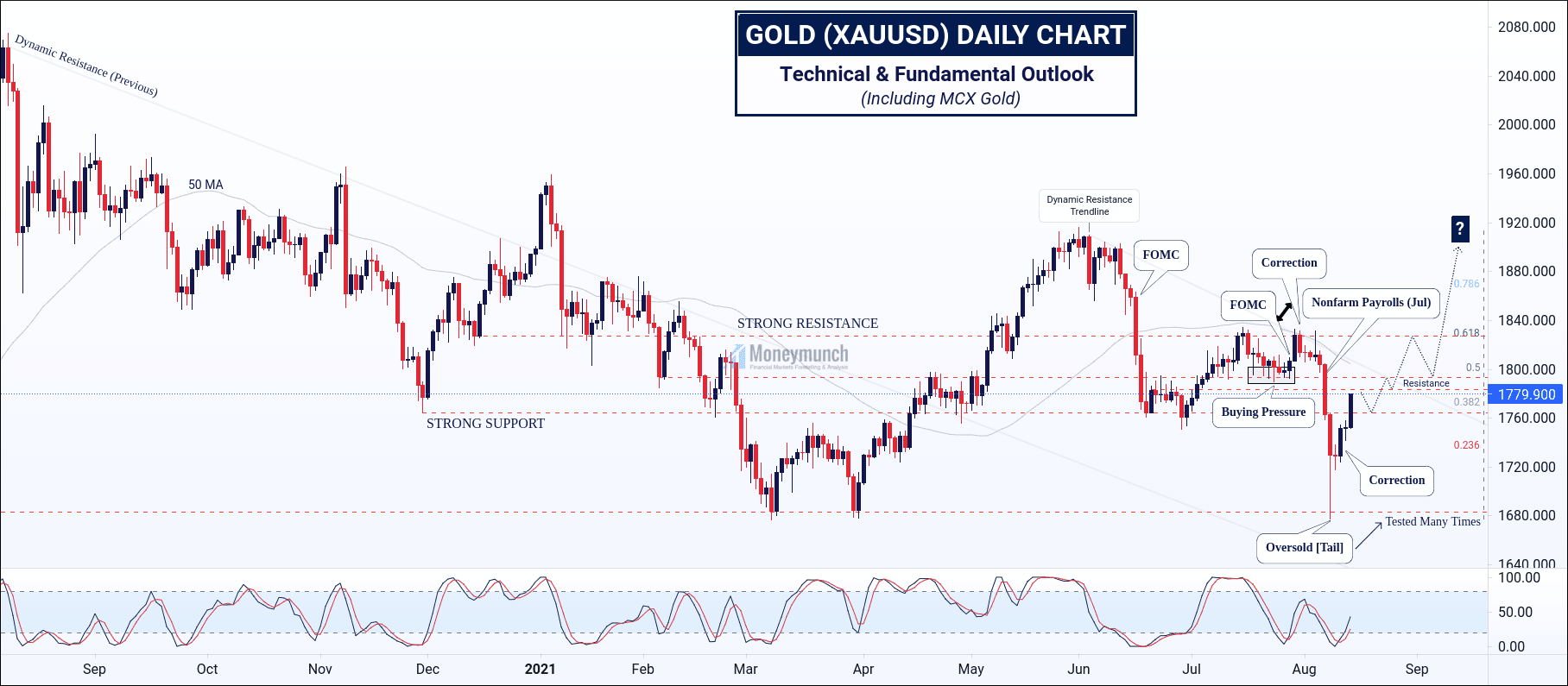

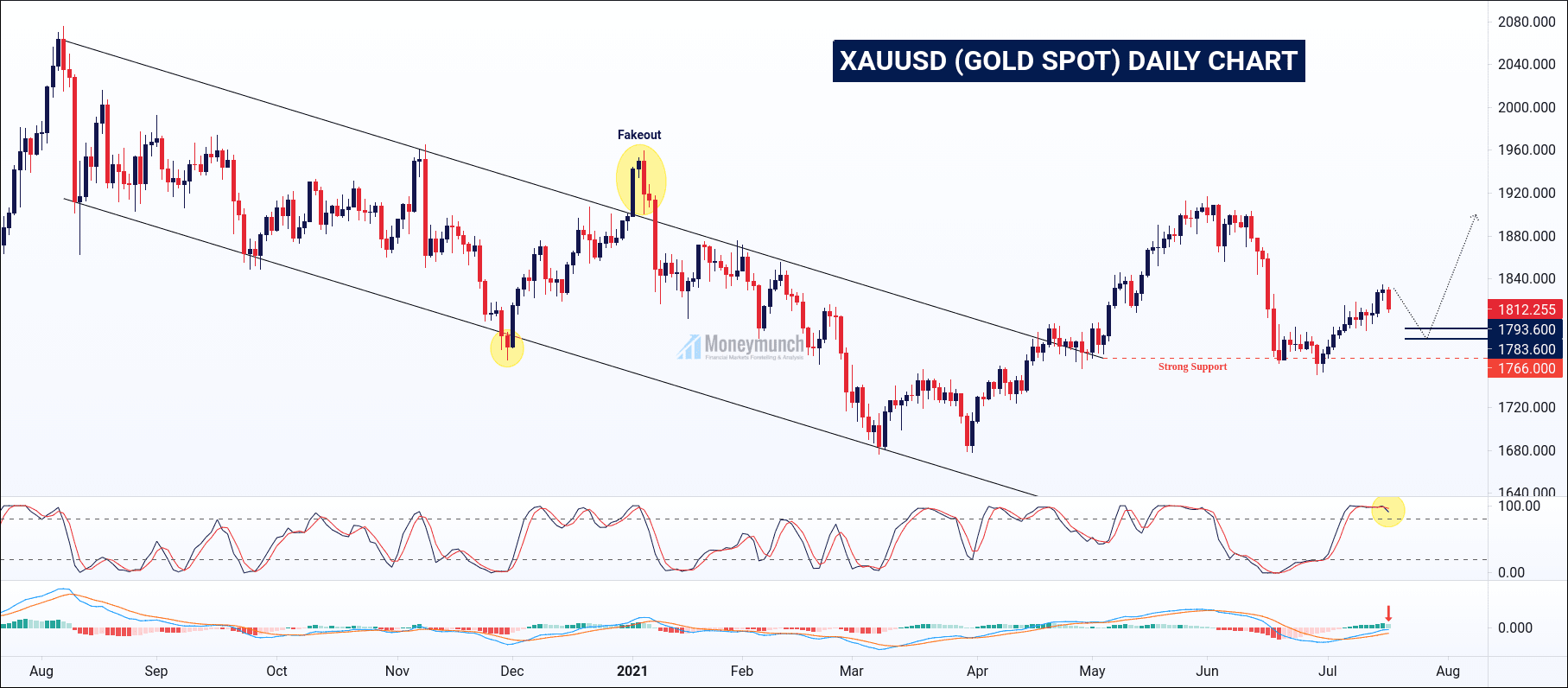

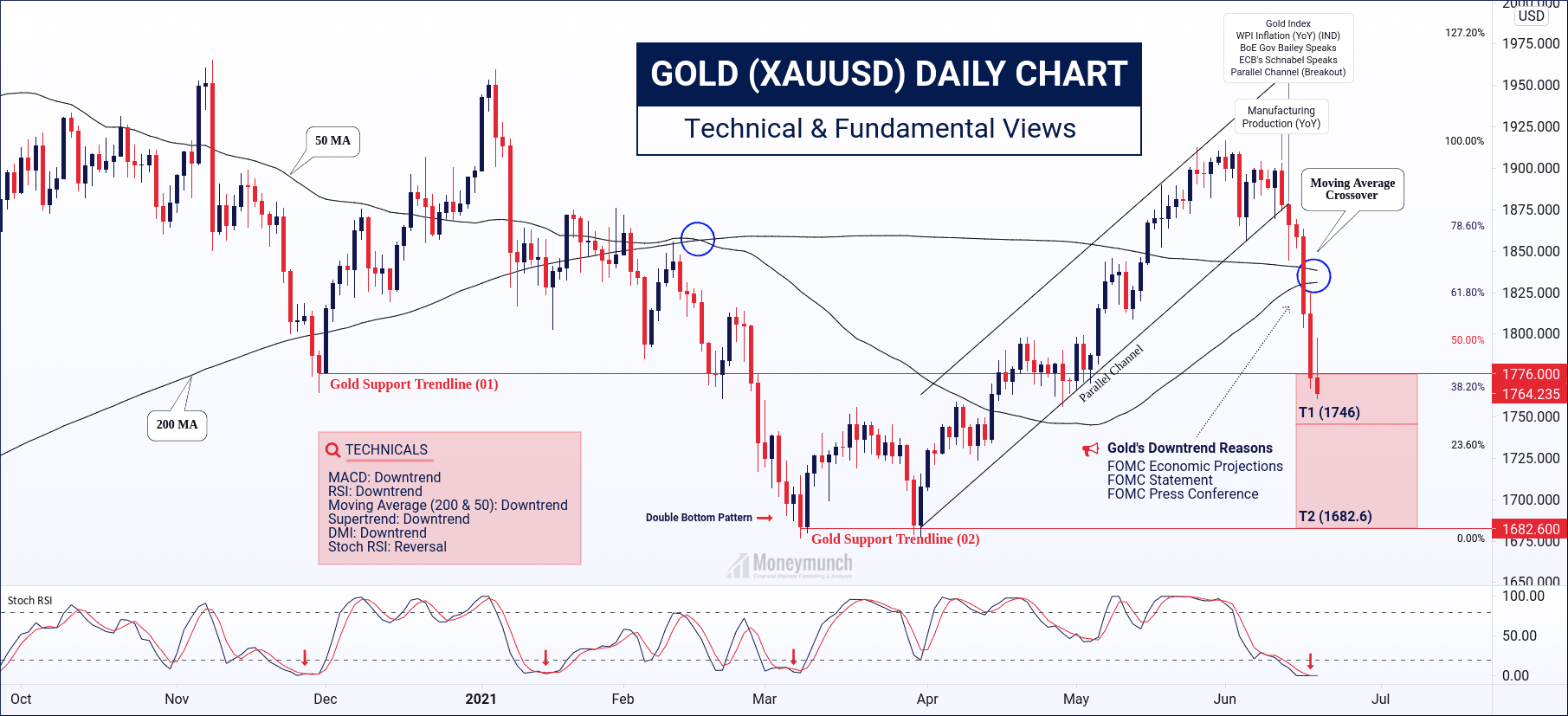

The gold spot needs to break the 1793.6 level to start an uptrend. Afterward, it will go for 1806 – 1826 levels. And these levels can push the gold price up to 1900.

But if gold breaks the strong support again, it will start falling. This time, it won’t stop! Hence, the short-term traders can start selling from there for the targets of 1744 – 1726 – 1684.

