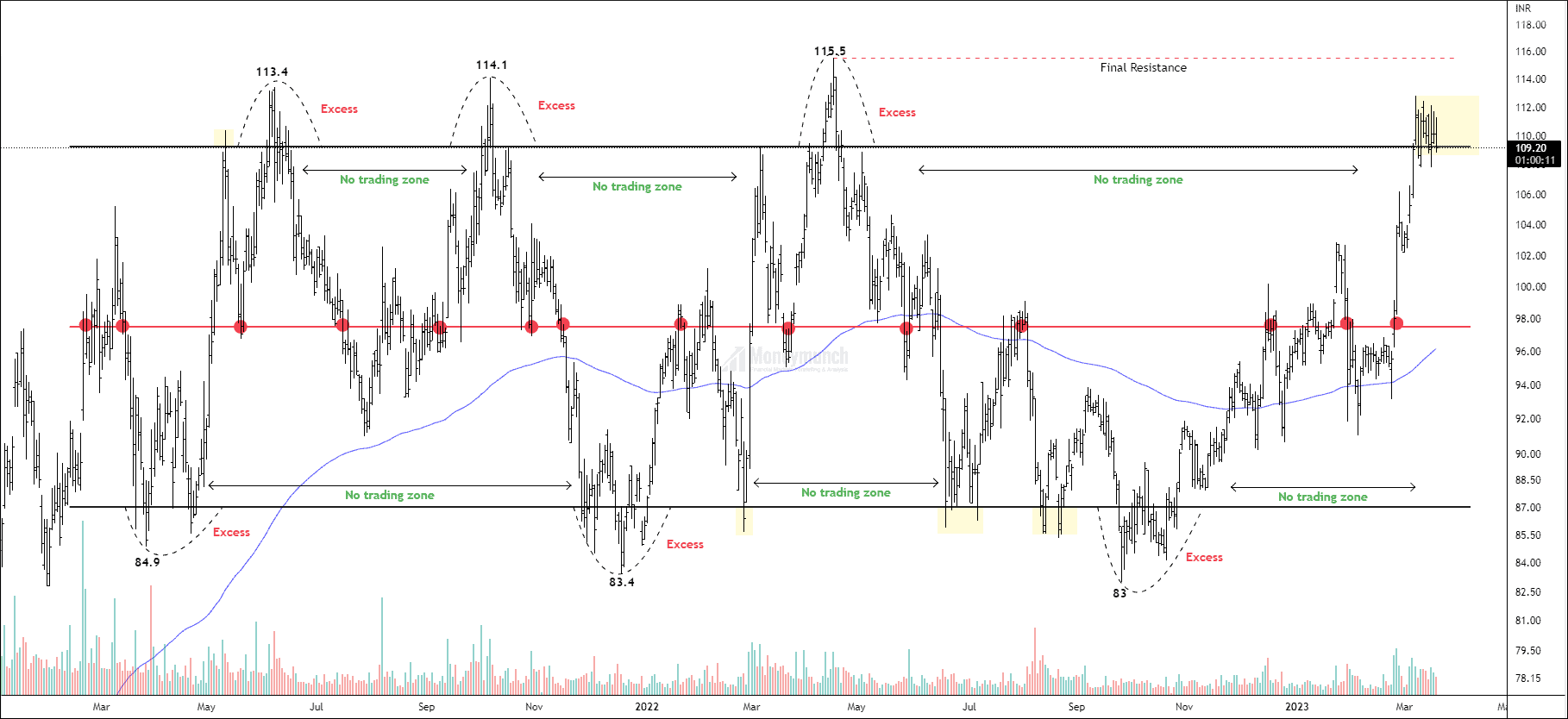

NSE GAIL – Detailed Look at Price Consolidation in the Value Area

Timeframe: Daily

The price has been consolidating within the value area for more than 111 weeks, indicating that the market is in a state of equilibrium where supply and demand are balanced. The upper and lower bands have been tested four and six times respectively, indicating strong support and resistance levels.

Additionally, the gravitation line has been touched 14 times, indicating its effectiveness as a control line. The three no-trading zones at the upper and lower bands suggest that traders have benefited from counter moves in the past.

Currently, the price is trading near the upper band of the channel at a resistance level of 115.6. Historically, the price has not been able to break out of this resistance zone. If the price sustains below the lower band of the channel, traders may consider selling with potential targets at 105.9 – 101.9 – 97+.

Additional updates and in-depth analysis will be made available at a later time.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Great catch!