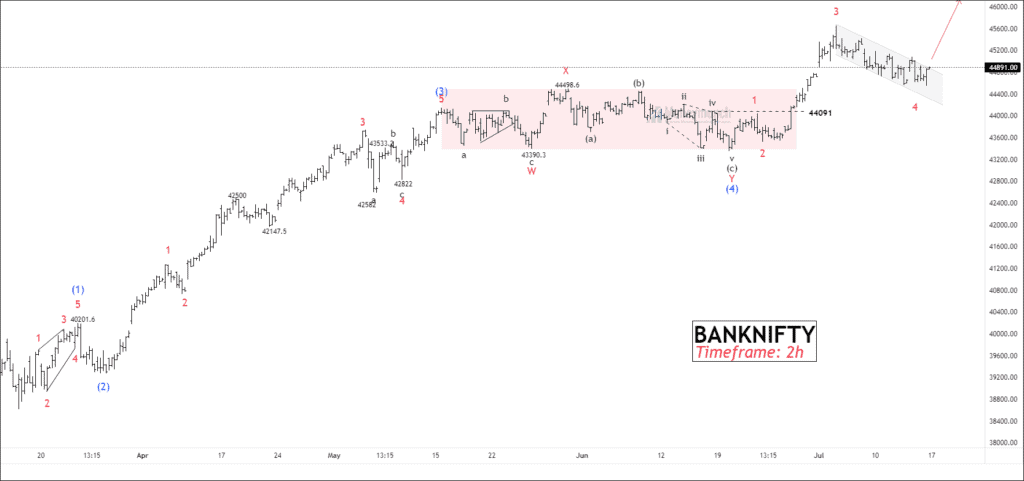

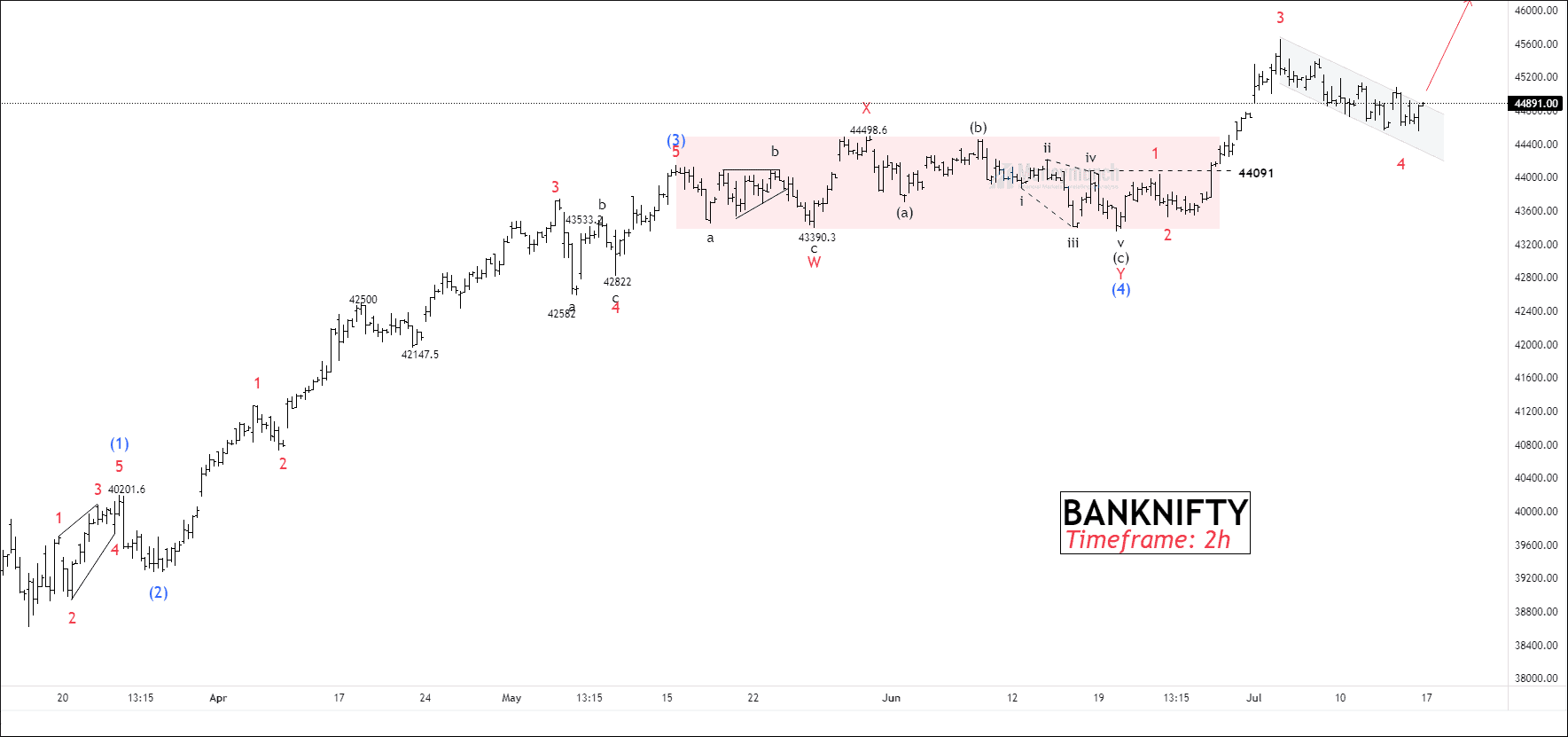

Timeframe: 2h

In our previous idea, we discussed that the breakout of the correction was just the starting point of an impulse. Price formed a new all-time high. Banknifty is looking strong outside of the channel because it is trading above 20/50/100/200 EMA.

Price recently experienced a decline, dropping from its high of 45655 to 44663.05 (-2.15%). According to the wave principle, there is still one more upward move remaining, which could potentially reach a target of 46000. Traders can use the reverse Fibonacci levels of the previous sub-wave (3) to (4) to set targets after the breakout of the corrective channel. These targets include 45320 – 45655 – 46124+

We will update further information soon.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Excellent analysis of bank nifty by Elliott wave, I have been seaing this portal from last one month your forcast is like GPS of bank nifty