How many of you traded on DRREDDYS FUT call?

Yesterday: NSE DrReddys Fut could crash more – Bearish Trend Continues?

I had written in bold words, “according to TA, we will see the target of 3780 – 3720 levels soon”.

It has touched all targets.

I have also said to sell RBL yesterday. Have you?

Yesterday: NSE RBL extending downtrend’s extent?

I had written, “Key level: 628

If it breaks the above level, then the stock price will hit the target level of 610 – 600 – 570“.

The first target of RBL had achieved yesterday. And the second target has come now (today). Will it touch the third target?

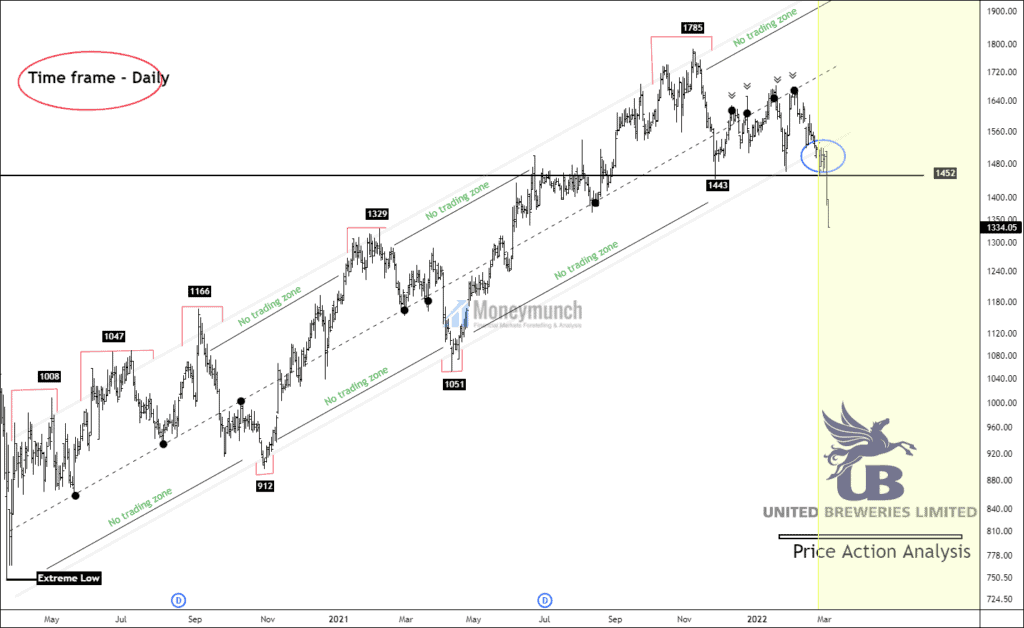

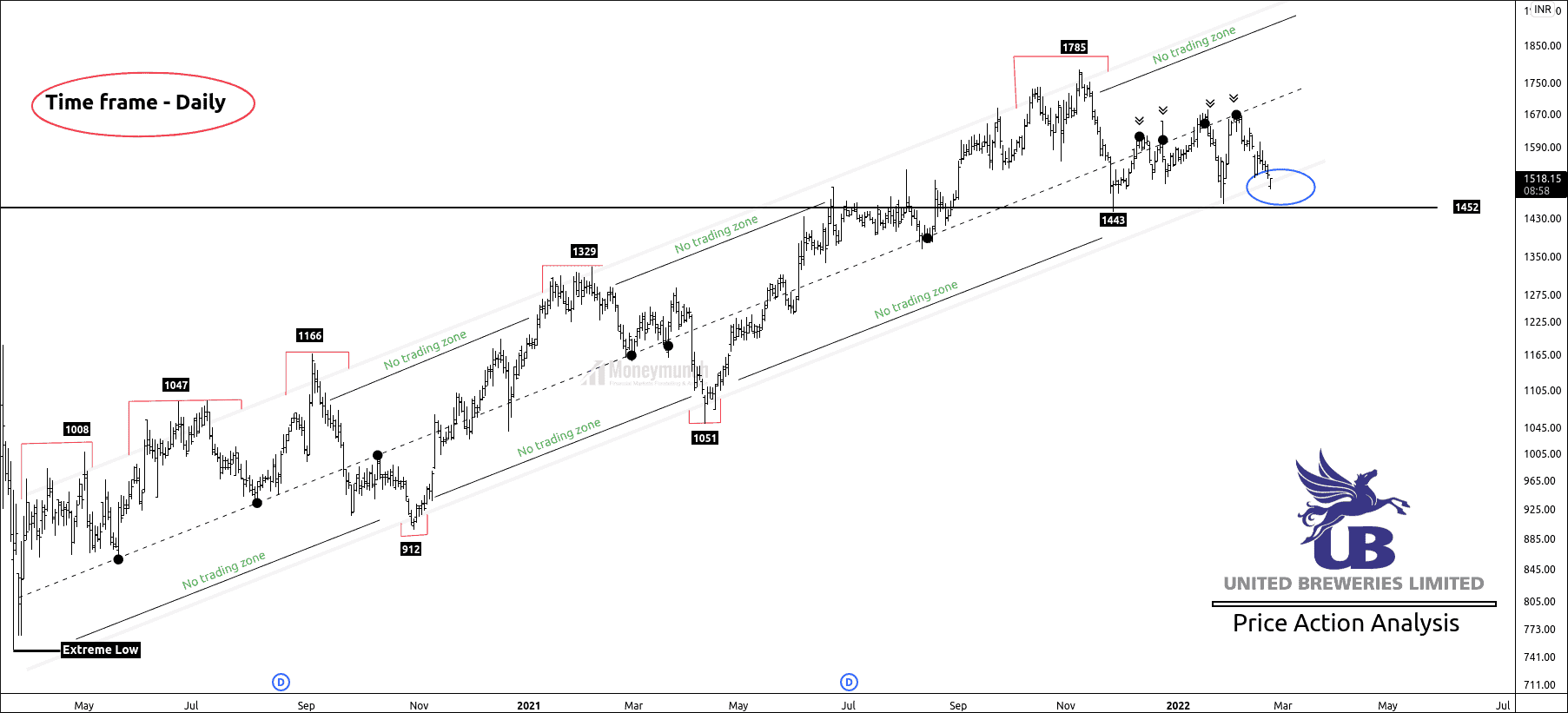

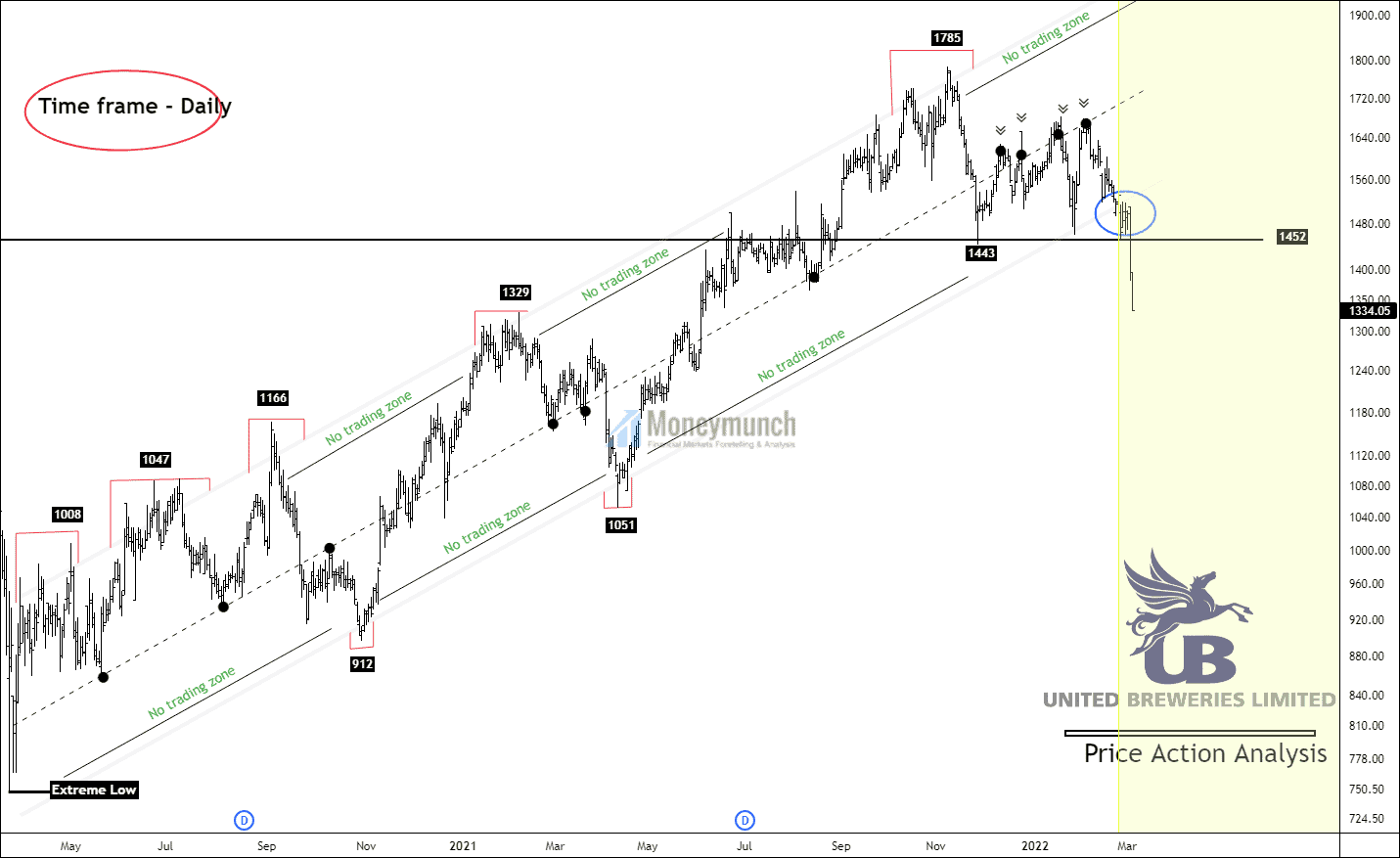

Did you read the UBL tips report?

Feb 22, 2022: NSE UBL Is Declining, But Major Support Is Ahead

I had written, “we are using a pivot zone at 1452 to avoid fake-outs. If the price breaks the pivot level, it can go for 1390 – 1311“.

