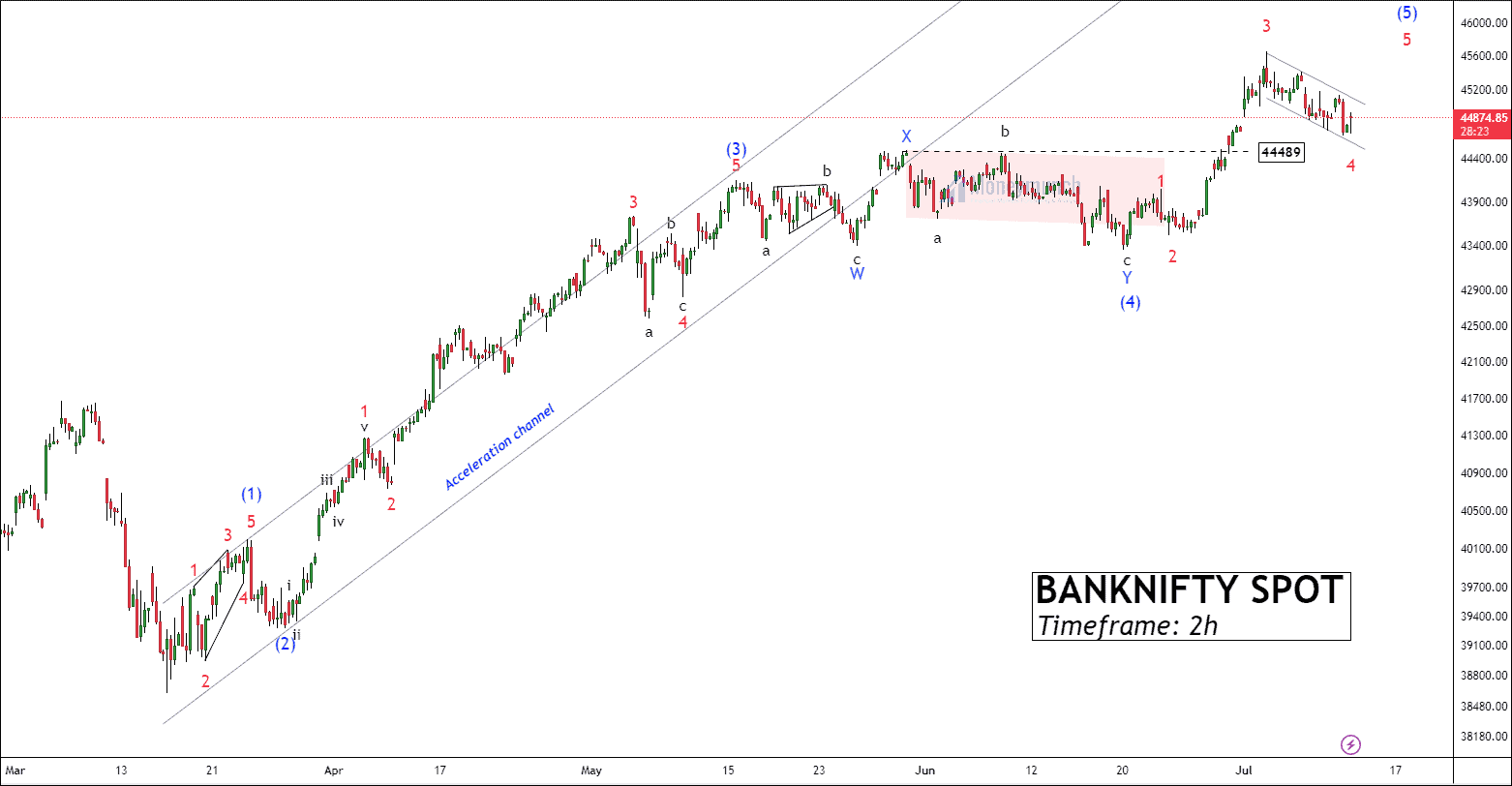

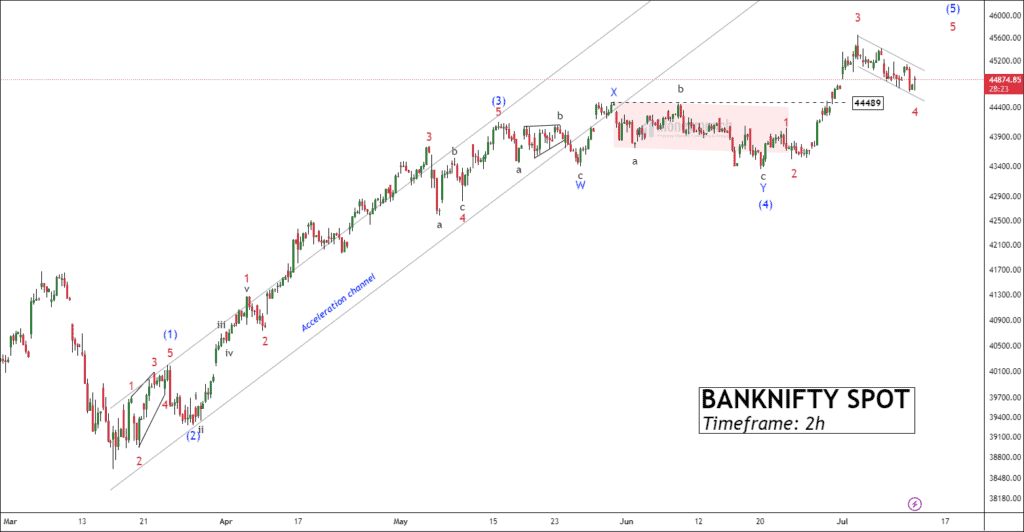

Timeframe: 2h

In our previous analysis of banknifty, we discussed the completion of wave C within the larger wave Y of wave (4) and the beginning of wave (5). The corresponding article was published on June 21, 2023, and the projected price levels were successfully achieved.

However, the price recently experienced a decline, dropping from its high of 45655 to 44663.05 (-2.15%). According to the wave principle, there is still one more upward move remaining, which could potentially reach a target of 46000. Traders can use the reverse Fibonacci levels of the previous sub-wave (3) to (4) to set targets after the breakout of the corrective channel. These targets include 45320 – 45655 – 46124+.

It’s important to note that this setup is only valid after the breakout of the corrective channel, which is drawn from wave (3) to wave (4). Corrective moves typically lack significant strength, so ideally, the price should stay within the confines of the channel. Only an impulsive wave can breach the boundaries of the corrective channel.

We will provide further updates on this market situation in the near future.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Impressive analysis.