MCX Gold Will Have An Explosive Rally This Wednesday

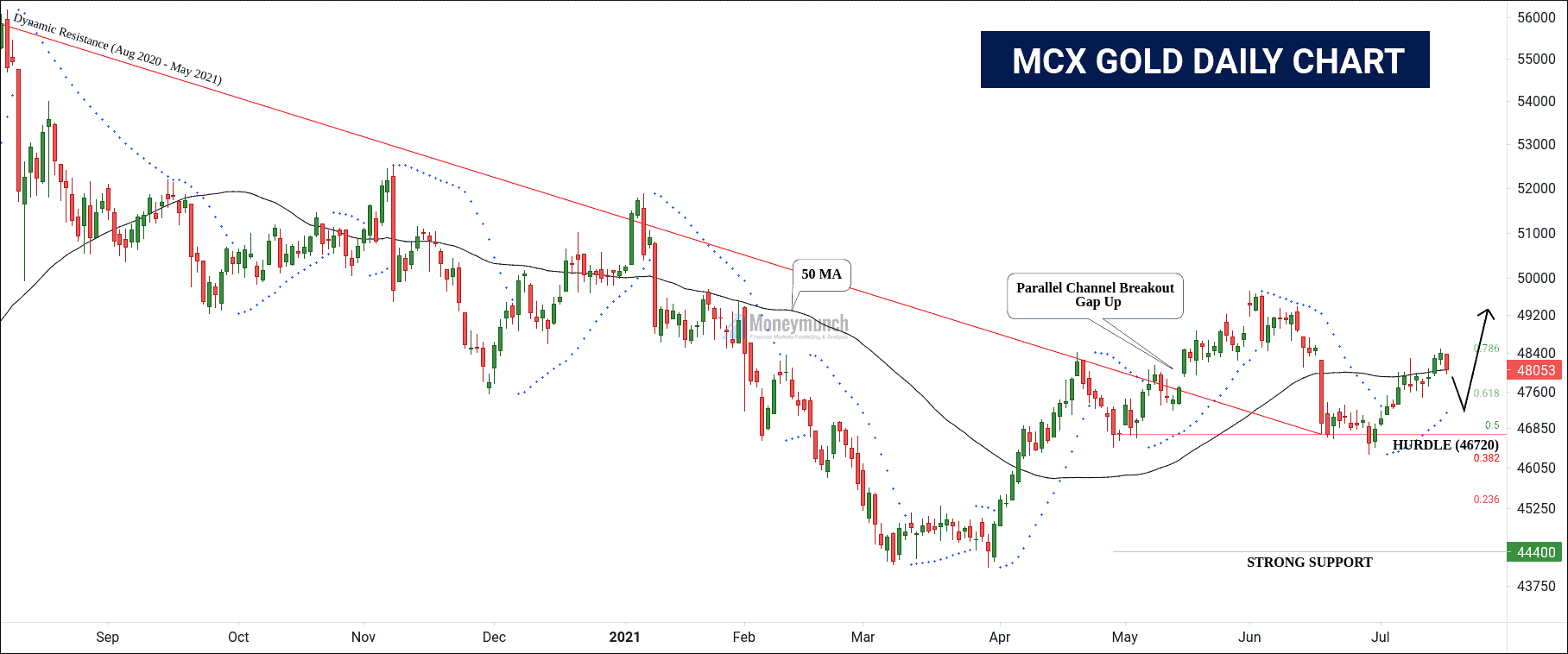

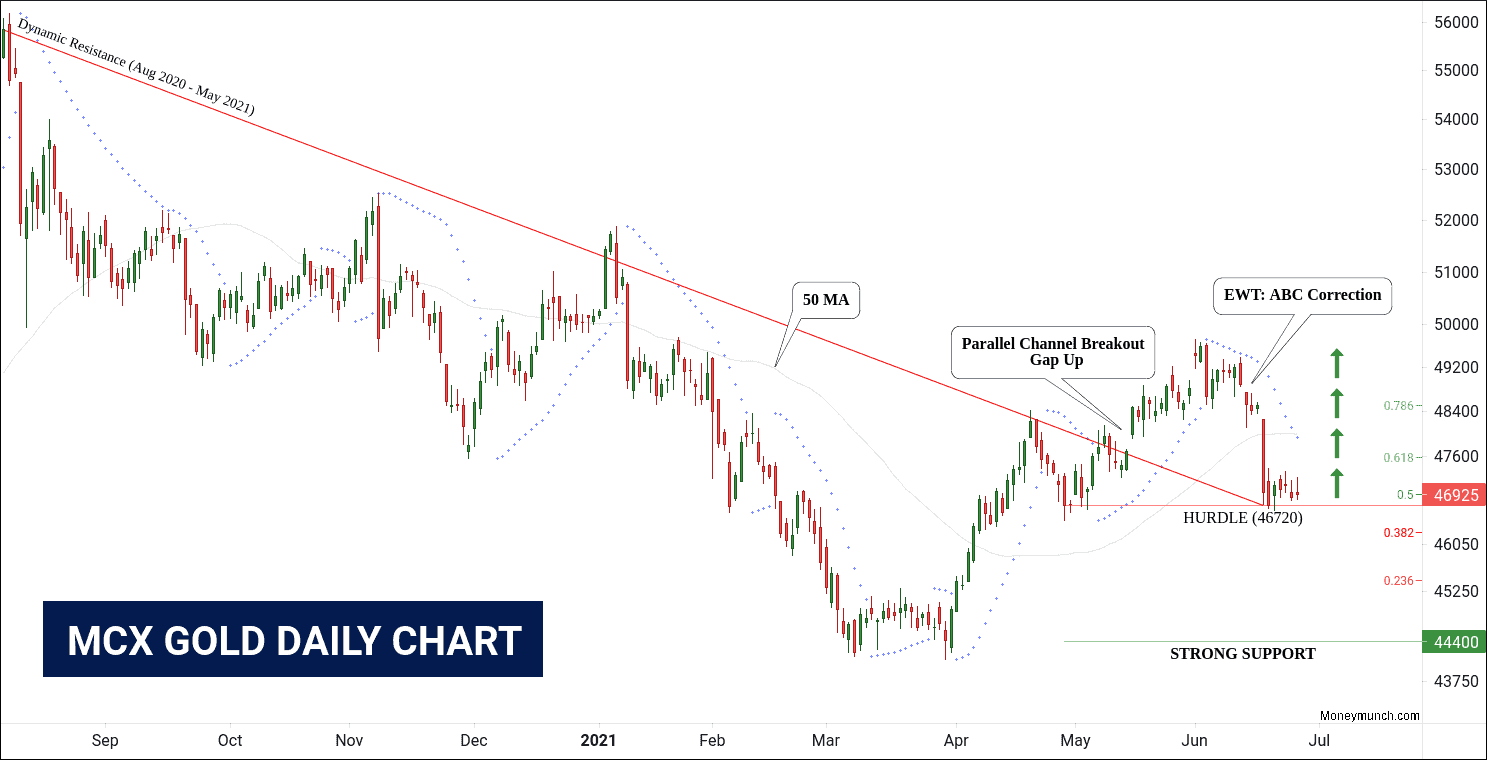

MCX traders should keep their eyes on the 46720 levels. It’s a trend changer.

As per XAUUSD, Indian MCX Gold can raise 47500 – 48260 after a breakout of $1793.6. And if it breaks the strong support of Gold Spot, it will keep falling for targets of 46260 – 45860.

