Timeframe: 1h

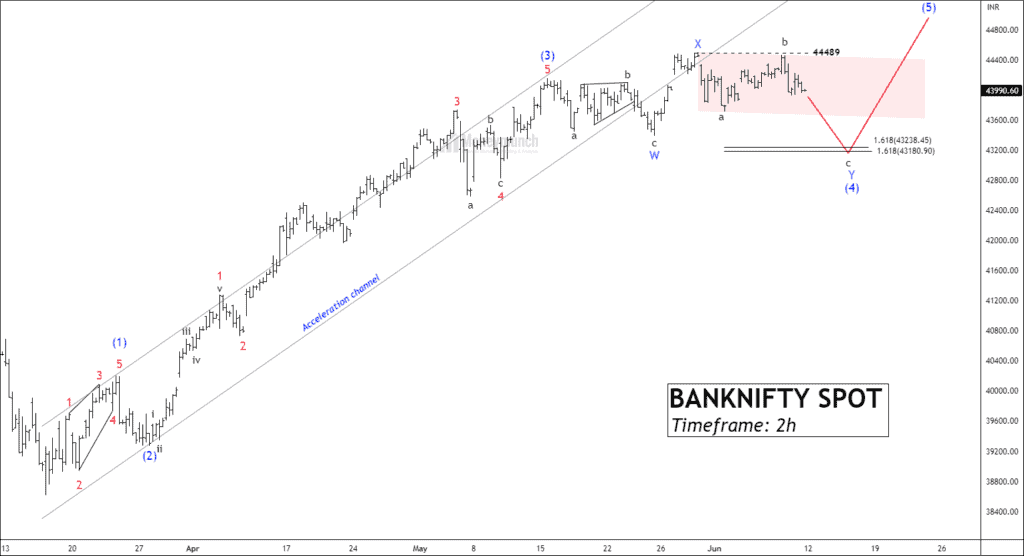

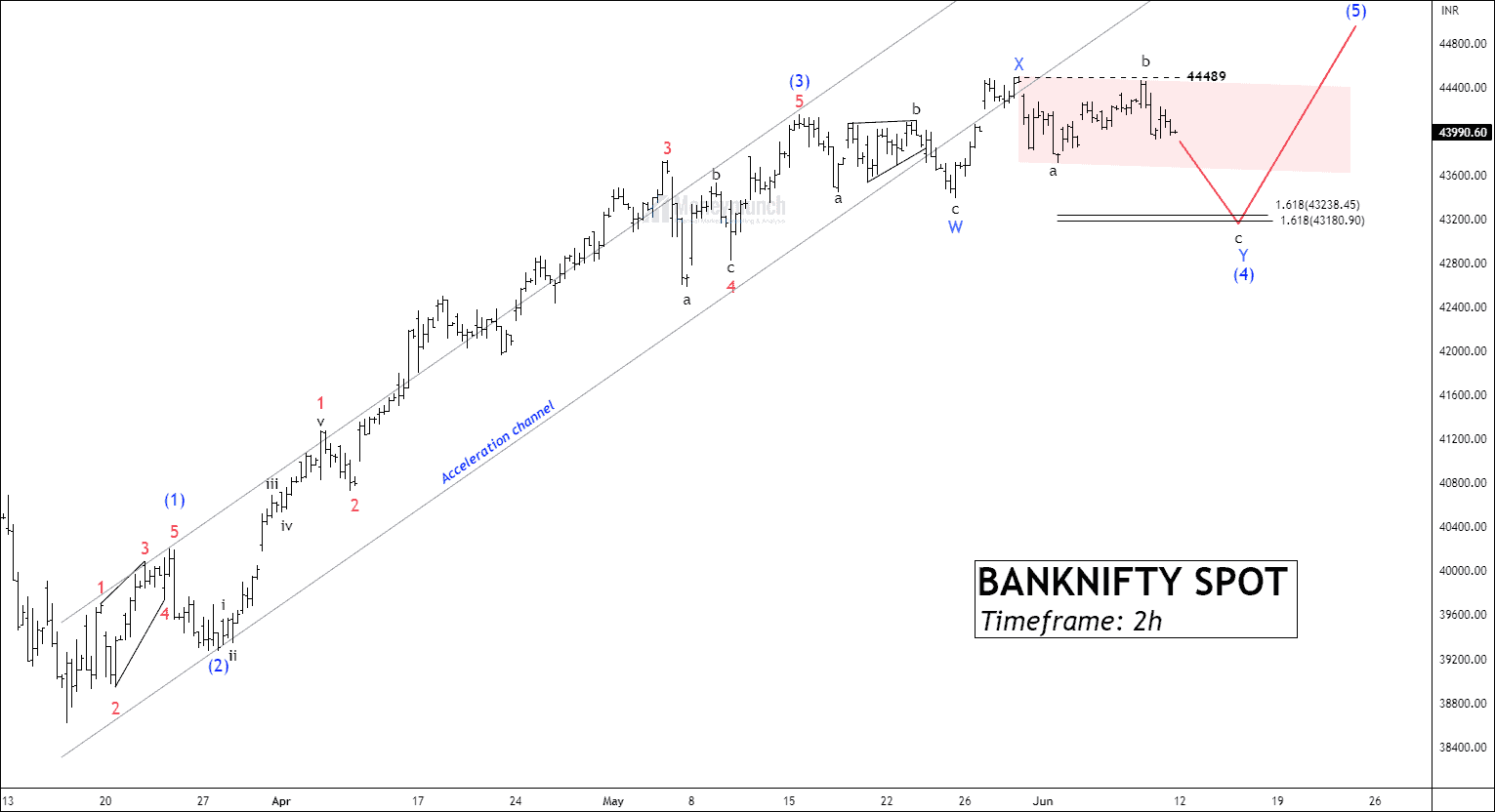

BANKNIFTY(SPOT) has experienced a strong upward movement from 38613 over a period of 12 weeks, indicating an impulsive cycle. The price has completed a motive wave (3) and is now in the process of developing a corrective wave (4).

The current price movement is part of a corrective structure, as it has broken below the acceleration channel and is trading outside of it. Upon closer examination of wave (4), it appears to be forming a double formation pattern. Bank Nifty has completed wave X at 44489, which is a sub-wave of wave (4), and has started forming wave C of wave (y). The overall wave perspective suggests a bearish angle.

There are two potential levels where wave C could complete its formation:

- Wave C could end near 161.8% of the length of wave a, around 43180.9.

- Wave C could end near 161.8% of the length of wave W, around 43238.

Traders can consider selling after the breakdown of wave a at the given price levels. They have the option to extend their target to sub-wave 3, which is expected to be around 42822. However, it is important for traders to confirm the development of wave (5) using percentage or Gann filters after the completion of wave (4).

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Thank you for accepting my request on analysing Banknifty, It’s brilliant!

Your analysis is very top-notch! Your ability to pay close attention to detail, exercise critical thinking, and glean insightful information is extremely impressive. Your analysis exemplifies both your great analytical skills and a thorough comprehension of wave theory.