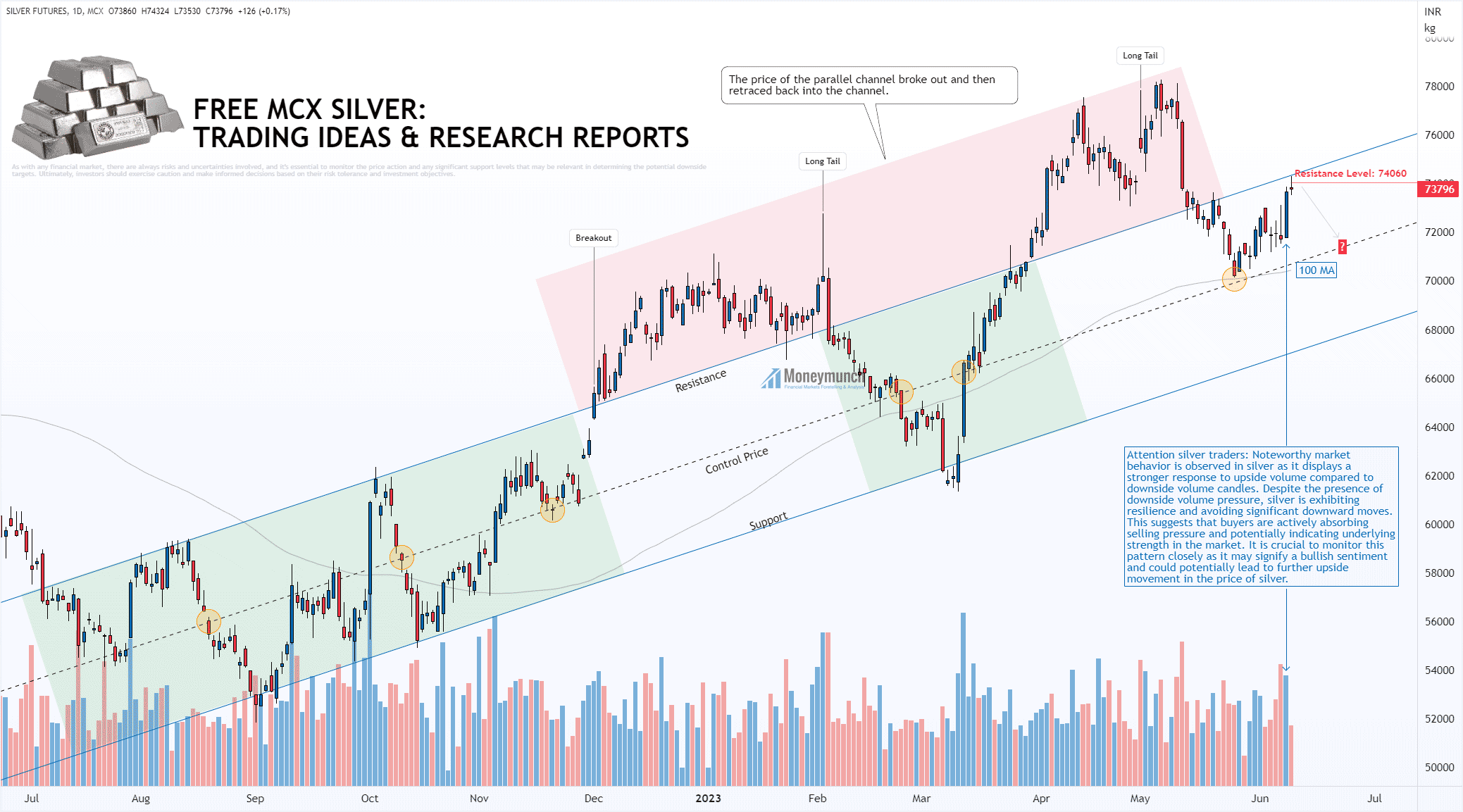

Examining the Parallel Channel and Resistance Levels for Short-Term Traders

Upon analyzing the chart, it is evident that silver has been trading within a parallel channel for almost a year, indicating a well-defined price range. In the previous trading session, the price of silver reached the resistance line of this channel. For short-term traders, a critical resistance level to watch is 74060. If this level is not surpassed convincingly, it could lead to a potential downturn towards the control price (CP) line. It is worth noting that silver has yet to test the CP line and the 100-day moving average (MA) successfully.

Taking into consideration the parallel channel pattern, it suggests that silver prices may experience a decline towards levels around 73000, 71800, and 71360.

Furthermore, volume plays a significant role in the current scenario. Short-term investors should be cautious and await a successful breakout of the channel for a potential upside move towards price levels of 74900, 75560, and even exceeding 76800. Monitoring the volume and price action closely will provide further insights into the market direction and potential trading opportunities.

As a market participant, it is important to closely monitor the following market-moving events, as they have the potential to impact the prices of gold, silver, crude oil, and natural gas:

Monday, Jun 12, 2023

23:30 Federal Budget Balance (May) and Note Auctions: These events have a medium impact and can provide insights into the economic health of the country, potentially influencing investor sentiment and market movements.

Tuesday, Jun 13, 2023

11:30 Employment & Unemployment, Avg Earning Index, Claimant Count Change: These medium-impact events provide crucial data on the labor market, which can have a significant effect on commodity prices.

18:00 CPI and Core CPI: These high-impact events reveal the inflation rate, which is closely watched by traders as it can impact the value of commodities.

Wednesday, Jun 14, 2023

02:00 API Weekly Crude Oil Stock: This medium-impact event discloses the inventory levels of crude oil, which can influence crude oil prices.

18:00 PPI and Core PPI: These medium-impact events measure changes in producer prices and can affect commodity prices.

20:00 Crude Oil Inventories: This high-impact event reports the weekly changes in crude oil stocks, which can impact the price of crude oil.

23:30 Fed Interest Rate Decision & Projection, and FOMC Economic Projections & Statement: These high-impact events provide insights into the monetary policy decisions of the Federal Reserve, which can have a broad impact on commodity markets.

Thursday, Jun 15, 2023

00:00 FOMC Press Conference: This medium-impact event involves a press conference following the Federal Reserve’s interest rate decision, providing further context and potential market-moving statements.

18:00 Import Prices MoM & YoY: This low-impact event reports changes in import prices, which can indirectly affect commodity prices.

20:00 EIA Natural Gas Stocks Change: This low-impact event reveals the weekly changes in natural gas inventories, potentially impacting natural gas prices.

Friday, Jun 16, 2023

01:30 Net Long-term TIC Flows: This low-impact event discloses the flows of international capital, which can have an indirect impact on commodity markets.

17:15 Fed Waller Speech: This low-impact event involves a speech by a Federal Reserve official, which may provide insights into monetary policy and influence market sentiment.

19:30 Michigan Consumer Sentiment: This medium-impact event measures consumer confidence, which can affect demand for commodities.

Monitoring these events will help traders and investors stay informed about potential catalysts that can impact the prices of gold, silver, crude oil, and natural gas.

Get free MCX ideas, chart setups, and analysis for the upcoming session: Commodity Tips →

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Fantastic job! the analysis of the parallel channel and resistance levels is thorough and insightful

clear, concise, and provides actionable information for traders

Very well-researched analysis!

Impressive analysis