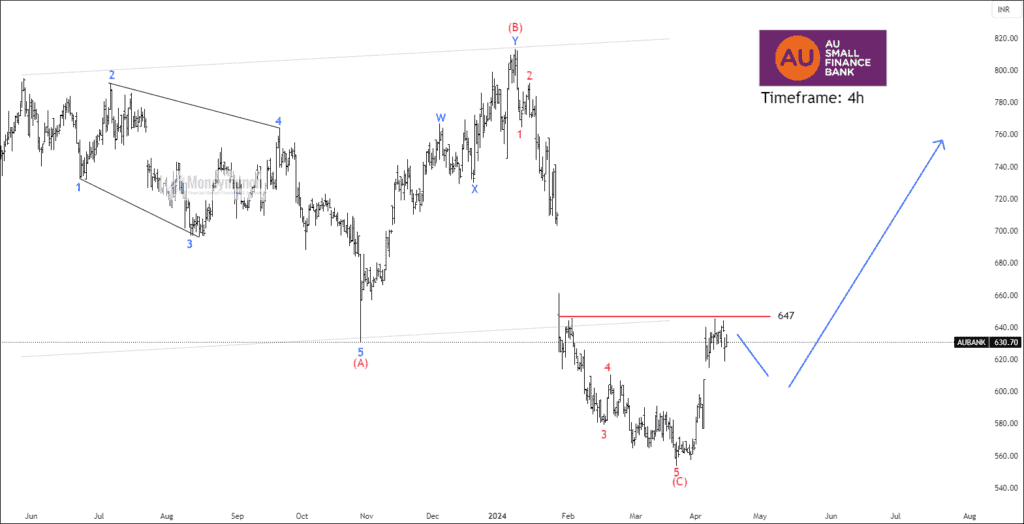

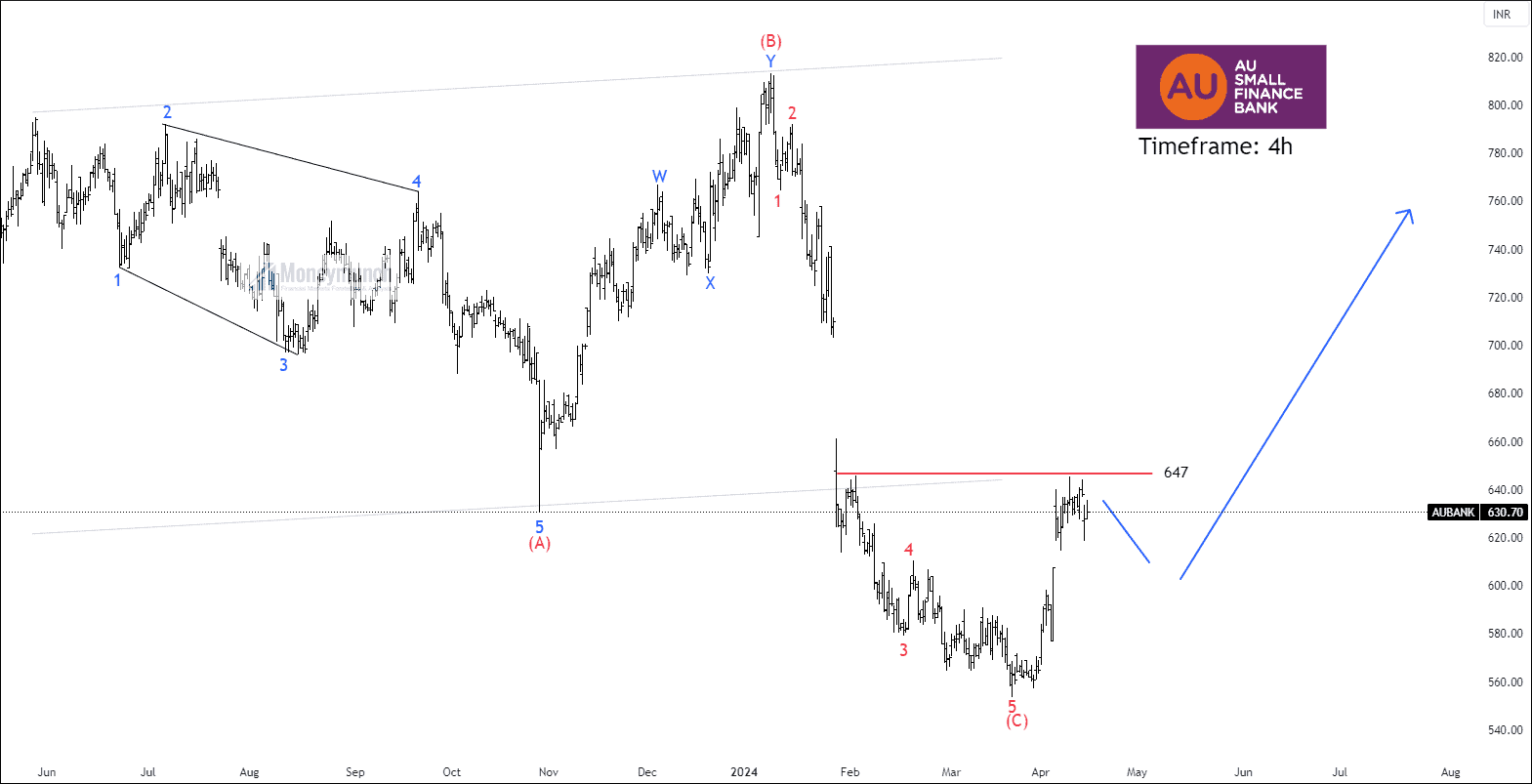

Timeframe: 4h

NSE AUBANK has undergone a corrective phase spanning 42 weeks, forming a discernible structure. With a price Average True Range (ATR) of 11.52, the ADX indicator reflects a robust rise to 32.7. Notably, the price maintains positions above the 20/50/100 Exponential Moving Averages (EMA) but faces resistance from the 200 EMA.

Having completed wave 5 within wave (c) at 553.7, the price has initiated an upward trajectory for a new cycle. Despite encountering formidable resistance at the 647 level, coupled with the 200 EMA, the price could experience a throwback near wave 4 of wave (c). Upon surpassing the 647 mark, traders may target subsequent levels at 670 – 696 – 742+.

Stay tuned for further updates.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Superb analysis

Please share your daily views on nifty and banknifty.

What do you think about torrent pharma, gael and industower

Perfect count!