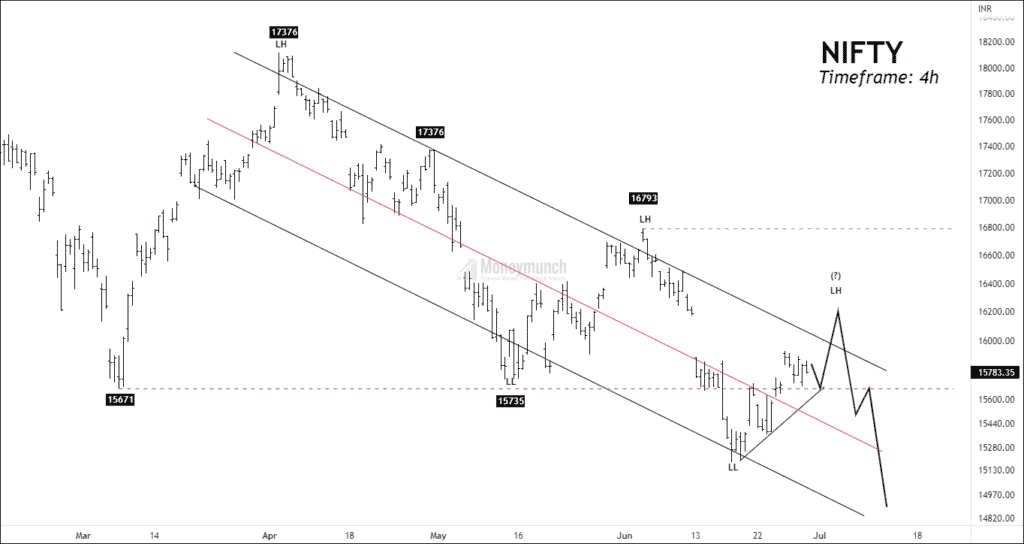

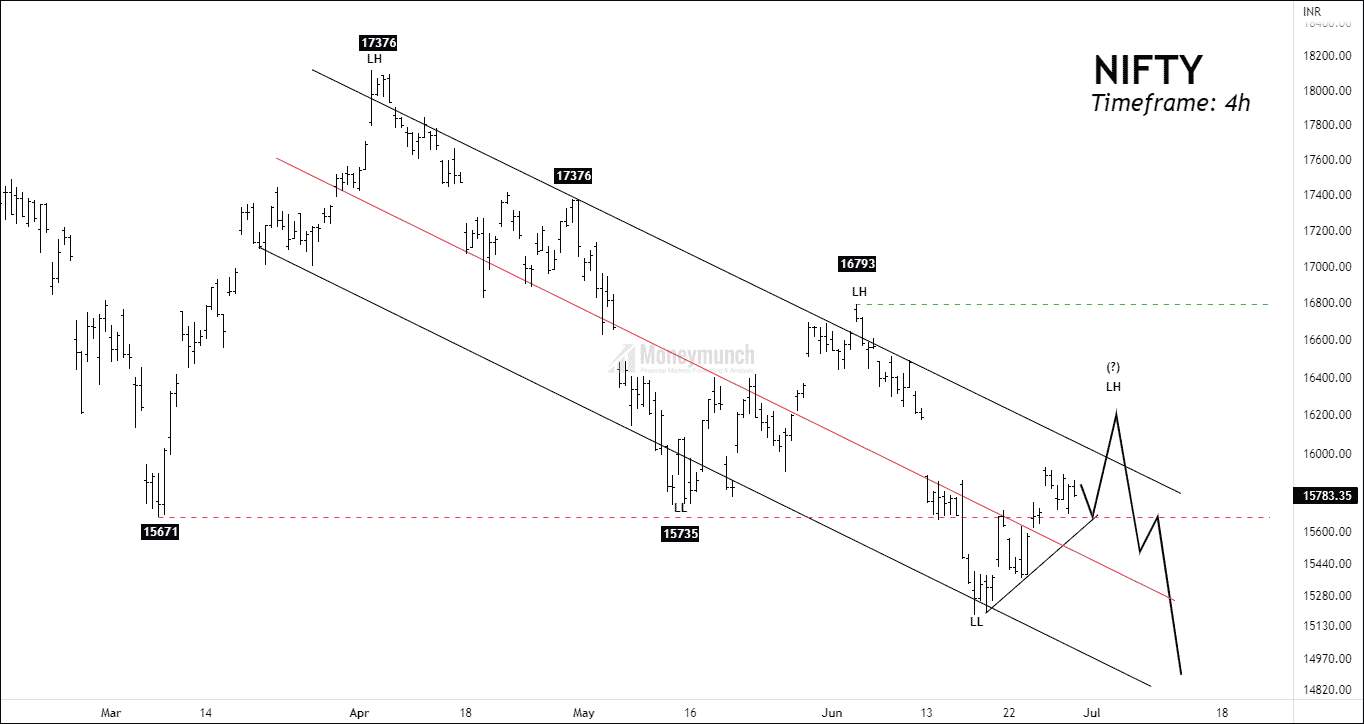

Nifty is forming in a descending parallel channel. Prices are building corrective pullbacks to manage demand pressure and fall from resistance since the start of the correction. Nifty has created a lower low at 15183 and given an upward move of 15927.

Nifty has faced supply pressure on the upper band three times. It indicates that bulls are not exceeding supply pressure and upper band. As bulls give up, bears enter and drive prices to lower levels.

As per my previous article, 16200 is strong resistance for bulls and the supply zone of the parallel channel. If the price sustains below 16200, traders can expect the following targets: 15740 – 15326 – 14870. We can expect a fake-out of the parallel channel.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Thank you so much! This is an excellent outlook for swing tarders.

Please share your views on Banknifty.

at what timeframe, you anticipate the move down to 14800? End of July’22?

I have never seen this type of explanation of Wave analysis before, Thank you sir, appreciate your efforts 👍👌

yah ..its unique ..great work

Very clear and insightful. You trading methodology is very simple to follow. I have been following you for some time. Appreciate your effort to share ideas with new traders. Keep it up.