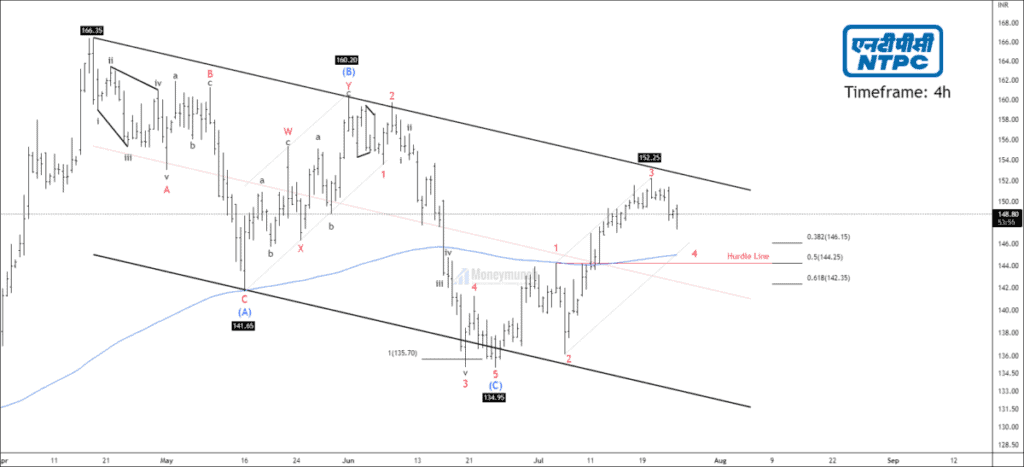

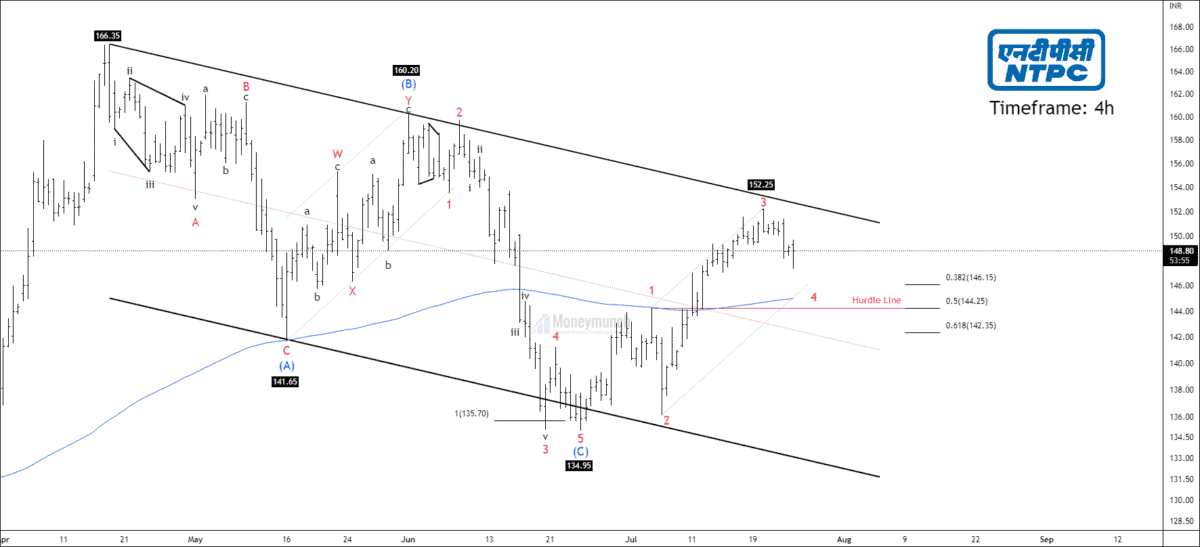

Timeframe: 4h

NTPC has accomplished corrective wave (c) at 134.95 and started an impulse structure. Currently, the price is forming a corrective wave after experiencing impulse wave 3.

Wave 4 can cease at 146.10 at 38.2% of wave 2. It can be the best price for the traders to ride on the existing trend.

If the price sustains above 144.50, traders can trade for the following targets: 150 – 155 – 160. Please note that 200 EMA is also crucial support for NTPC

But, if the price fails to sustain above 61.8% of the 3rd wave at 144.20, Supply pressure will lead the price to the following targets: 142 – 138 – 135.

After the invalidation, our label will be W-X-Y-X-Z or Triple Three.

I will upload further information soon. To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Wow , Good work

fall can be possible because a lots of negative data about to come in market

Excellent explanation and very clear. Thanks.

very much liked.The idea of small but consistent profit

everything spotted correctly what a trader wants