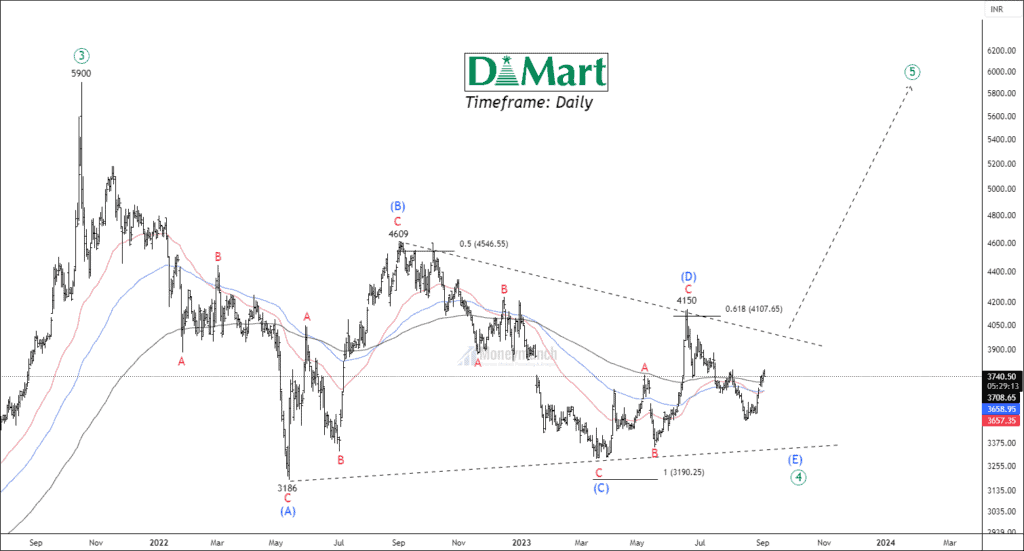

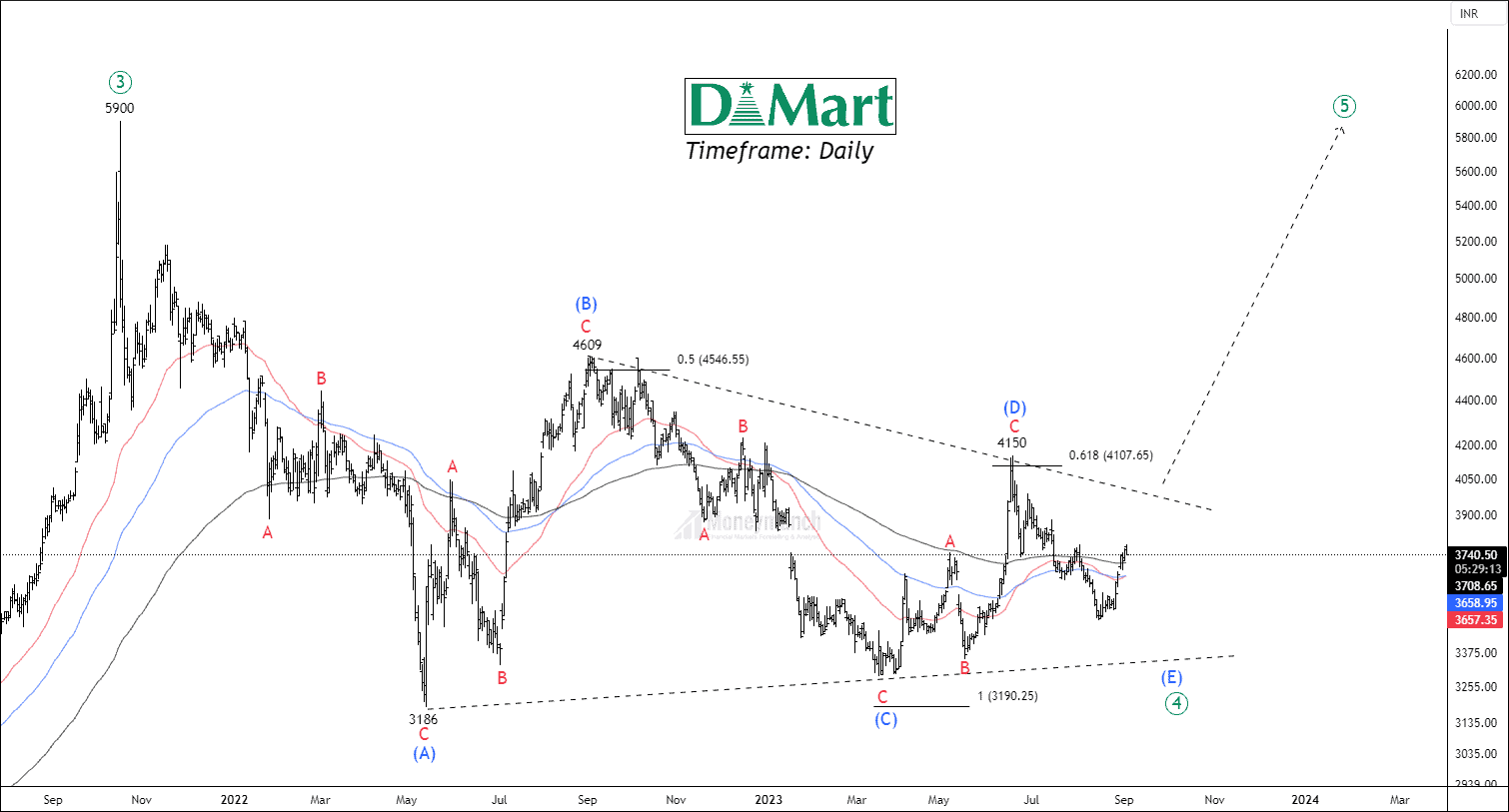

Timeframe: Daily

NSE DMART has been forming corrective formation for more than 22 weeks. Prices are moving above 50/100/200 Exponential moving averages.

As per the Elliott wave perspective, the impulsive wave (3) occurred at 5900, and the price is the construction contracting triangle of wave (4). Currently, we are at wave (E) of wave ((4)). If the price breaks out B-D trend line, traders can buy for the following targets: 4350 – 4640 – 5105+.

Traders should wait for the breakout to initiate their entry. By this wave, they can reduce the risk of failure. The breakdown of the A-C line will continue its corrective structure.

We will update further information soon.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Well done!

top-notch