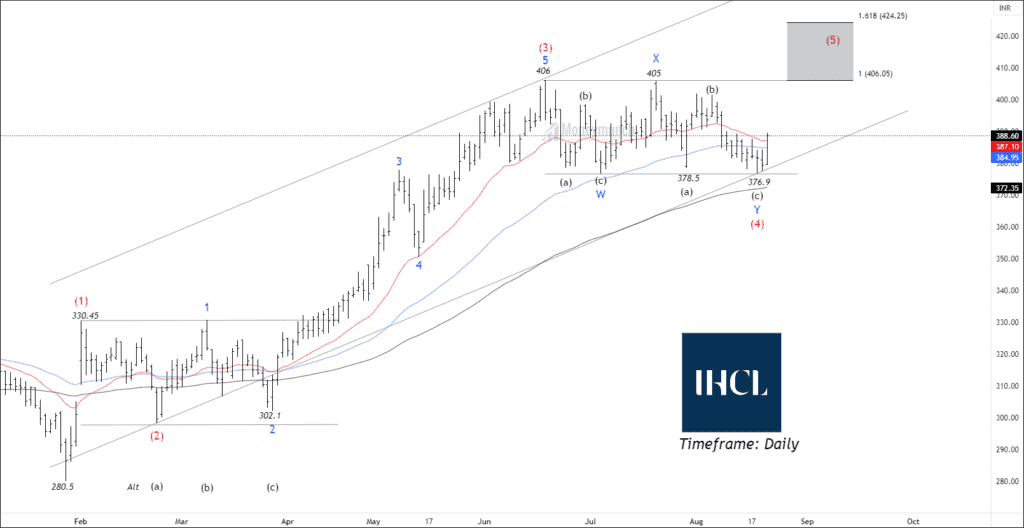

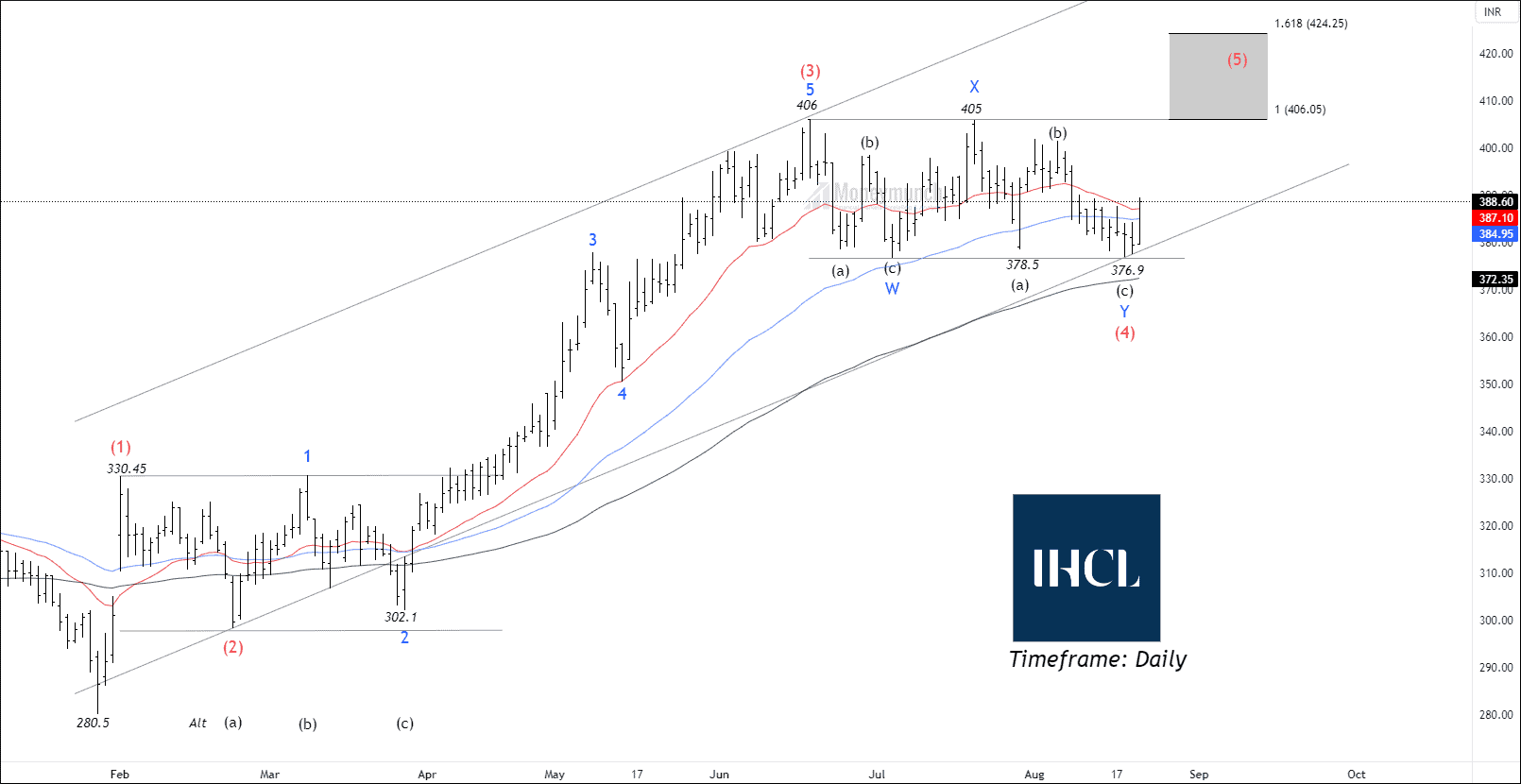

Timeframe: Daily

Since the end of January, NSE INDHOTEL has entered into a noticeable upward trend. Currently, prices are trading above the 20, 50, 100, and 200 exponential moving average levels. Traders have observed a significant value area that goes back 9 weeks. This value area is playing a role in supporting and resisting prices, creating a balance between buyers and sellers.

INDHOTEL completed an impulsive wave (3) at 406 and has since initiated a corrective phase, leading to a decline. The retracement of wave 4 corresponds to 38.2% of wave 3. The structure of wave 4 is a double zigzag. Traders can consider the following targets: 402 – 415 – 424. Note that the setup will be invalid after the breakdown of the close below wave (Y).

Detailed trade setups, including precise entry and exit points as well as invalidation levels, will be exclusively available to premium members.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.