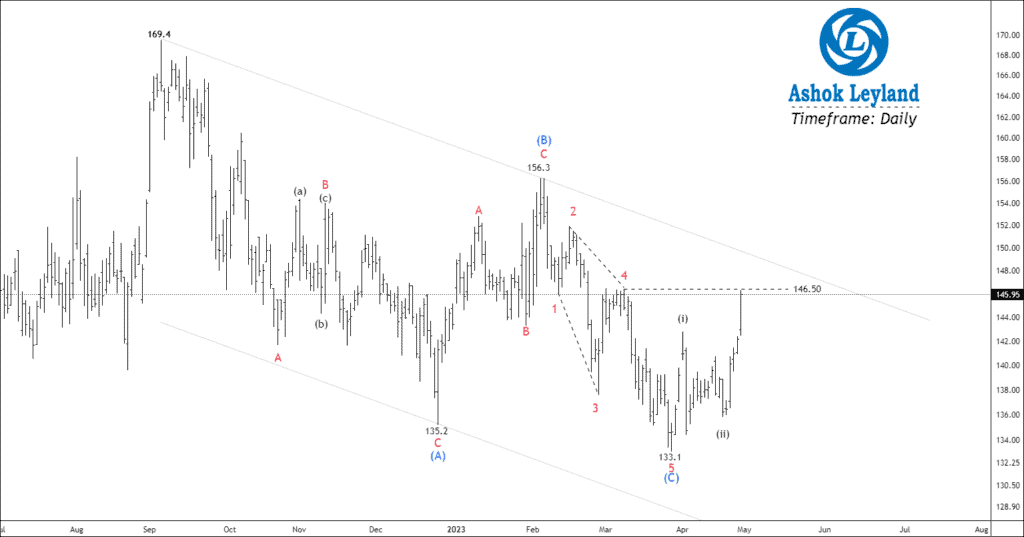

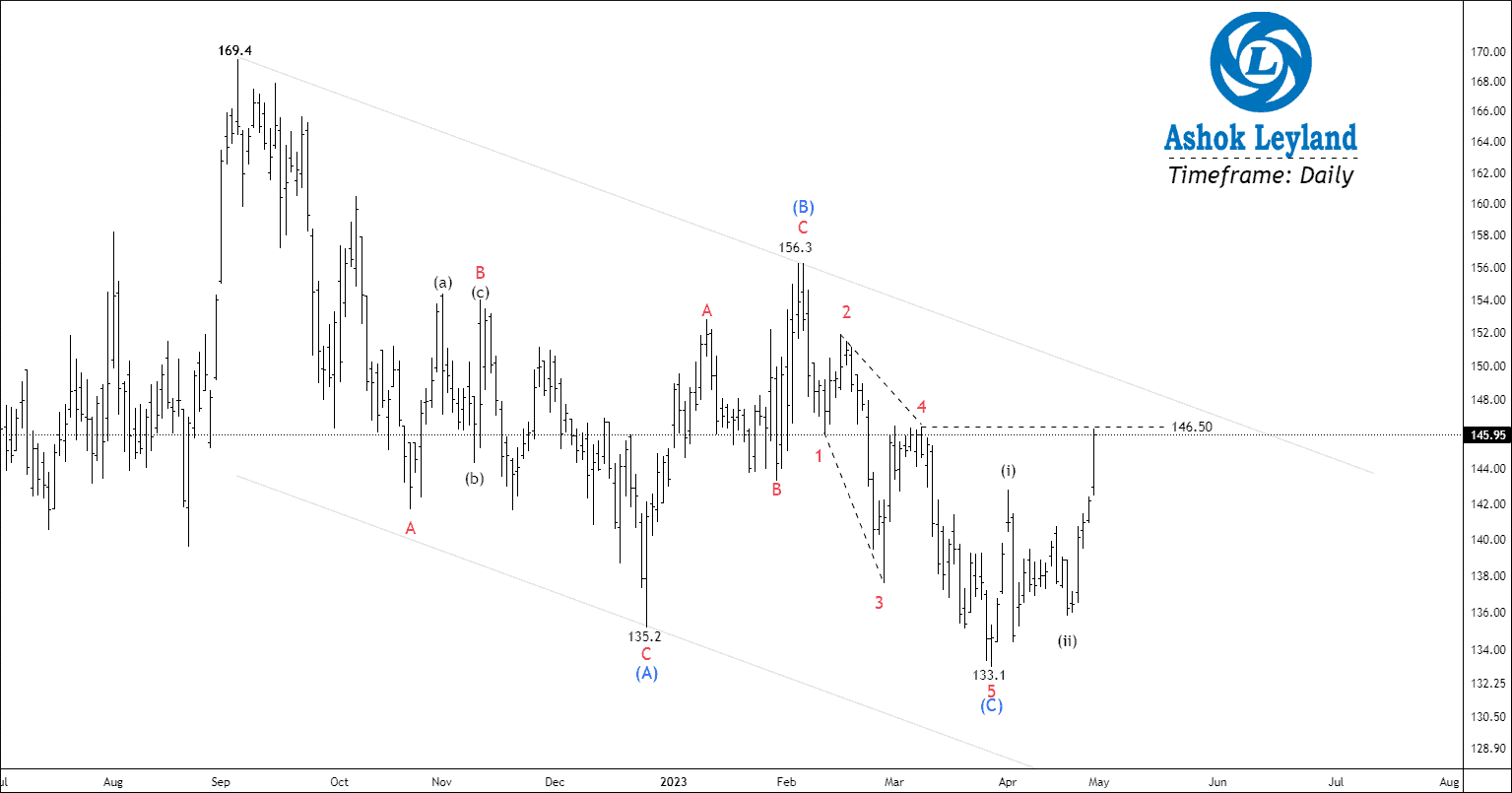

Timeframe: Daily

The NSE ASHOKLEY has been experiencing a corrective formation for over 29 weeks and has successfully completed wave 5 of wave (C) at 133.1, and started forming wave (5). The security has also managed to break out of the 20/50/100/200 moving average, and has started to move upward.

Based on the Elliott wave principle, wave (C) has extended 78.6% of wave (A), and the price has undergone wave (ii) at 135.8, before rising rapidly. The price also broke out of wave (I) at 142.8 in the previous trading session, indicating a positive trend.

In accordance with the Elliott wave principle, the price can only initiate a new cycle after a sub-wave breakout (4). If the price manages to sustain itself above 146.5, traders are advised to buy the security, with the following targets in mind: 149.7 – 155 – 162.4+.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Sir perfect summing up

Sir need good calls in CASH SEGMENT

HI any update on Ashok Leyland