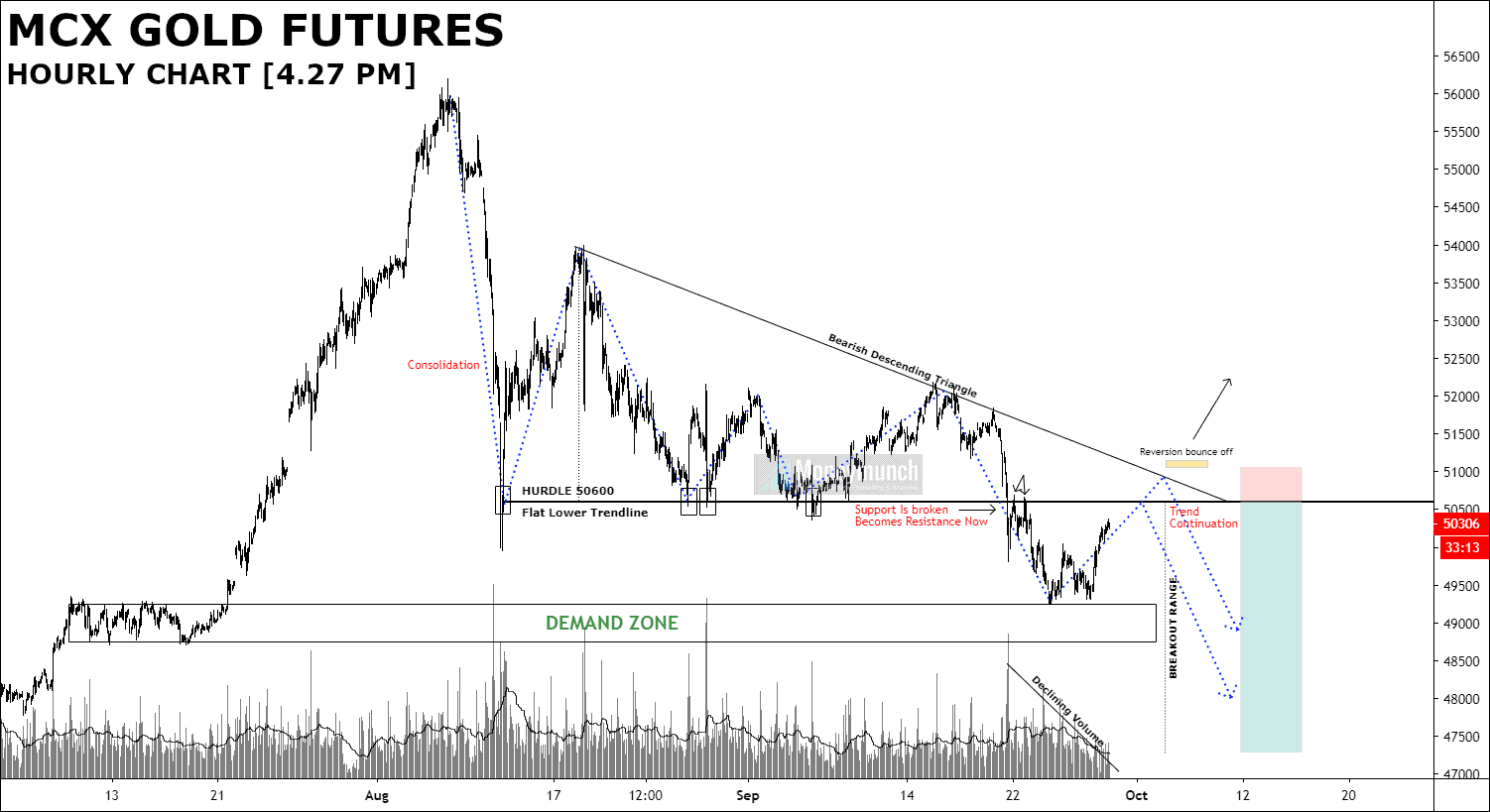

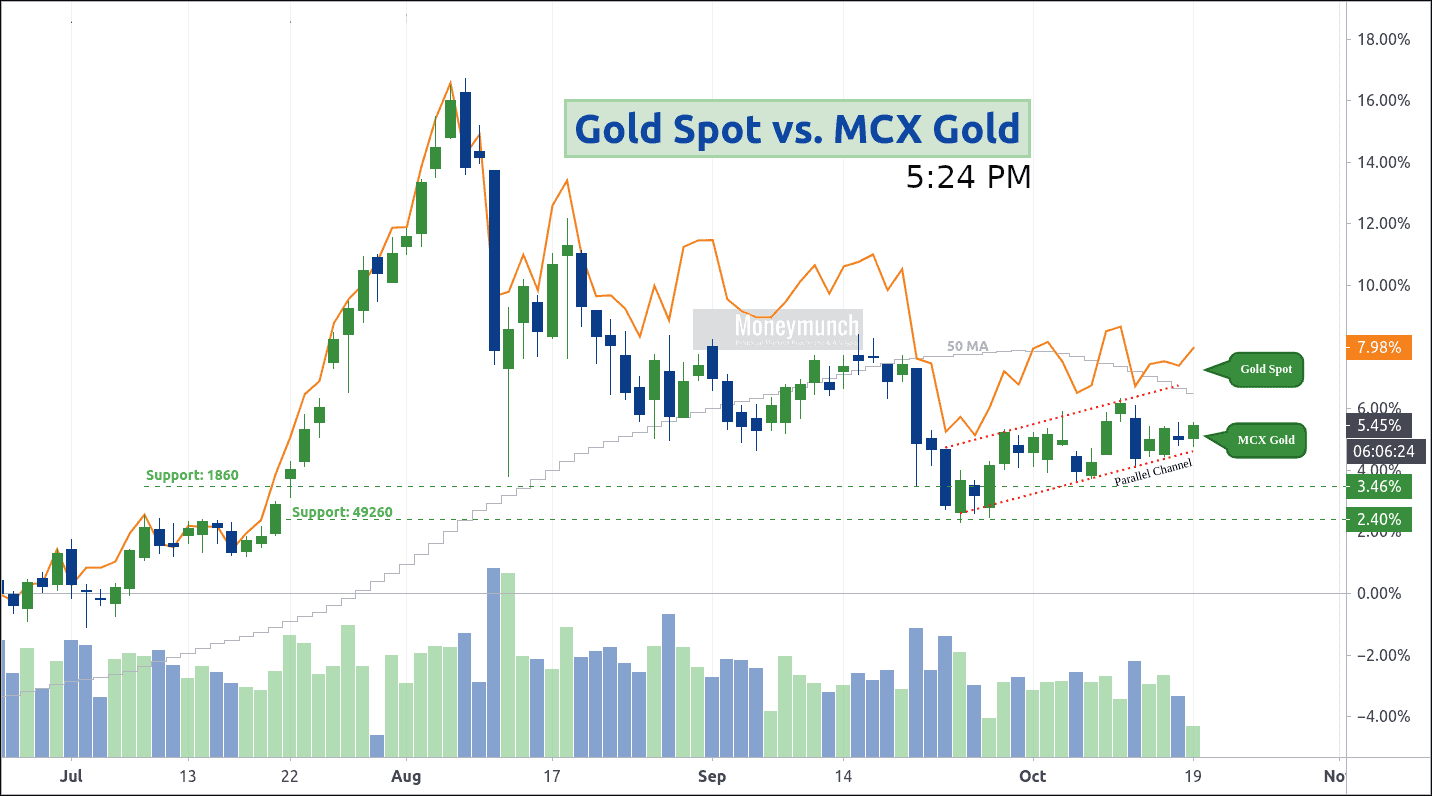

Have you bought Gold? If not, I have updated a free call on gold three days back.

Have you bought Gold? If not, I have updated a free call on gold three days back.

Read Now: Gold Spot vs. MCX Gold – Weekly Reports & Tips

I had written in bold words, “according to this chart, gold is trying to climb upward after hitting the PC (Parallel Channel). And if it remains into the PC, we may see 51000 – 51500+ levels before the weekend”.

Gold has reached the first target (51000) and made a high of 51454 yesterday. Will it touch the next target or not?

