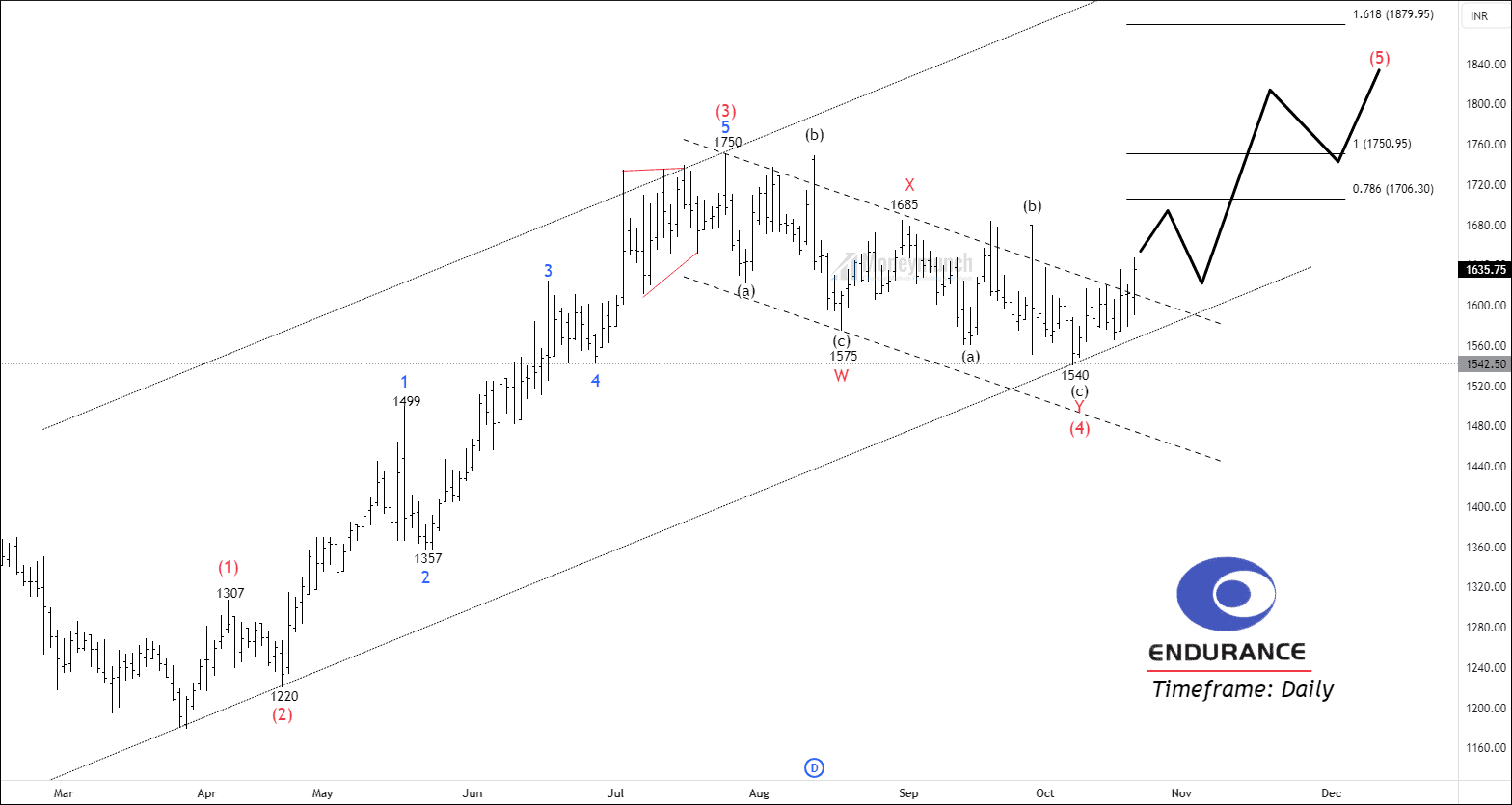

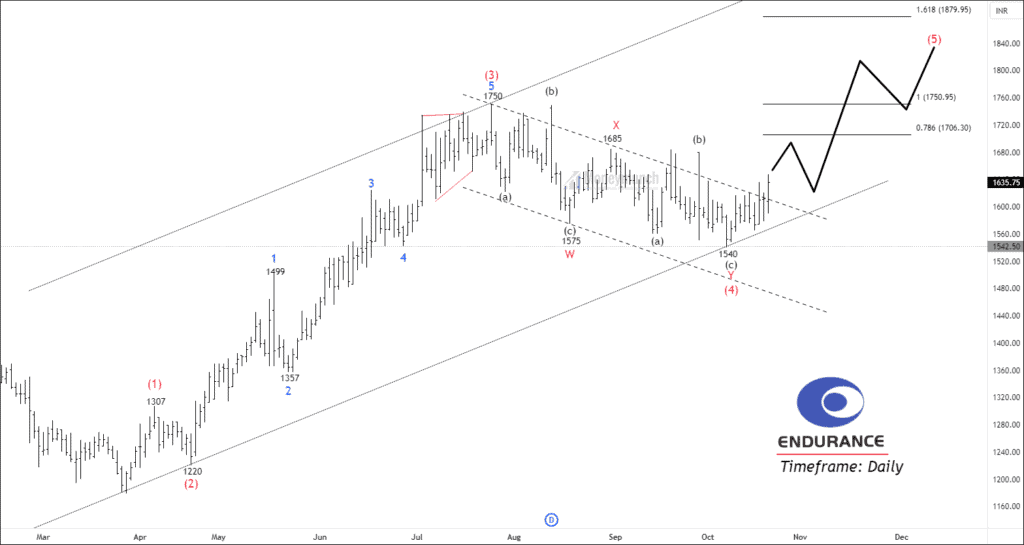

Timeframe: Daily

NSE ENDURANCE is showing signs of a bullish trend after hitting a low of 1179. The price has broken through key moving averages, such as the 20-day, 50-day, 100-day, and 200-day exponential moving averages, with the support of a positive candlestick pattern. Additionally, the Relative Strength Index (RSI) stands at 58, indicating a reasonably strong momentum, and the Average True Range (ATR) is 48, suggesting notable price volatility.

Price has completed a corrective pattern labeled as w-x-y within wave (4) and has now initiated an impulsive wave (5). For traders seeking potential buying opportunities, a breakout above the descending channel of wave (4) presents an attractive entry point. In such a scenario, one may consider long positions with the following target levels: 1686 – 1742 – 1840+.

We will update further information soon.

NSE DIVISLAB – Breakdown Setup

NSE DIVISLAB has broken down a crucial support level of 3580. The price is trading below the 20/50/100 exponential moving average. The RSI of the price is 33.32, whereas the ATR of the price rose to 70.54.

Traders can have a strategic setup with healthy reward risk. If the price sustains below 3593, traders can short for the following targets: 3544 – 3518 – 3465+. Free subscribers can take the previous day’s high as invalidation.

The invalidation level is available for premium subscribers only.

NSE BERGEPAINT – Bullish setup

NSE BERGER PAINT has exhibited a notable breakout by surpassing the 20-day, 50-day, 100-day, and 200-day Exponential Moving Average (EMA) levels. Supported by a Relative Strength Index (RSI) of 52.62 and an Average True Range (ATR) of 13.56, the stock’s technical indicators suggest a favorable scenario.

Furthermore, the price has broken through a crucial resistance point at 573, signaling an opportunity for bullish control.

This presents a promising chance for bulls to regain momentum following a significant decline. Traders may consider initiating long positions if the price maintains itself above 577 for the following targets: 585 – 594 – 603. Free subscribers can take the previous day’s high as invalidation.

The invalidation level is available for premium subscribers only.

Outlook BANKNIFTY – Is It shaky Foundation for Bulls?

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Thank you for pre market report

Simple n effective!