In this outlook, we are covering two scenarios that will be helpful for day traders as well as investors. We should negate the possibilities because Murphy’s law says,

Whatever can happen will happen

Shall we direct jump on the pool? Yes, shallow ends first.

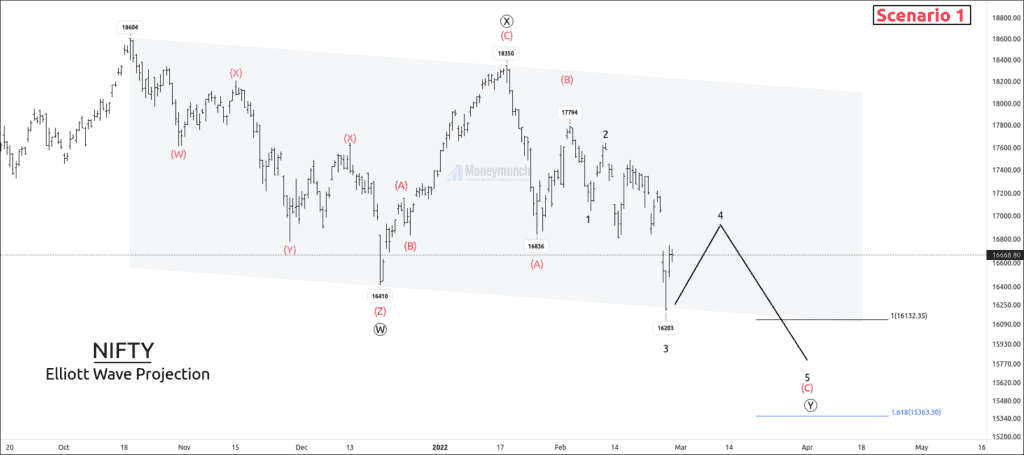

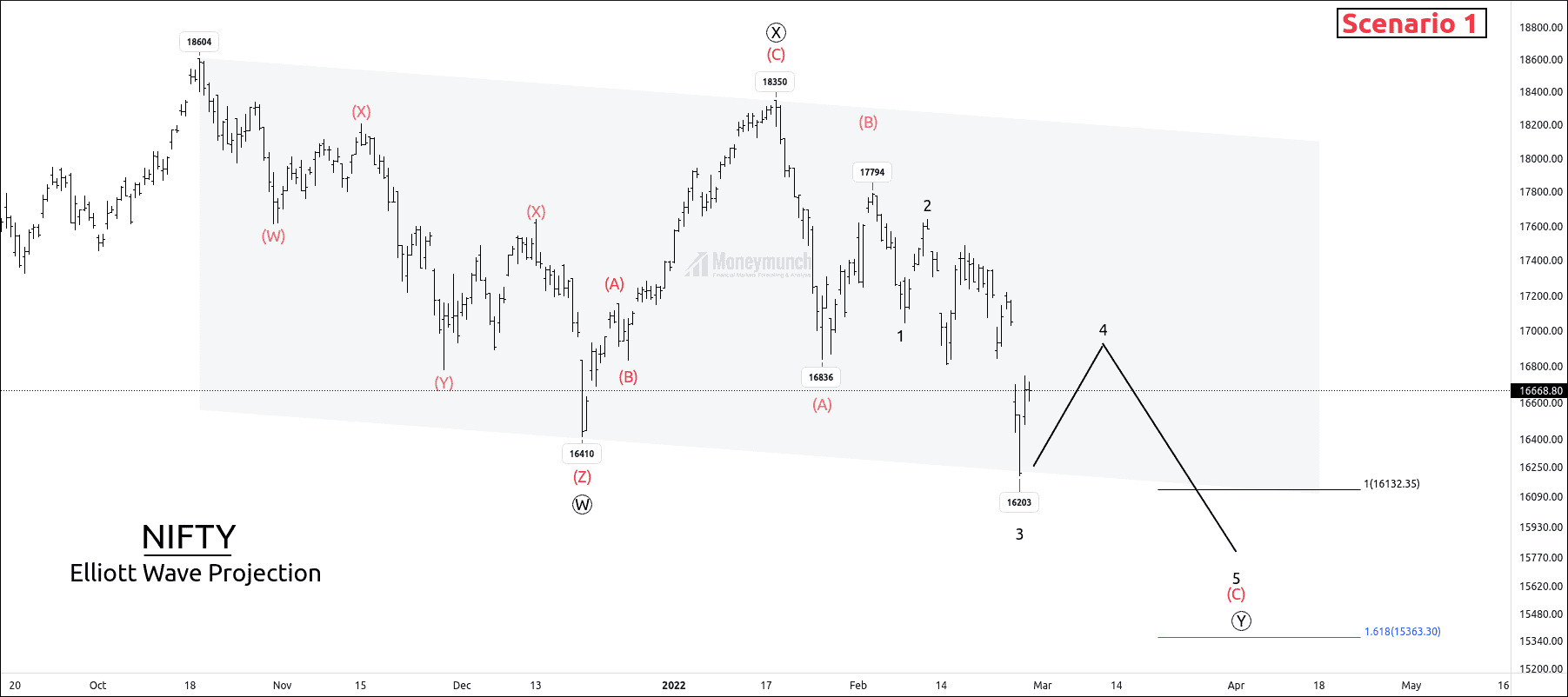

After creating a high of 18600, the price has occurred a double zigzag. Currently, we are riding on the impulsive wave sub-wave 4 of wave C of complex (Y).

