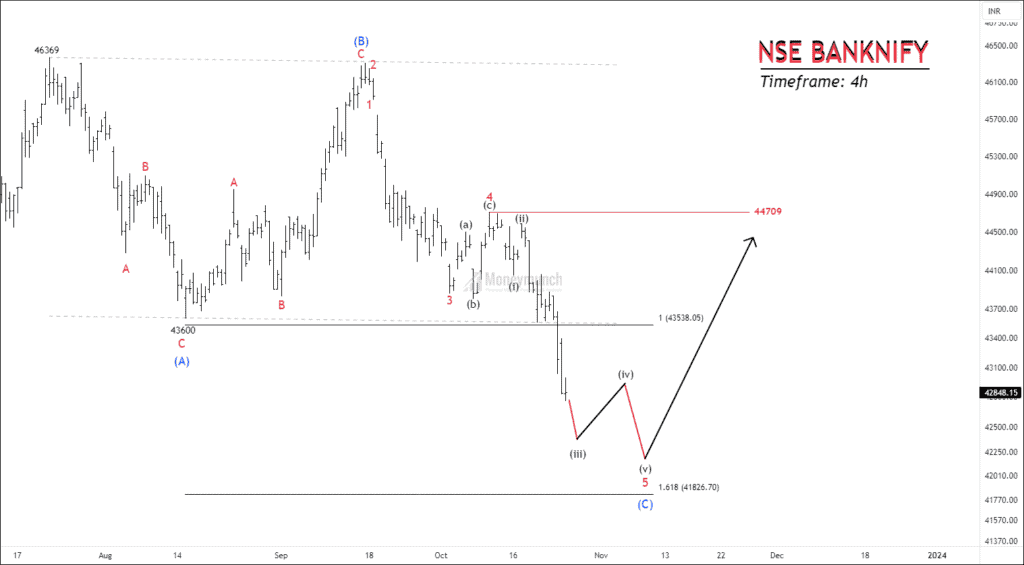

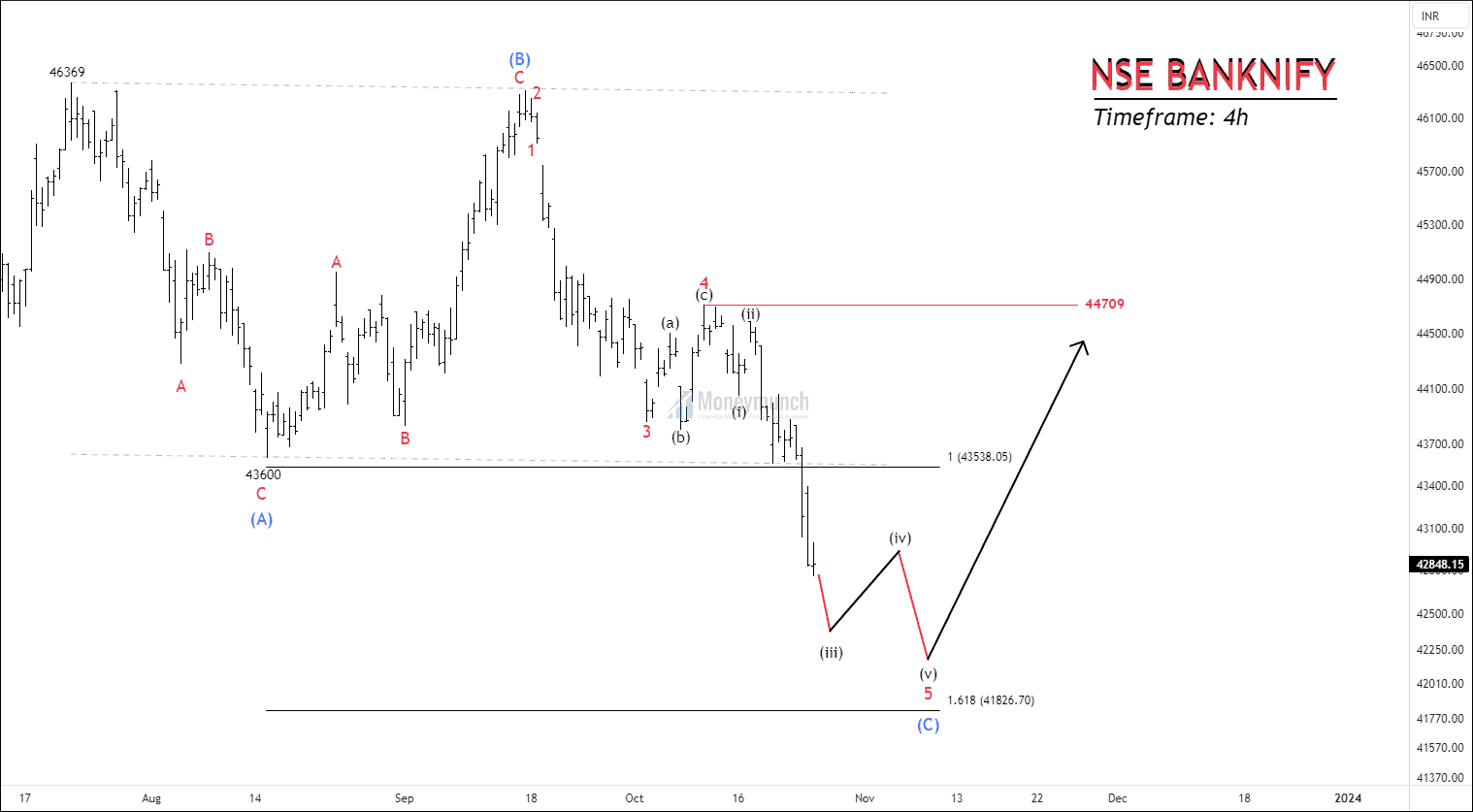

Timeframe: 4h

NSE BANKNIFTY appears to have undergone a corrective formation labeled A-B-C. During this correction, the price broke below wave A at the level of 43,600, coinciding with the breakdown of the 200-period Exponential Moving Average.

Within this corrective pattern, BANKNIFTY has completed sub-wave (ii) of wave (5) at 44,589.85, and it is currently in the process of forming sub-wave (iii) of wave 5 within wave C. Notably, wave C has already retraced to the 161.8% Fibonacci extension level. It suggests a potential reversal zone around 41,826, which aligns with the final territory of the 161.8% Fibonacci extension. Traders may want to monitor this critical support level at 41,826 closely, as it could signify an important turning point in the price action of BANKNIFTY. After the reversal, upside potential has an abstract of wave 4 at 44709.

We will update further information for premium subscribers soon.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.