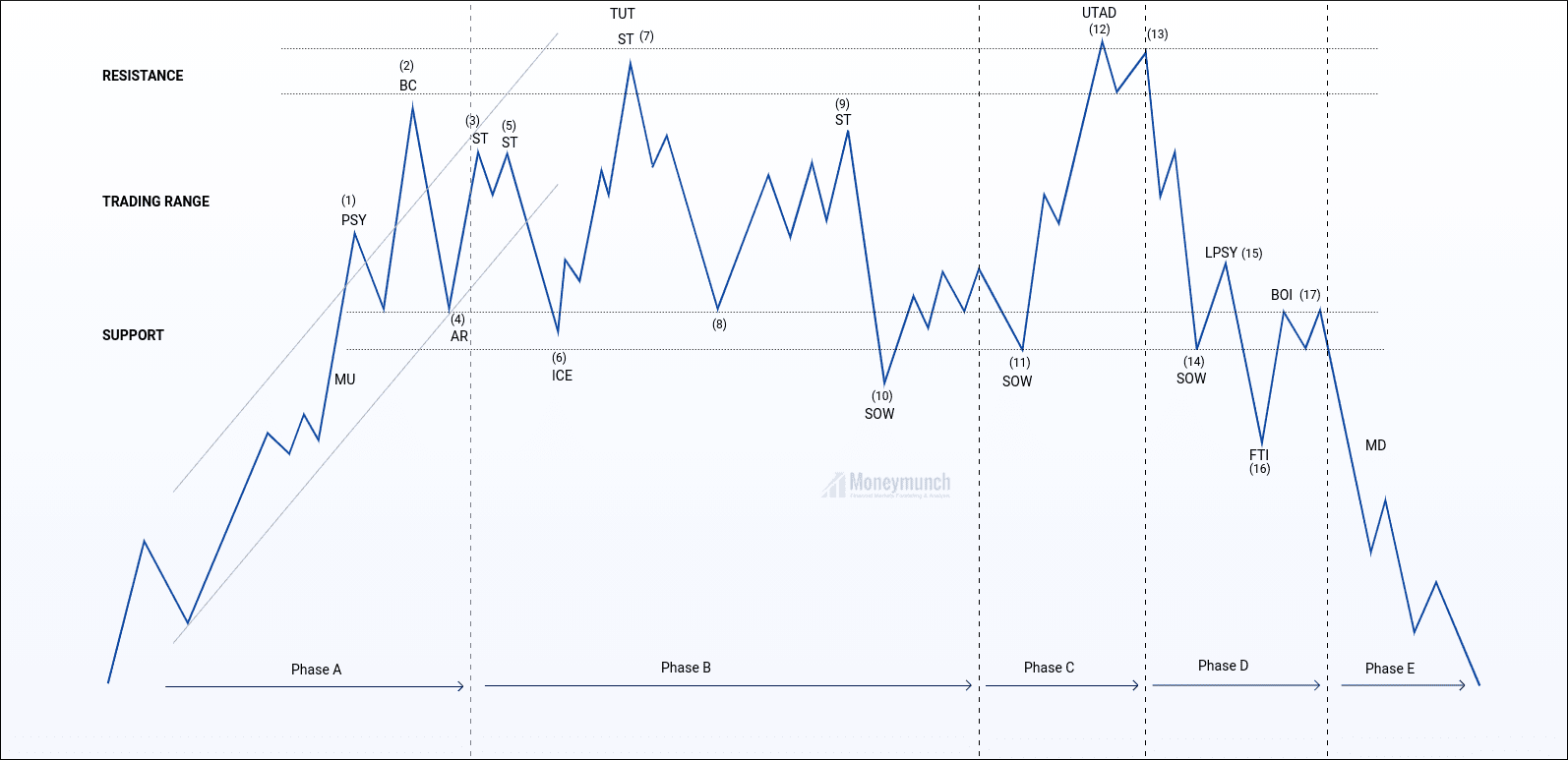

Wyckoff was a pioneer in the technical analysis of the stock market in the early 20th century. He established the Stock Market Academy in 1930. The main course is to introduce how to identify the dealer’s process of collecting chips and the process of distributing chips/judge. Second and third, in the basic law of “causality”, the horizontal P&F count within the trading range represents the cause, and the subsequent price changes represent the result.

Fourth, fifth, the relationship between price and volume on the candlestick chart to analyze the relationship between supply and demand. This law sounds simple, but it takes a long time to practice in order to accurately grasp the volume and price. I heard that Wall Street financial institutions are using Wyckoff’s trading method to judge the trend of the stock market and look for opportunities. So what exactly is Wyckoff’s theory? Today, I will introduce to you the famous Wyckoff transaction method.

The background of the birth of Wyckoff theory

Wyckoff’s theory was proposed by Richard Wyckoff. He was a pioneer in the technical analysis of the stock market in the early 20th century. He and Dow Jones, Gunn, Elliott, and Merrill Lynch are considered the five giants of technical analysis.