UBL has touched the first target by making a low of 1381.5 yesterday. And it is very close to the second target. To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Wow, you are an Ace analyzer. I am following your views.

Booked amazing profit because of you.

okay, demand for goods and services was abruptly altered in March 2020. by August they changed how they account for inflation to supplement their carousel of economic values. they printed a bunch of money and skipped monetary policy but were saved by shortages that distorted inflation calculations maybe.

now we have no more masks. a huge start to rid the economy of the grappling burden of covid and begin to restore GDP.

inflation is hard to gauge because during the pandemic the shutdowns created shortages which increased prices drastically on many things such as cars, essential items, food, CPU. there are a lot of scenarios but really pay attention to the shortages. if supplies go back to where they were before then prices will come down but yet now there’s more money multiplying which could stabilize current pricing or increase demand for more goods.

so increasing rates and monetary policy reserve requirements will help taper the economy from roaring back on to the scene too fast and control real inflation.

furthermore, the number of averages of inflation will taper down because the supply chain will return robust as ever with covid restrictions in the past means more money pumping everywhere multiplier effect. making inflation average go down since prices will stabilize or reduce since shortages will disappear.

I just think shortages and changing calculations of inflation have created some issues. I mean the increased money everywhere and all those stimulus checks were kept from creating too much inflation by shortages…

ALL JUST AN OPINION. PLEASE feel free to tell me how silly I sound