Wave Structure:

Wave ((W)) – 16410

+ Internal structure – Triple Zigzag

+ Fibonacci relationship – 50% of wave ((5))

Wave ((X)) – 18350

+ Internal structure – Engaged corrective wave

+ Fibonacci relationship – 100% of wave ((W))

Wave ((Y)) – New low at 16203

+ Internal structure – Zigzag correction

+ Fibonacci relationship – 100% of wave ((w)) at 16156.

Target projection for scenario 1:

- Wave (C) can end near the 1.618% Fibonacci extension of the wave (A) at 15363.

- Wave ((Y)) can cease at 100% Fibonacci extension of wave ((W)) at 16136, but if the price breaks this level, then the next Fibonacci level is 15600.

To become a subscriber, subscribe to our free newsletter services. Our service is free for all.

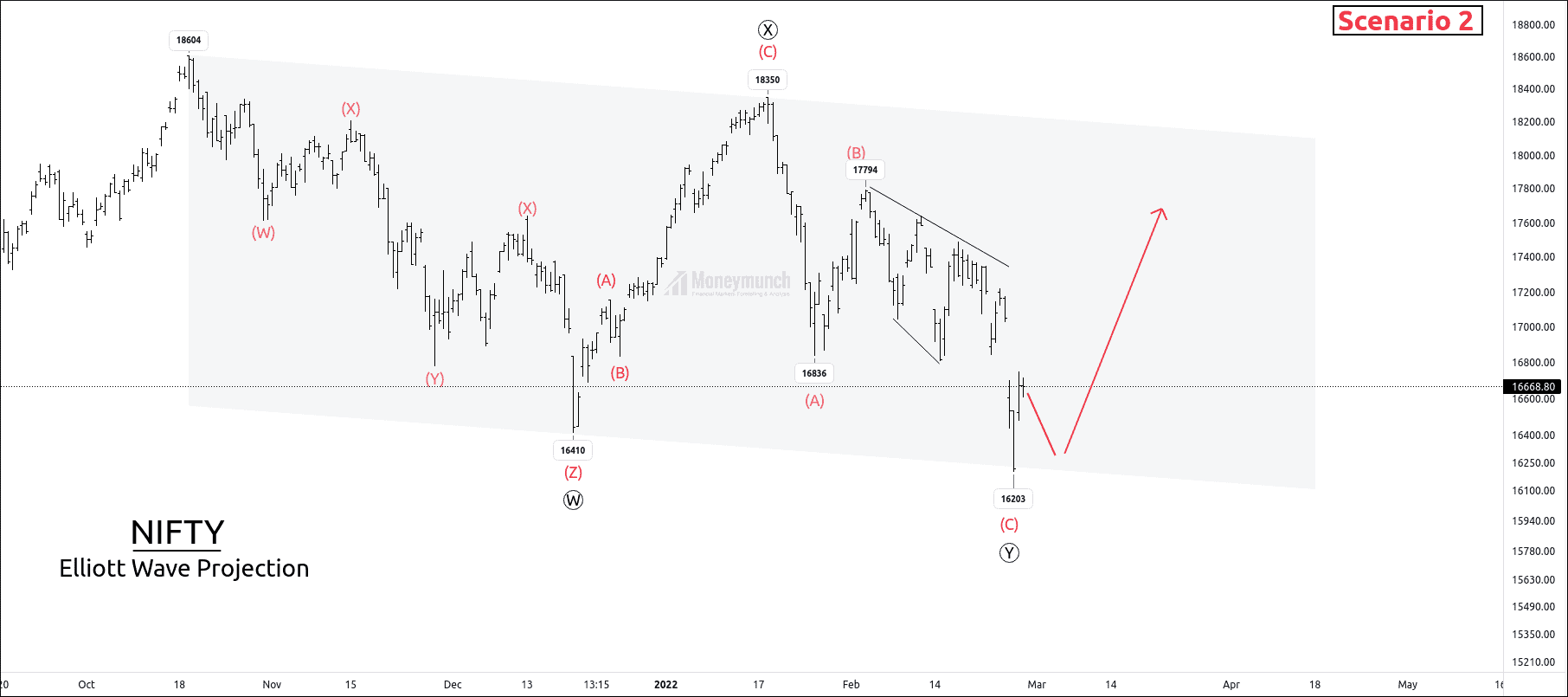

Perspective:

Price has completed the double zigzag correction by completing wave C of wave (Y).

Wave ((Y)) has already traveled 100% of wave ((W)). Price will start an impulsive cycle, which will be the sub-wave of wave ((5)).

Price has to confirm its bullish move by breaking wave B at 17794.

Bullish sentiments can derive a price for 19000 and more.

Get free important share market ideas on stocks & nifty tips chart setups, analysis for the upcoming session, and more by joining the below link: Stock Tips

Have you any questions/feedback about this article? Please leave your queries in the comment box for answers.

Nice analysis!

How long do you expect it to be in that correction (nifty dropping to 15000?), until the end of the year or longer?!

Also, do you think value companies will be the same affected or less? until now, they seem to resist better to the fall…

thx for the answer!

Warren Buffay says buy when everyone is scared or something to that effect

Imagine leveraging on the futures trade… quickest and biggest profits are from shorts. So dramatic lol. Crazy

looks like the uptrend will eventually go back up. buy when it goes lower.

I want excess in your application. I am going to buy your package.

amazing! waiting for your BTST and Option trade.

You are the best. I am willing to buy your package, today I will transfer money. I hope that I will get calls from Monday because I don’t want to lose Monday in this news-based atmosphere.