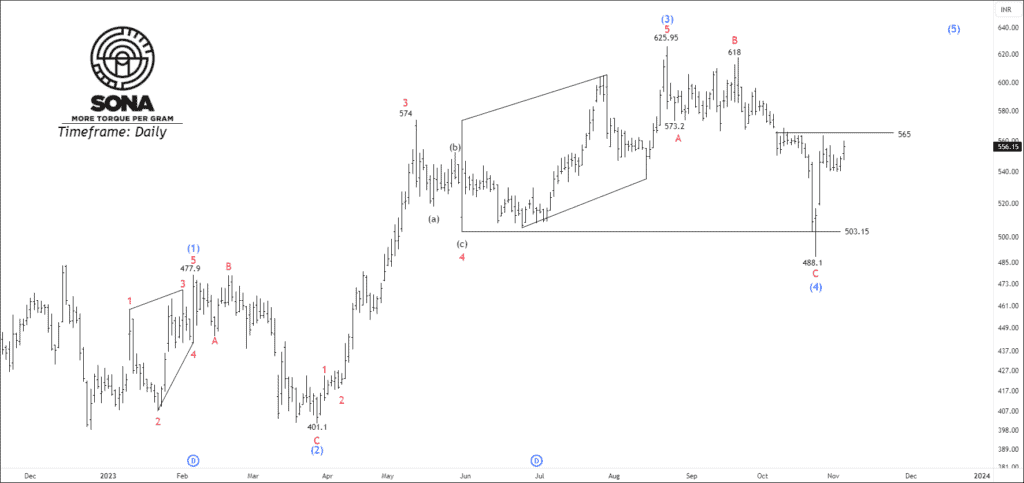

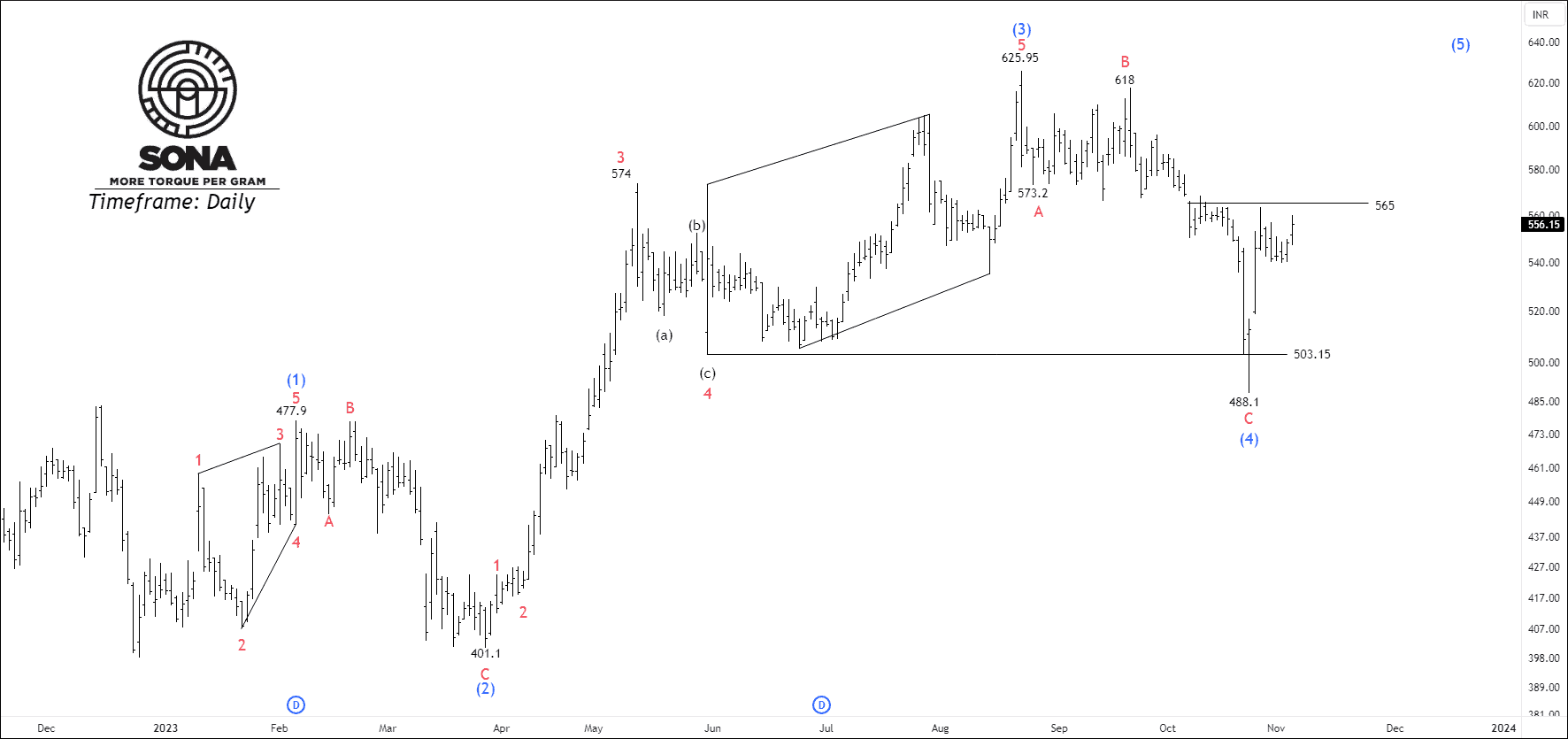

Timeframe: Daily

NSE SONACOMS appears to have completed corrective wave (4) and initiated an upward move, suggesting the potential emergence of the final impulsive wave (5) after a recent price surge from 488.1. Notably, the stock is currently trading above both the 200-day and 100-day Exponential Moving Averages (EMA) and is also maintaining its position relative to the 20-day and 50-day EMAs. The Relative Strength Index (RSI) for the price has climbed to 51.18, indicating positive momentum, while the Average True Range (ATR) has decreased to 15.86.

For traders, it is advisable to exercise patience and wait for a pullback, as this will help assess the depth of the potential V-shaped recovery. If the price manages to break above the 565 level, traders can consider the following target levels for their trades: 580 – 605 – 628+.

Only premium subscribers will receive precise entry and exit points, as well as invalidation levels, at the exact time.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.