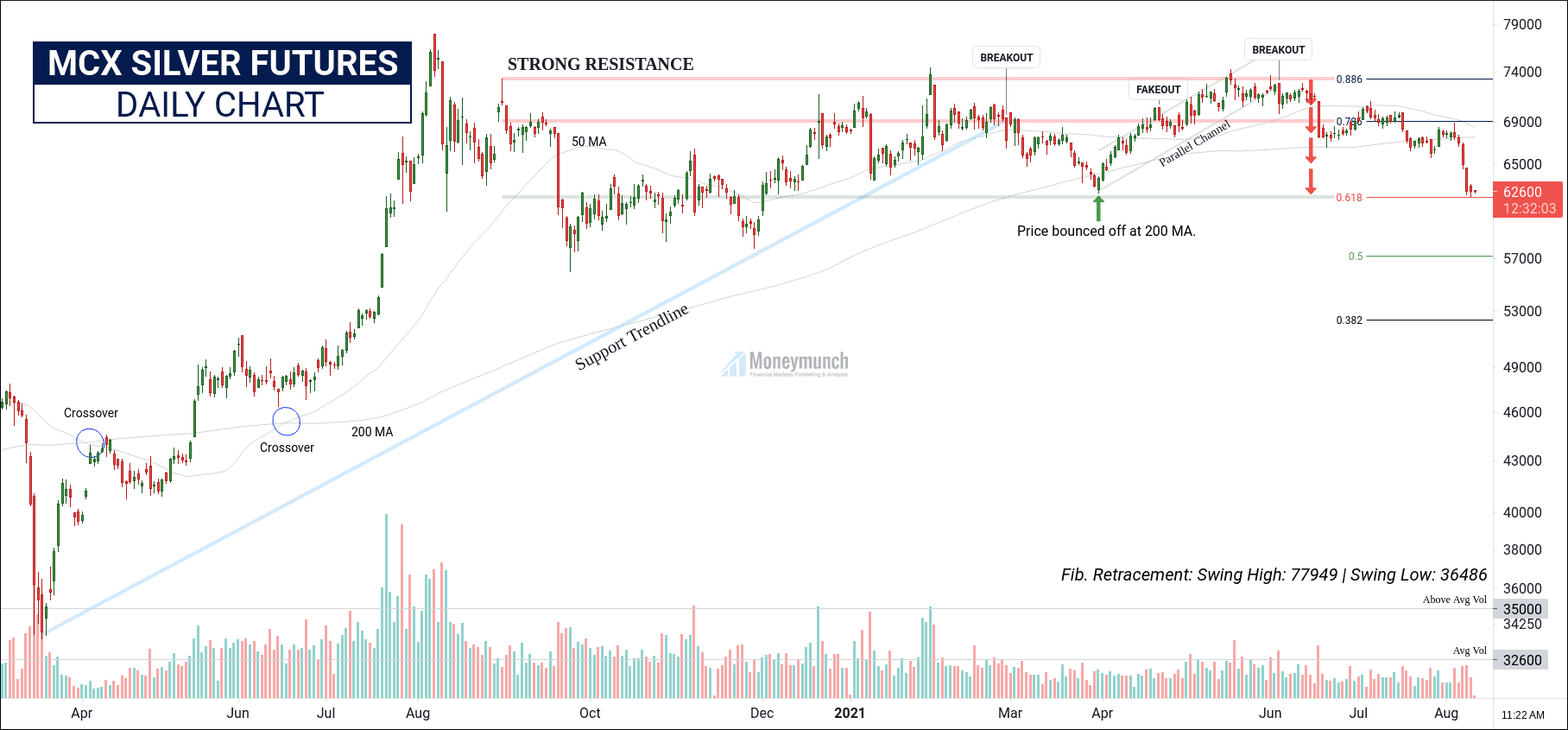

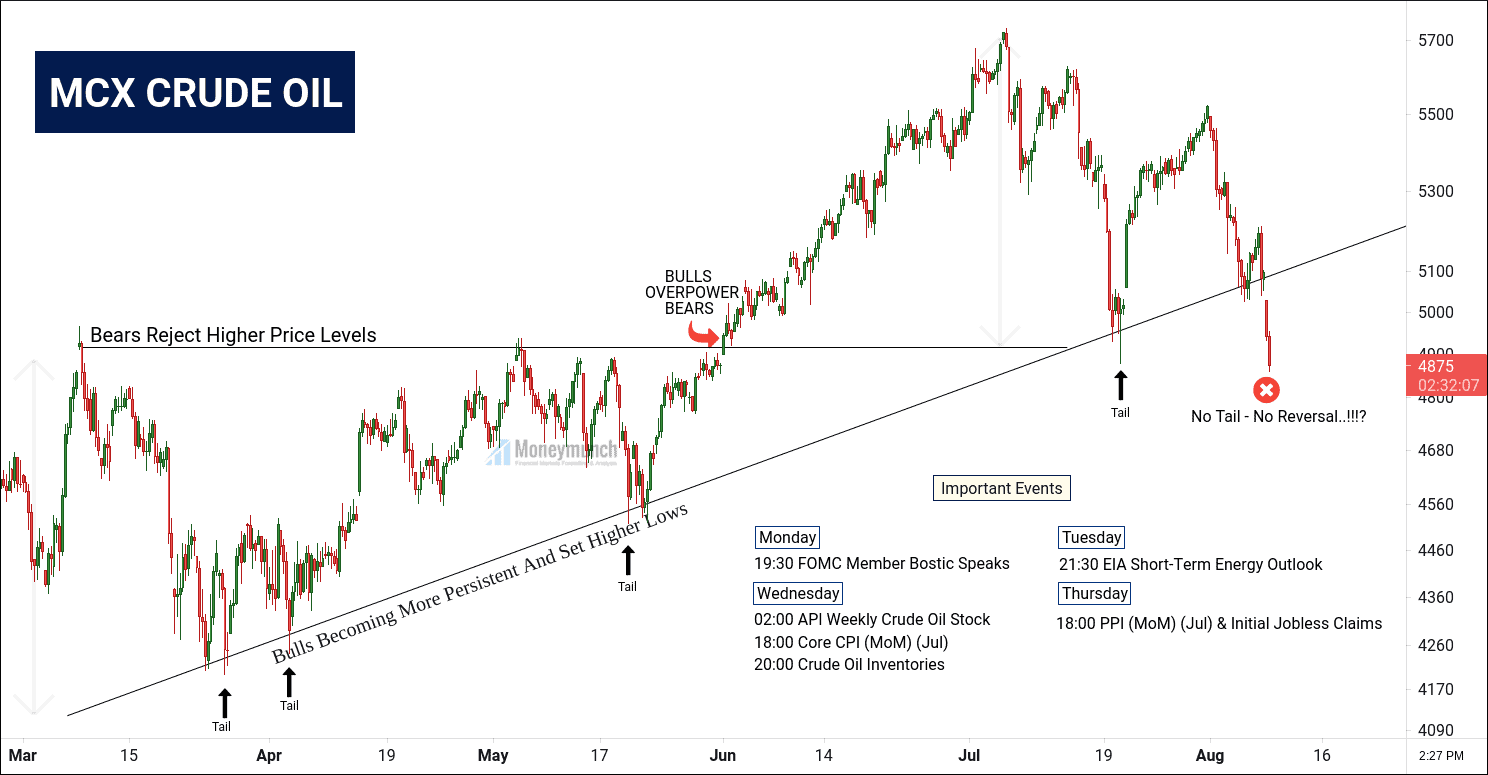

For advance traders, watch significant releases or events that may affect the movement of gold, silver & crude oil. Especially, don’t forget to watch this Wednesday’s events to find out gold upcoming actions.Continue reading