Wyckoff is good at summarizing his years of failures in stock investment, and is committed to introducing individual investors to the rules of the game in the market and the impact of large funds behind them.

In 1930, he established the Stock Market Academy. The main course is to introduce how to identify the dealer’s process of collecting chips and the process of distributing chips. Till, there are still many professional traders and institutional investors applying Wyckoff’s method.

Two Five Steps of Wyckoff Analysis

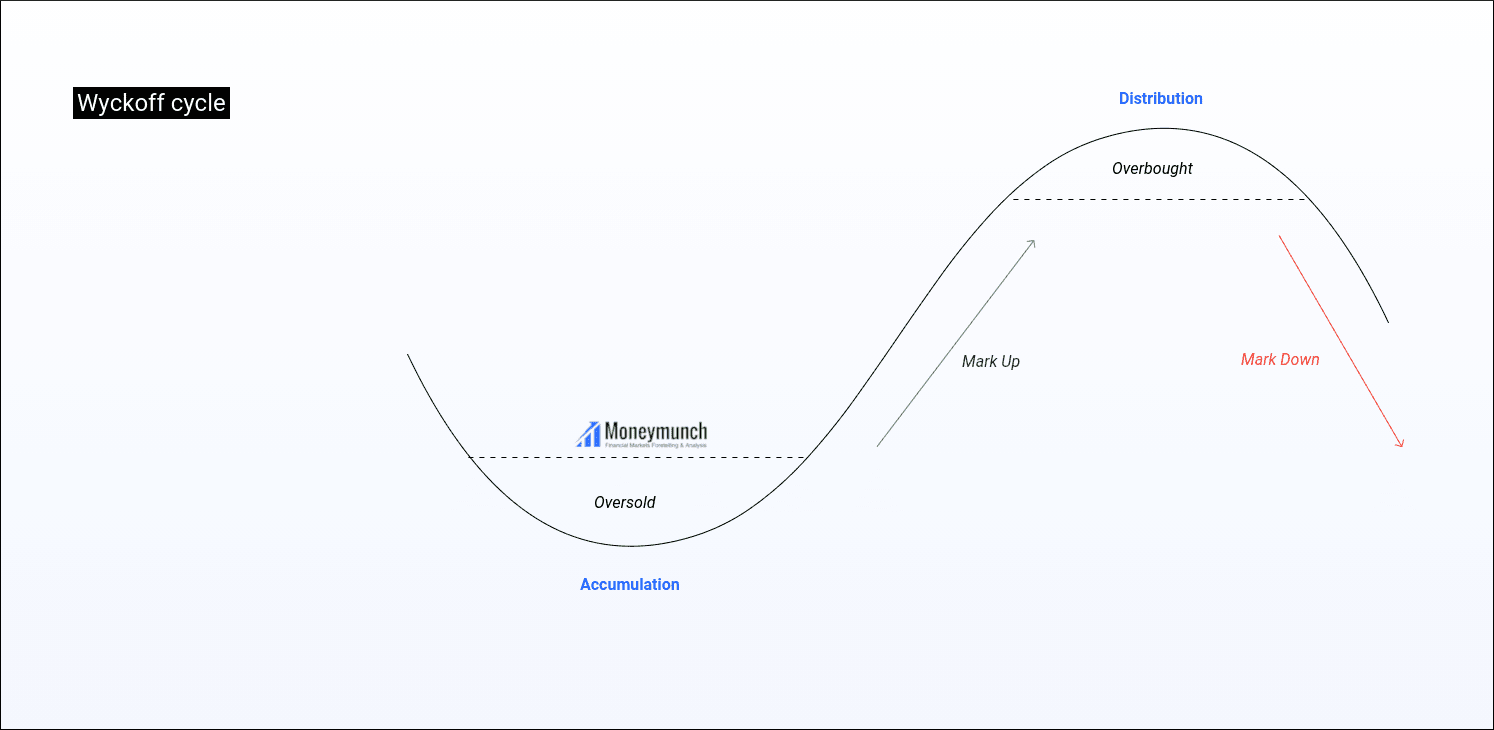

(1) Determine the current state of the market and possible future trends.

Judging the current market trends and future trends can help us decide whether to enter the market and go long or short.

(2) Choose stocks that are consistent with market trends.

In an uptrend, choose stocks that are trending stronger than the market. In a downtrend, choose stocks that are weaker than the market.

(3) Choose stocks whose “reason” equals or exceeds your minimum target.

An important part of Wyckoff’s trading selection and management is his unique method of using long-term and short-term trading point forecasts to determine price targets.

In Wyckoff’s basic law of “causality”, the horizontal P&F count within the trading range represents the cause, and subsequent price changes represent the result.

(4) Make sure that the stock is ready to move.

(5) When the stock market index reverses, there must be contingency measures

Three-quarters of the stocks are moving in line with the market. Grasping the market trends can increase the success rate of transactions.