Min. Profit Per Lot: Rs.30,000

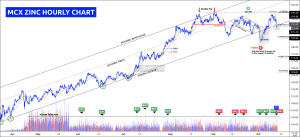

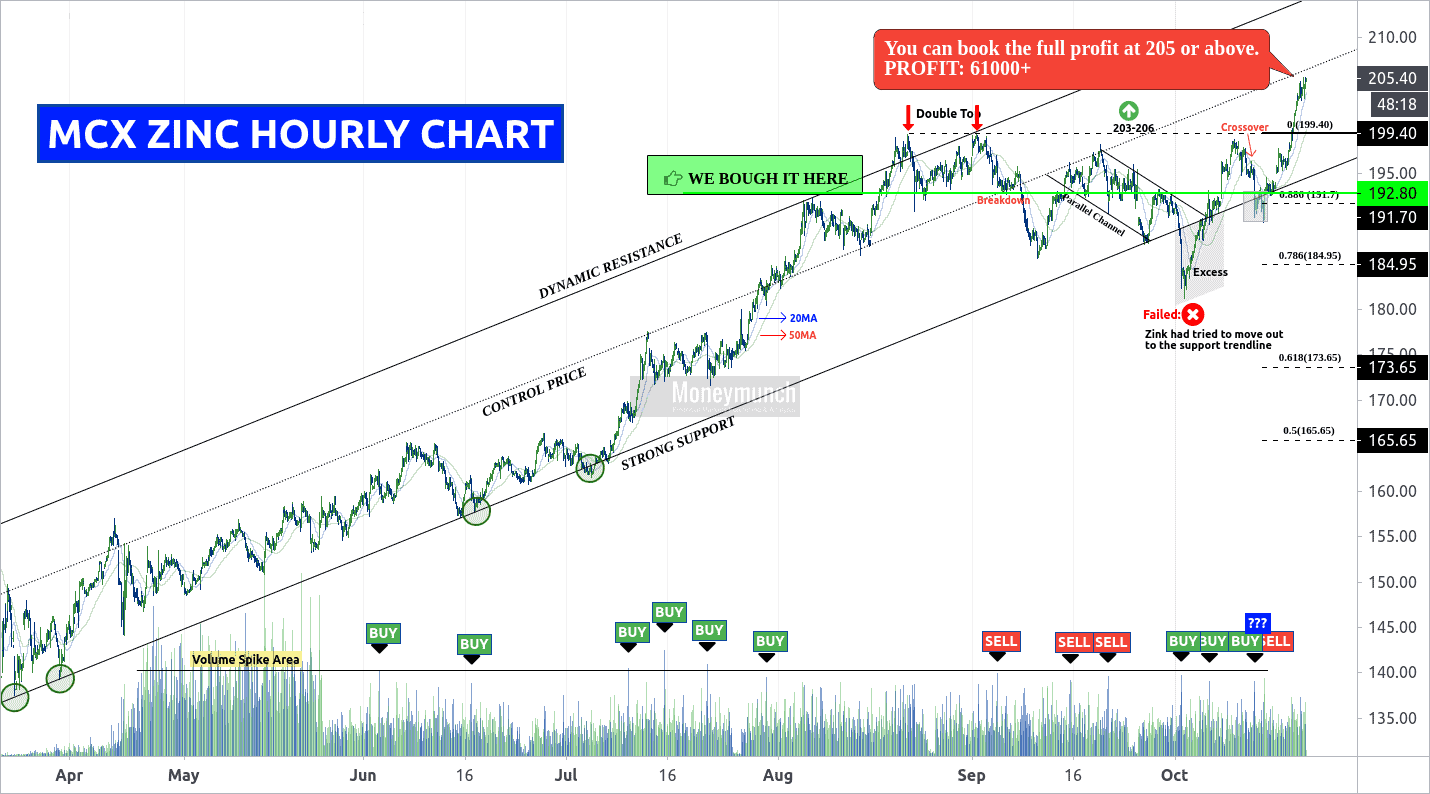

I have updated a free Zinc trading call on 15 Oct 2020. First, visit here to read that article: MCX Zinc Ready For Another Rally Attempt

I have updated a free Zinc trading call on 15 Oct 2020. First, visit here to read that article: MCX Zinc Ready For Another Rally Attempt

I had written clearly, “The day traders can keep buying above 0.886 value of retracement for the target of 194.6 – 196 and above. Breakout of 199.4 means boom! It can fly from there for 203 – 206 levels”.

Zinc has touched all day trading targets, and it has also touched the positional target of 203. Will it touch the last target 206 level before the weekend?

Min. Profit Per Lot: Rs.61,000

What else you want in a free subscription? To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

Lock

Lock