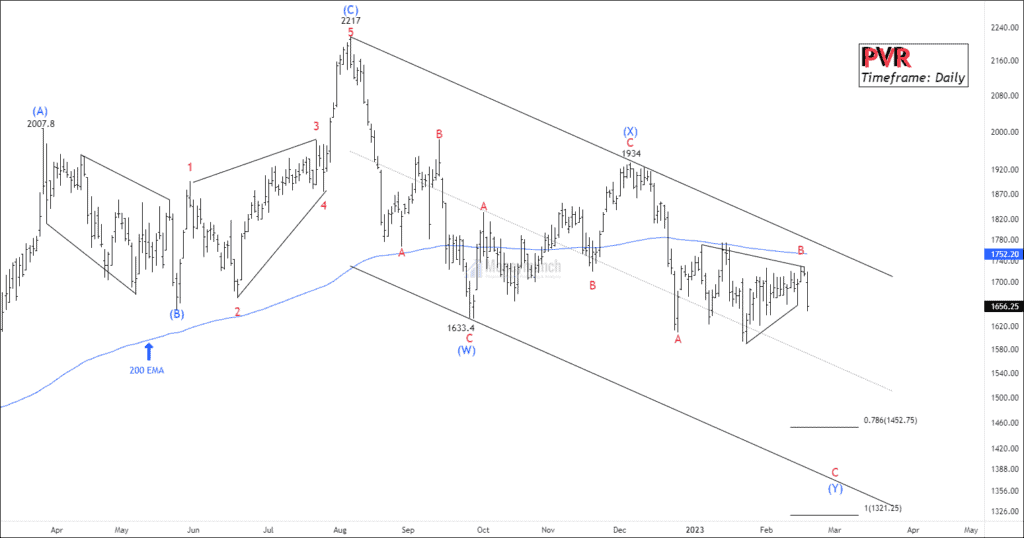

On a daily timeframe, NSE PVR has been trading within a channel for more than 28 weeks. However, the current price is weak as it is trading below the 200 EMA. Wave B was not strong enough to sustain, resulting in choppy price action. The corrective wave b of wave (y) has occurred, and the price has started to fall for wave c of wave (y). Wave (y) has retraced 0.618 Fibonacci extension and is heading towards the 0.786 level.

The cluster range includes:

- 78.6% Fibonacci extension of wave (W) at 1476.5.

- 78.6% Fibonacci of wave A at 1452

- 100% Fibonacci of wave (W) at 1352, where Wave (W) = Wave (Y).

- 100% Fibonacci of wave A at 1321.25, where Wave A = Wave C

In addition, a head and shoulder pattern is visible on the daily timeframe chart with the neckline at 1633. If the price remains below 1657, swing traders can sell for the following targets:

- TP1: 1618

- TP2: 1576

- TP3: 1540

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Lock

Lock

Superb research ✌🏽

Nice chart nice levels

I want to learn this wave analysis, Please help me.

Perfect Analysis